Hong Kong regains global IPO crown from New York in 2018 thanks to its listing reforms

- The city saw 125 companies raise US$36.5 billion, the highest since 2010, according to Refinitiv data

- TMT sector accounted for 39 per cent of all funds raised on the back of listing reforms

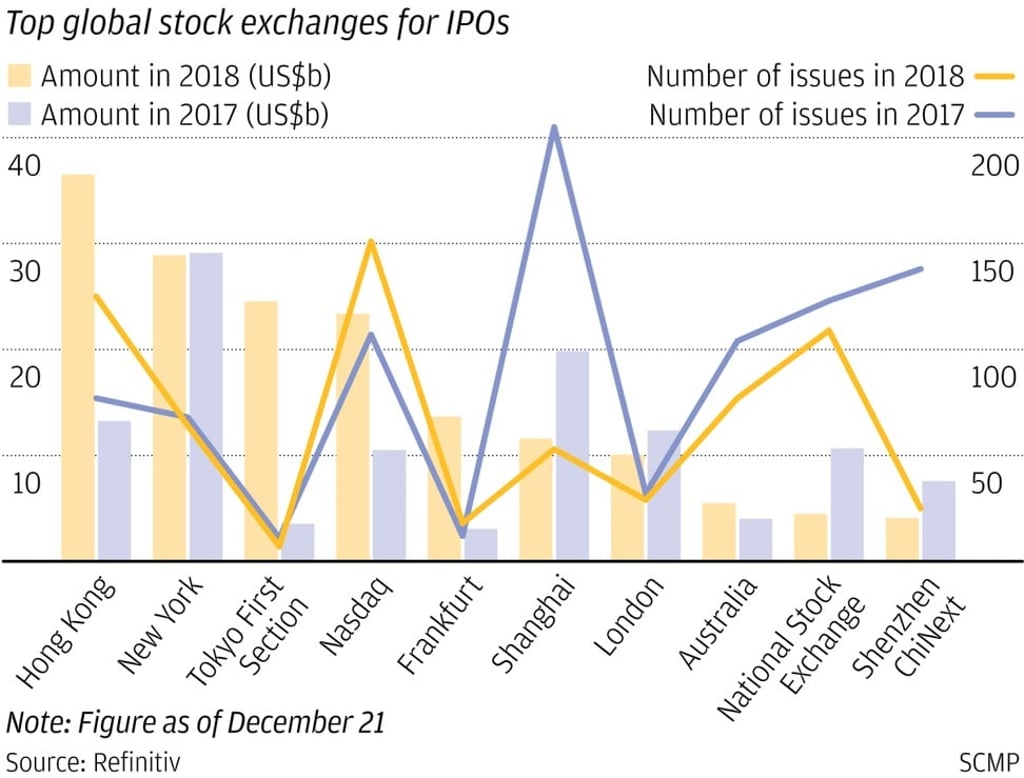

The Hong Kong stock exchange reclaimed its crown as the No 1 IPO market in the world in 2018, beating last year’s winner New York, as listing reforms led to the highest fundraising in eight years, according to Refinitiv data.

Hong Kong’s main board had a 17.6 per cent share of the global IPO market this year as of December 21, with 125 companies raising US$36.5 billion. This was the highest since 2010 and up 175.5 per cent from last year, according to the data provider formerly known as Thomson Reuters.

The New York Stock Exchange on the other hand saw 64 IPOs raising US$28.9 billion, accounting for 13.9 per cent of the global IPO market.

While Hong Kong was the No 1 IPO market in 2015 and 2016, the city mainly attracted traditional manufacturing firms and financial companies, with few tech companies listing here as they preferred New York and the Nasdaq.

In terms of TMT (telecommunications, media and technology) listings, Hong Kong came second after Tokyo in its highest ranking ever in this category.