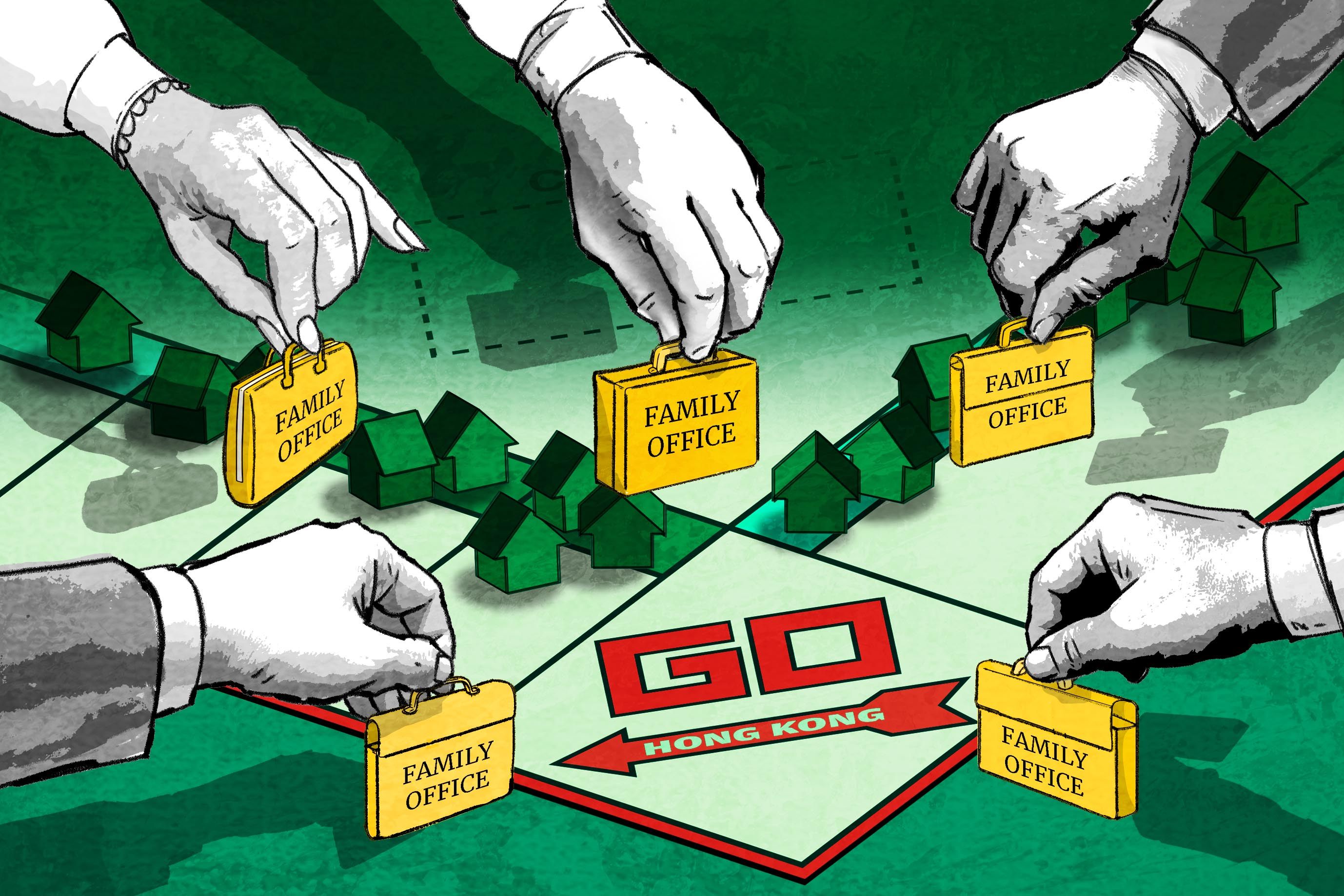

Two years ago, the government unveiled eight measures with the aim of attracting affluent families so they could set up family offices.

Minority shareholders are also expected to support the sale to receive a special bonus of as much as HK$25 a share, they said.

21 Mar 2025 - 7:09PM videocam

Bank is developing over 200 use cases for AI, including fraud detection and prevention, anti-money-laundering screening and new products.

20 Mar 2025 - 1:10PM videocam

The Fed is seen cutting rates again by midyear, while Hong Kong banks may lower their prime rates by 0.125 percentage points.

Steve Finch will take over as Asia CEO from May 9, replacing Phil Witherington who is heading back to Toronto to become global CEO.

Jose Vinals to bid adieu at the bank’s annual general meeting in May after nine years at the helm.

17 Mar 2025 - 10:00AM videocam

Hong Kong new sales rose 23 per cent to a record US$1.8 billion in 2024 as mainland Chinese bought more policies on their visits.

Thailand’s stock market is the third largest in Southeast Asia and 25th globally, according to the World Bank.

‘An IPO connect can meet the demand for mainland investors to invest in global assets,’ Peter Wong says.

The government think tank will undertake roadshows worldwide to highlight growth opportunities in the city, chairman Benjamin Hung says.

The carmaker will use the proceeds from the share placement for research and development and overseas expansion.

3 Mar 2025 - 10:09PM videocam

Hong Kong is a key market for the bank to achieve its goal of accumulating US$200 billion of net new money in the next five years.

Quinn’s experience at HSBC could help Julius Baer tap the fast-growing Asian market, one analyst says.

Henderson’s Eight Southpark, Wang On’s Coasto, and Kerry’s Hava see strong sales following the recent reduction in stamp duties.

We plan to proceed to the next phase of quota allocation around the middle of this year: HKMA.

Proposed measures to expand yuan usage could shield investors from swings in the foreign-exchange market, analysts said.

27 Feb 2025 - 5:00PM videocam

Net profit in 2024 rose 10 per cent to HK$13 billion (US$1.7 billion), aided by higher fees from handling market transactions and new stock listings.

The world’s fifth-largest ETF began trading in Hong Kong for the first time, giving investors access to top US tech firms during Asian trading hours.

‘We are pressing ahead with high-quality development of Hong Kong’s international financial market,’ financial secretary says.

26 Feb 2025 - 4:29PM videocam

The bonds will be issued on Thursday and carry an interest rate of 6.95 per cent a year.

Listed companies will go fully electronic in batches over the next five years, while individual investors have options and costs to consider: SFC.

The 12 fund managers have up to end-September to ensure their ESG disclosures match the new requirements.

24 Feb 2025 - 3:33PM videocam

60 per cent of affluent individuals in the region prefer insurance policies for estate planning, study shows.

Goldman raised its forecast to between US$3,100 and US$3,300 per ounce for 2025, citing higher demand from global central banks.

23 Feb 2025 - 9:00AM videocam

All 250 units of Hava project, on offer at an average price of HK$10,658 per square foot, were sold out as of 4.30pm.

The developer is suffering from valuation losses on its investment properties and high interest rate payments, analysts say.

Leung says Hong Kong, with its testing and trading capacities, should help mainland Chinese products enter the global marketplace.

Tencent Music and Horizon Robotics added to Hang Seng Tech Index, while ZTO Express and BeiGene added to Hang Seng China Enterprises Index.

Hong Kong, Singapore and Dubai are centres for wealth-management growth, bank says as it reports 19 per cent profit increase in 2024.

The new rules will benefit lenders such as HSBC, Standard Chartered, Bank of East Asia and Hang Seng Bank, analysts say.