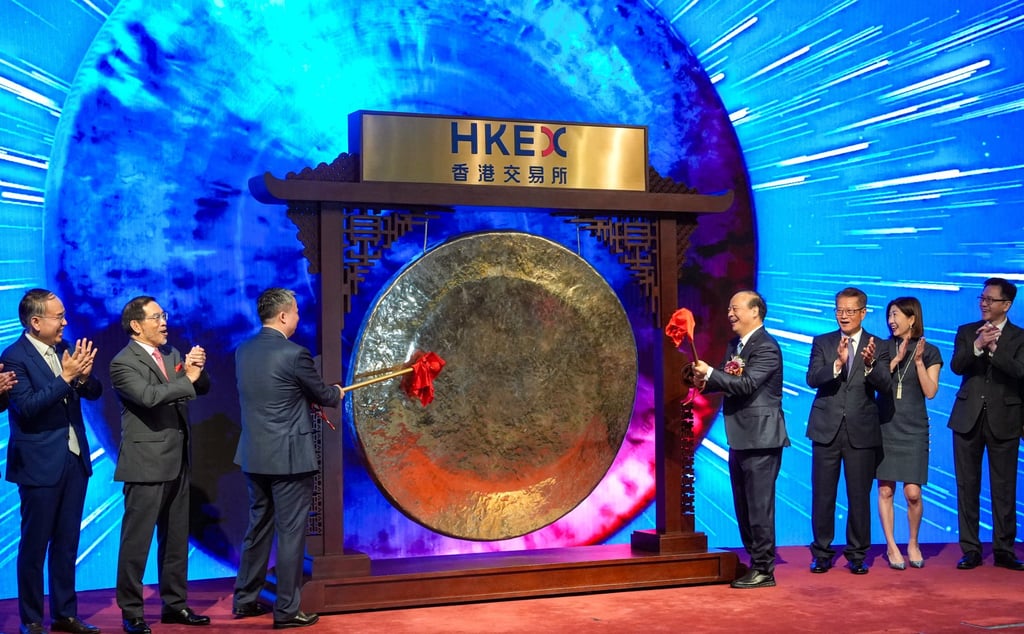

New energy, AI, EV and biotech to drive Hong Kong IPO growth: HKEX

11 companies raised US$4 billion in Hong Kong in the first three weeks of 2026, with hundreds more lining up to list, Bonnie Chan says

“In the past year, dozens of new companies in green energy, automation and other sectors have listed in Hong Kong, enabling them to scale their research and global impact,” wrote Bonnie Chan Yiting, CEO of HKEX, in an article posted ahead of the World Economic Forum Annual Meeting in Davos, Switzerland, on Monday.

“Looking into our pipeline, my optimism is reinforced by the steady flow of transformative ideas,” she said. “The next chapter of progress is being written by these visionary companies, their bold ideas and the markets that enable them.”

Chan said HKEX’s role was to “help turn the pages of that story faster, so that cleaner energy, transformative healthcare and better living standards move from promise to practice”.

That followed a total of 114 companies which raised US$37.22 billion on the main board in 2025, up 230 per cent from a year earlier. The surge pushed Hong Kong back to the top of the global ranking as the largest IPO market since 2019.