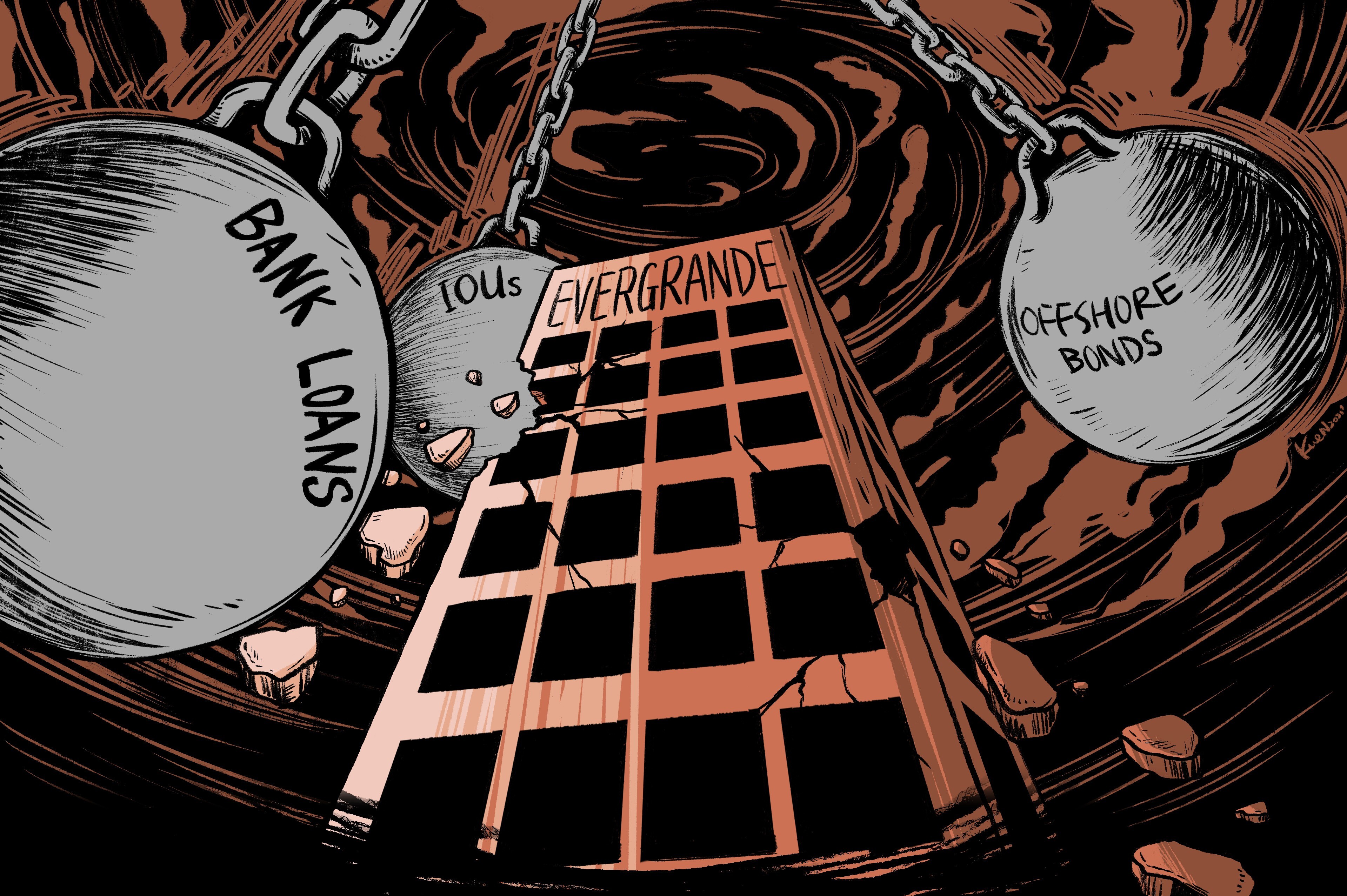

Evergrande: default alarms put thousands of suppliers, jobs and economy at risk as developer’s IOUs balloon

- World’s most indebted developer owed suppliers more than US$103 billion in construction, furnishings and materials sectors on June 30

- Evergrande’s founder and chairman Hui Ka-yan, also known as Xu Jiayin in mainland China, turns 63 today

The third of a three-part series on China Evergrande Group takes a deep dive into how the property developer’s debt crisis is affecting thousands of suppliers across the construction, furnishings and real estate services sectors and how the fallout of an Evergrande collapse could affect China’s economy.

The Emerald Bay development in Tuen Mun and its sister project The Vertex in Cheung Sha Wan were supposed to showcase properties for China’s biggest developer by sales, with high-end German appliances, in-flat wine refrigerators and opulent common areas featuring modern design elements.

02:25

Unpaid by Evergrande, supplier sells car and home to rescue his business

That could have profound effects on China’s economy, where the property development, construction and real estate services industry account for more than a quarter of China’s US$14 trillion gross domestic product.