Ant Group’s architect of mutual aid platform quits as insurance chief amid industry shake-out in world’s largest fintech market

- Yin Ming is the first member of Ant senior management to quit after the suspension of its listing in November

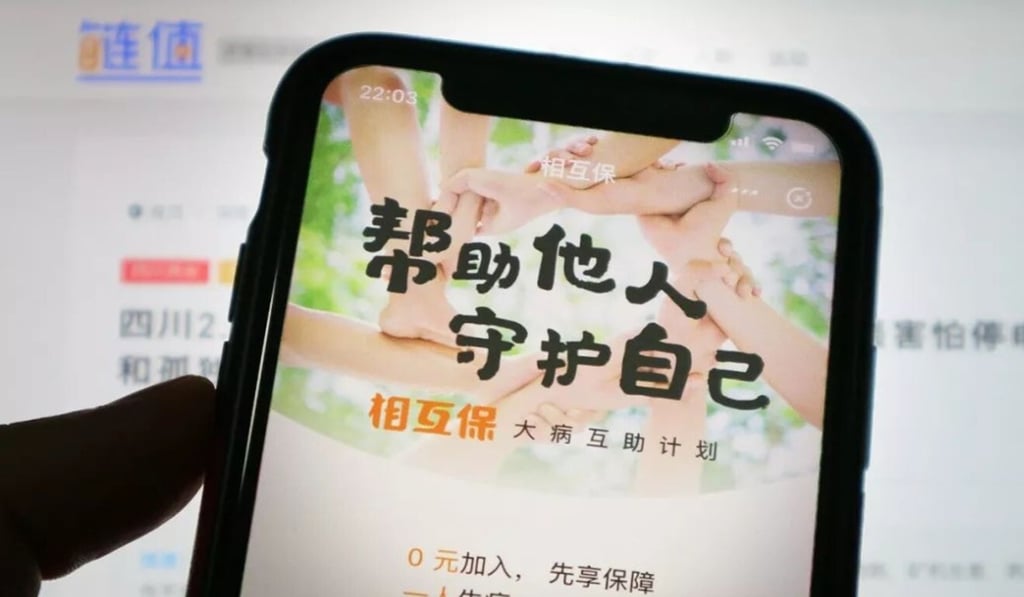

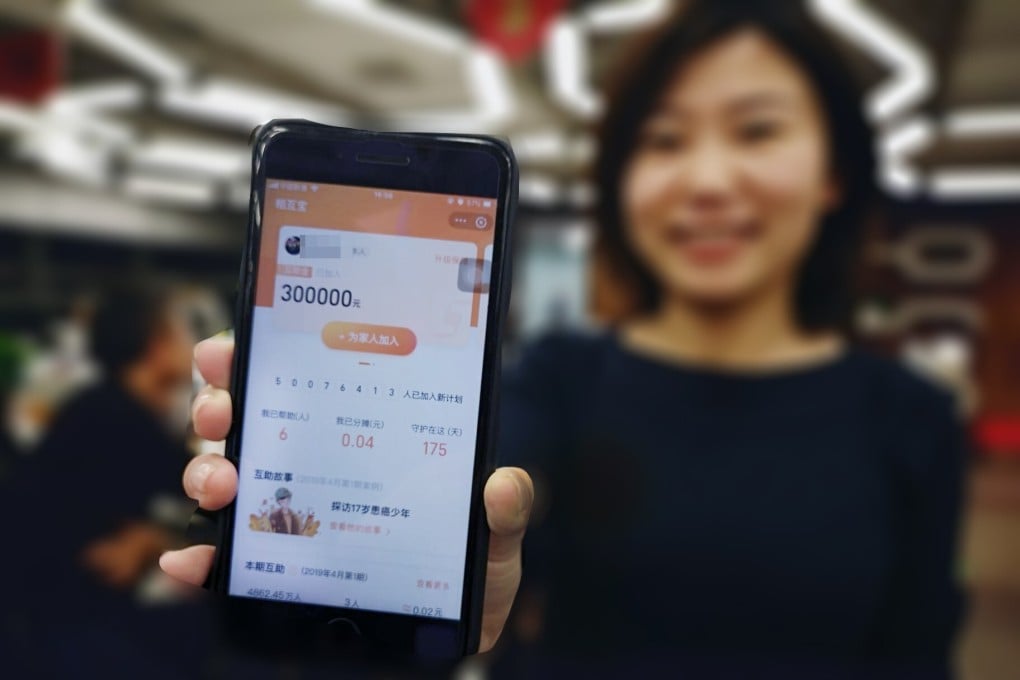

- Ant Group’s insurance business, including the Xianghubao mutual aid platform, reported 52 billion yuan in premium income in the 12 months ended June 2020

Ant Group, the world’s largest fintech company, has lost the head of its insurance unit after five years in the job, amid a regulatory shake-out over offerings of financial services by technology companies.

“Yin Ming has been a great colleague of ours for the past five years. We strived hard and overcame challenges together, and we appreciate his contributions to the company. We wish him the best of luck in the future,” according to the statement by the affiliate company of the South China Morning Post’s owner, Alibaba Group Holding.

Yin has spent most of his career in insurance, starting at China Life’s property insurance arm in 2009 before being tapped to lead Ant Group’s expansion in the fintech industry in September 2015. Yin could not be reached for comment.