Hong Kong could become biotech listing hub, says BeiGene boss as Chinese drug maker gears up for US$1 billion flotation

The cancer treatment firm is the first to seek a secondary listing in the city since the bourse overhauled its rules in a bid to attract big technology companies

Hong Kong’s stock exchange could become a hub for mainland Chinese biotechnology firms thanks to a sweeping reform of listing rules, said the boss of BeiGene, the first such company to take advantage of the new regime for a secondary listing.

The Chinese cancer treatment firm, already listed on the Nasdaq, is aiming to raise about US$1 billion through a secondary flotation on the city’s bourse on August 8. The public subscription period for the shares will run from Monday to Thursday.

“Hong Kong has the potential to attract many more biotechnology firms to list here as well as the investors to trade here. The research analysts and other related parties will follow. This will create an ecosystem for the biotechnology industry in Hong Kong.”

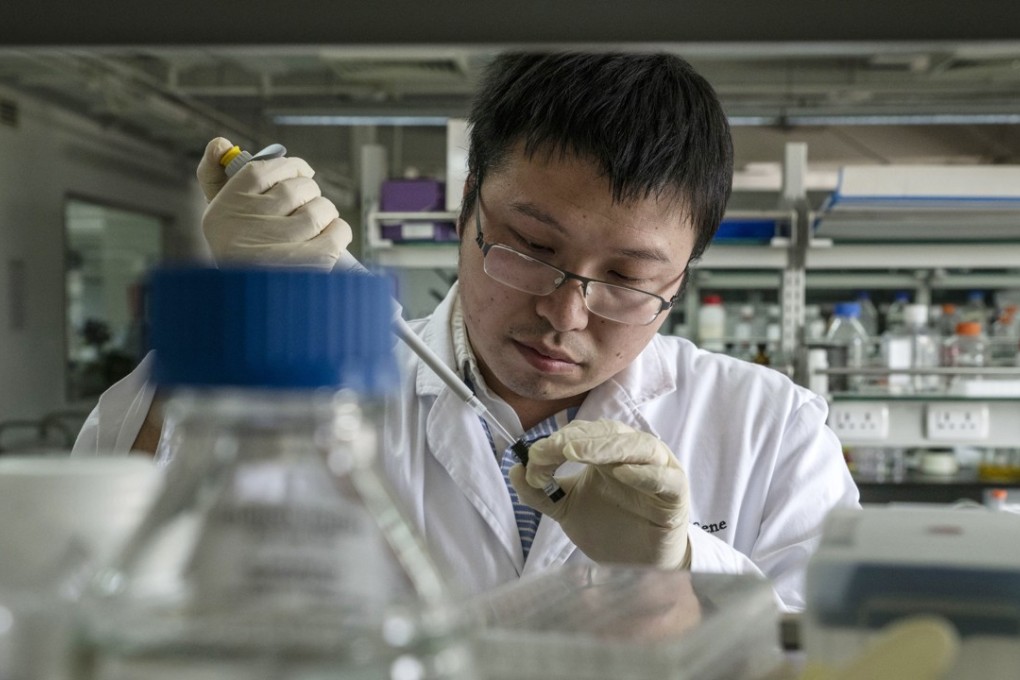

Set up in 2010, the Beijing and US-based company focuses on “immuno-oncology” research, treatments that use the body’s own immune system to fight cancer. It will issue 65 million new ordinary shares priced between HK$94.4 to HK$111.6 each, allowing the company to potentially raise between US$908 million and US$1.07 billion. It will be listed on the HKEX main board as a secondary listing, after it had already floated its stock on the US’ tech-heavy Nas daq in 2016. It closed 3.81 per cent lower on Friday at US$166.52.