HSBC completes latest round of US$7 billion stock buy-back as market awaits report on bumper 2023 profits

- HSBC bought back 208.1 million shares from UK trading venues, 179.9 million shares in Hong Kong under a US$3 billion mandate since November 1

- HSBC’s annual net profit probably surged 76 per cent in 2023, according to consensus estimates; bank is scheduled to report on February 21

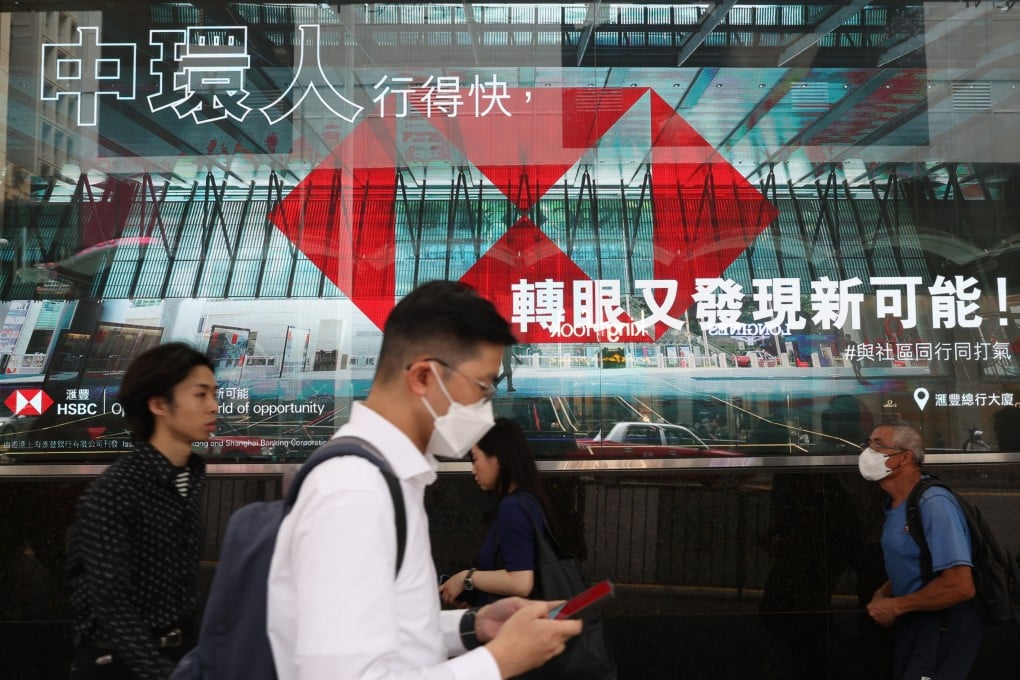

HSBC Holdings, the biggest commercial bank in Hong Kong, has completed a third round of buy-back to defend the stock amid a broader market sell-off, taking the cumulative purchases to US$7 billion since May 2023 as the lender prepares to report a jump in 2023 profits this week.

The UK lender, which generates most of its profits in Asia and counts Hong Kong as its single biggest market, rewarded its investors with dividends and accelerated buy-backs after overcoming credit losses incurred during the Covid-19 pandemic years. The bank is scheduled to report its full-year results after a board meeting on February 21.

Net profit probably surged 76 per cent to US$26.1 billion, according to consensus estimates by analysts compiled by Bloomberg, versus US$14.8 billion in 2022 and US$12.6 billion in 2021. Earnings doubled to US$18.1 billion at the halfway mark on June 30, with CEO Noel Quinn raising its full-year guidance for net interest income following several rounds of rate hikes.

“HSBC benefited from a high interest-rate environment last year,” said Kenny Ng Lai-yin, a strategist at Everbright Securities International in Hong Kong. “The growth in interest income is expected to continue” while credit losses remain a matter of concern for investors, he added.