The government’s annual work report showed signals that its priority has shifted from regulatory tightening and deleveraging to economic growth. This could result in attractive opportunities for investors as several expected stimulus measures gradually take effect.

Current stimulus measures are insufficient to boost long-term loans and investment in the real economy amid low private-sector confidence. More accommodative monetary policy and greater regulatory transparency could go a long way to improving sentiment.

As Southeast Asian economies begin their post-pandemic recovery, stock markets are set to offer solid earnings growth. New trends are emerging as a result of Asean’s transition from the traditional to the new economy, with opportunities in wide range of sectors.

The valuations of Chinese developer stocks have started to look attractive, and the recent policy changes could serve as a catalyst for price gains. However, investors must remember that the long-term investment logic for Chinese property stocks has changed.

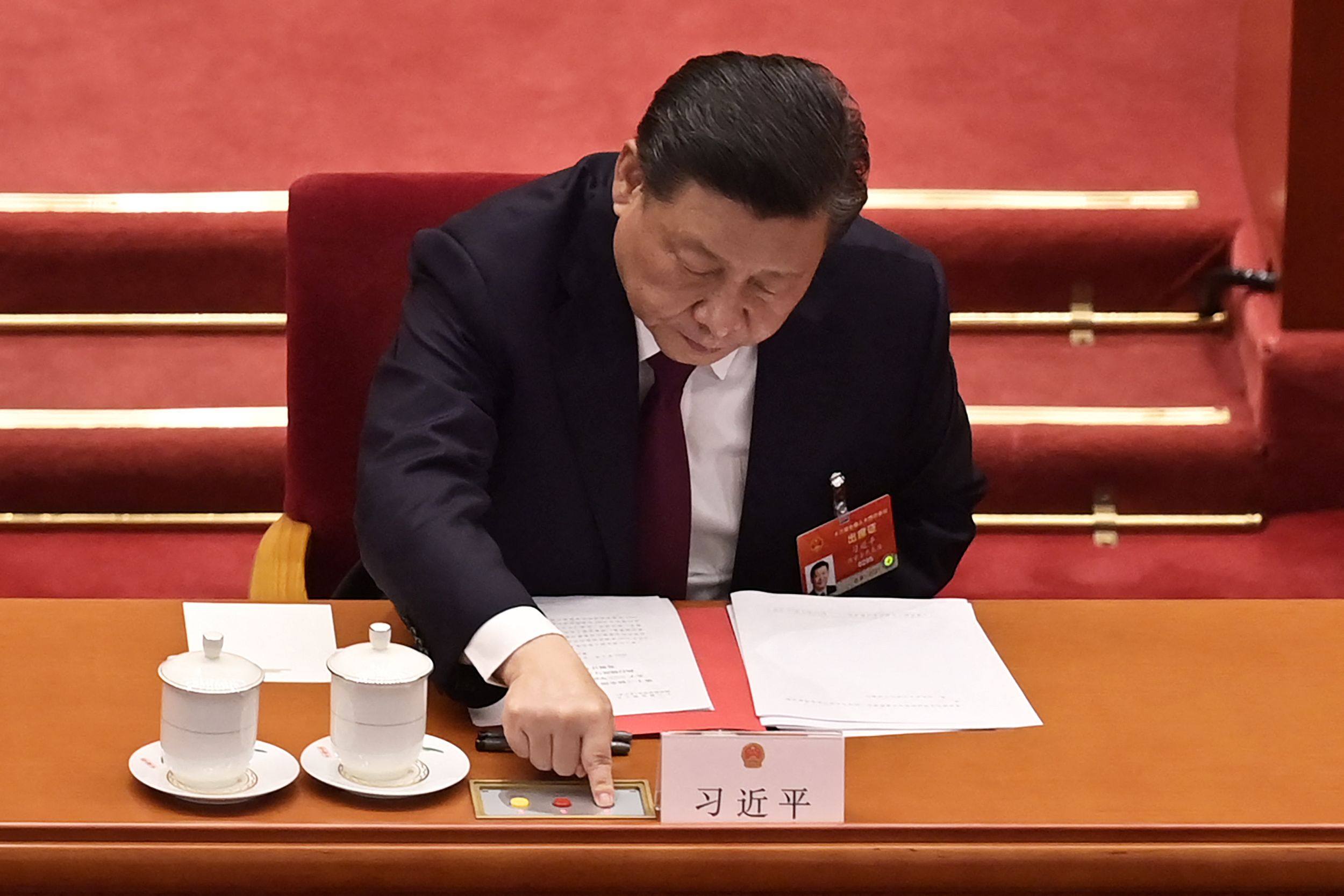

China’s economy is growing fast enough to give policymakers cover to continue with reforms, but some adaptation is necessary. The pace and breadth of reforms is weighing on market sentiment, possibly forcing a rebalancing between long-term goals and short-term stability.

The tech and tuition regulatory changes are meant to balance between short and long-term growth objectives as Beijing seeks better social outcomes. Given China’s enormous economic growth potential, it should remain an integral part of any investor’s portfolio in the long run.

The government has zeroed in on rising property prices near popular school districts and unequal access to education as areas in urgent need of reform. As these reforms gain pace, questions remain over whether they can succeed to lower education costs and convince more young couples to have children.

Worsening affordability measures and rising debt levels are signs of an inflating housing bubble. However, an immediate burst seems unlikely – although bond defaults may rise as developers face cash flow stresses.

During China’s most recent long holiday, tourism, box office revenue and consumer good sales surged, returning to pre-pandemic levels. This augurs the sustainability of China’s economic recovery through the rest of the year.

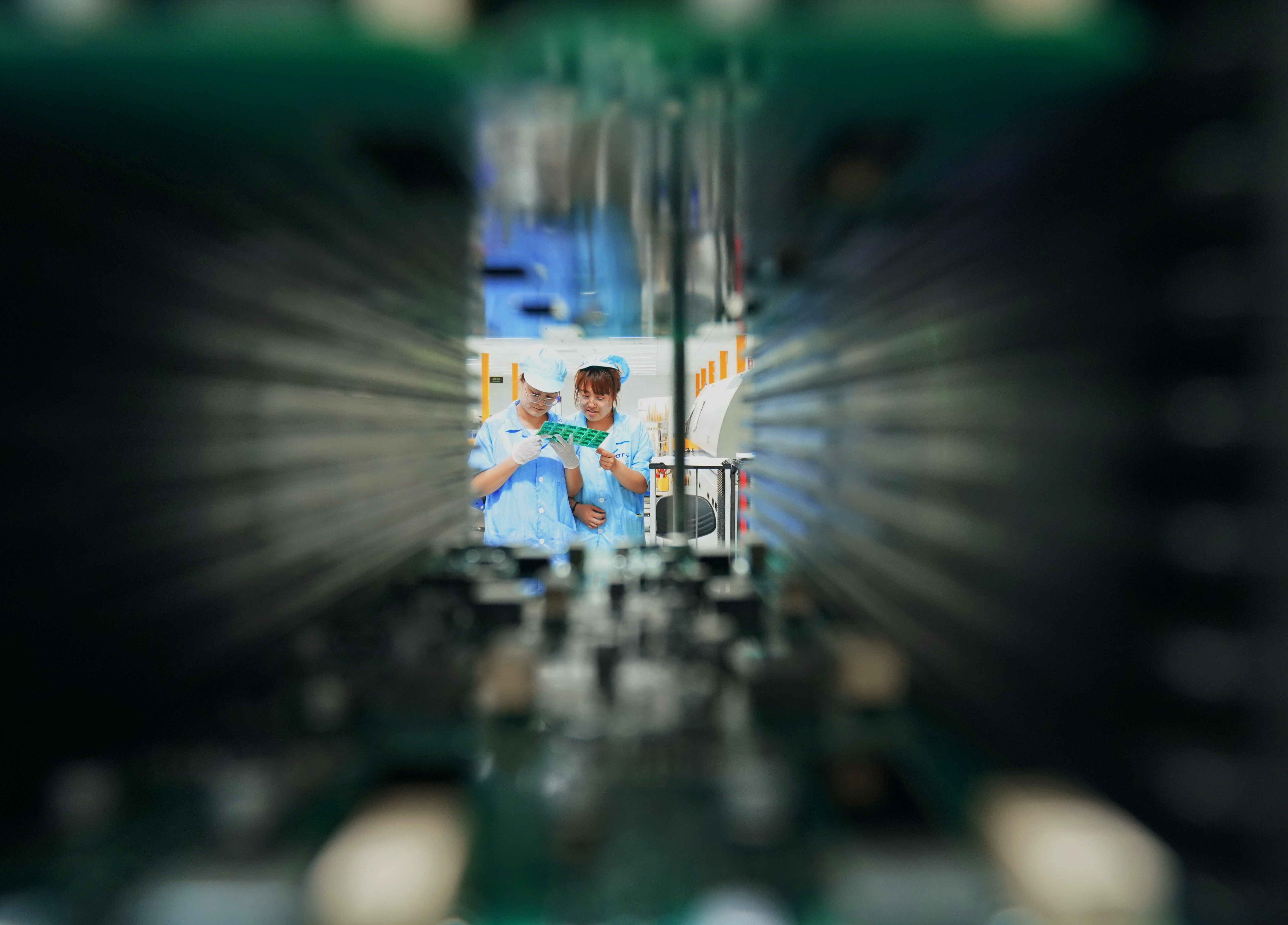

Innovation and technological development drive productivity growth and thus are the top priority in the new five-year plan. Investment in frontier fields, R&D, infrastructure, green manufacturing and more form the core of plans for long-term growth.

Given how quickly EV companies’ stock prices have rocketed, a short-term correction is likely. But, in the long term, the sector is supported by structural trends which underpin the case for investing. Here are three things to focus on.

The short-term nature of the stimulus package underscores the need for further relief. The long-term costs are also worth watching, as we hopefully approach the end of the pandemic and look towards a broad economic rally.

Investors have long awaited news of a vaccine breakthrough that will kick off a rotation in equity markets. Sectors such as travel, retail, energy and financials that have struggled in the pandemic are expected to rebound while demand for tech stocks wanes.

Beijing needs to adapt its investment system for higher efficiency and less waste, with greater public-private cooperation. As long as the investment system stays on track, we can be optimistic about China’s domestic technology development.

As Beijing seeks more efficient and fairer development, rebalancing is likely to be key, given the increasingly complicated international environment. To achieve this, China might advocate further marketisation reforms, while supporting development of strategic sectors.

Investor sentiment before this week was already deflating against the backdrop of a continued pandemic and a pricey stock market, but mixed news this week and continued grim virus milestones make the market rally look increasingly fragile.

Updates to registration-based public offering rules, making it easier for tech companies to list on local exchanges are at the heart of the reforms. They should attract fast-growing tech companies and galvanise investment opportunities in China.

For China, the short-term coronavirus shock is coming on top of an economic slowdown. Policymakers remain cautious about an all-out stimulus, and will be eyeing long-term reforms to improve economic structure and boost productivity.

Since China’s recovery trajectory will be shaped by external events, including the effects of the pandemic in its demand markets, Beijing is focusing on domestic priorities like jobs, small companies and loosening financial conditions.