Are Chinese property developer stocks a good buy right now?

- The valuations of Chinese developer stocks have started to look attractive, and the recent policy changes could also serve as a catalyst for price gains

- However, investors must be aware that the long-term investment logic for these stocks has changed

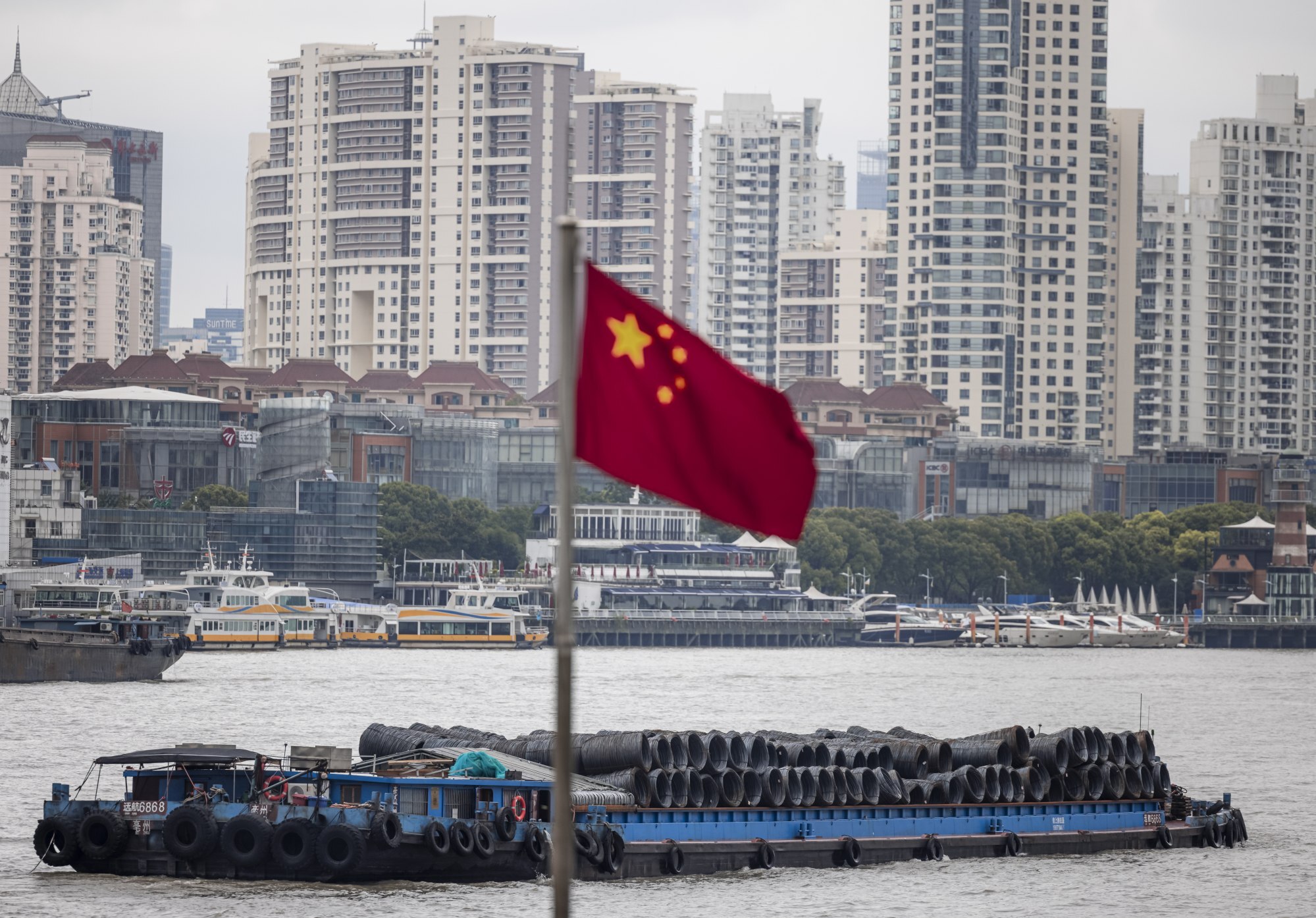

As a result, Chinese developers’ stocks delivered the worst performance among all sectors in the A-share market, with market capitalisation shrinking by 18.4 per cent, or 2.8 trillion yuan (US$440 billion), in the first 10 months of this year.

Since October, the authorities have been fine-tuning property-related policies to mitigate the risks. In the stock market, investor sentiment has also started to improve, and the sector recorded a 4.1 per cent, or 600 billion yuan, rebound in market capitalisation from October 29 to November 23.

During the recent policy easing, the priority has been to provide liquidity support to projects under construction, instead of across-the-board easing. Hence, a full turnaround in nationwide property sales can hardly be expected.

In such circumstances, the old business model is no longer applicable. Moreover, the changing policy regime also makes financial analysis more challenging.

For instance, to guarantee the completion of ongoing projects, local governments introduced very strict measures to monitor funds. Down payments and mortgage loans from homebuyers, and developer loans from banks, are locked to specific projects.

This means developers cannot allocate capital at their discretion and investors face the challenge of evaluating developers’ financial health with limited data from financial reports.

That said, opportunities still exist in this sector. China’s urbanisation rate reached 61.4 per cent in 2020, still below the typical 80 per cent or above rates in major developed economies. The percentage of people living in large cities and city clusters is also lower than that in developed economies.

As a result, there is still potential for real estate development within large cities, particularly those with a strong economy and continuous population inflows.

State-owned developers were less aggressive than their private-owned peers in the previous bull market, so their overall financial positions are more resilient. Therefore, state-owned developers might be preferred by risk-aversive banks and could receive more financial support as part of the policy easing.

Besides debt ratios, inventory structure should be another consideration when evaluating developers’ prospects. In tier one and tier two cities, aggregate inventory is relatively low in the primary market.

For instance, Shanghai had 5.3 million square metres of new residential property inventory as of November 24, with daily average sales of 54,000 square metres in November. This suggests a turnover cycle of around 100 days, meaning a stable cash flow for developers from home sales.

On the other hand, in tier three and tier four cities, primary markets have turned illiquid with high inventories, so developers with inventory in tier one and tier two cities are better positioned.

In general, the long-term direction of Chinese property policy will not change despite the recent easing of credit policy. Developers may face challenges from lower growth and continuing regulatory changes.

At low valuation levels, developer stocks may seem attractive, but only those with financial resilience and the right inventory structure are likely to enjoy the rebound.

Chaoping Zhu is a Shanghai-based global market strategist at JP Morgan Asset Management