Singapore mulls ways to remain magnet for wealthy investors after G20 corporate tax deal

- Global minimum tax not a ‘deal breaker’ but could affect American firms seen as strategic investors

- Singapore, Hong Kong now need to sharpen non-tax incentives, be more business friendly

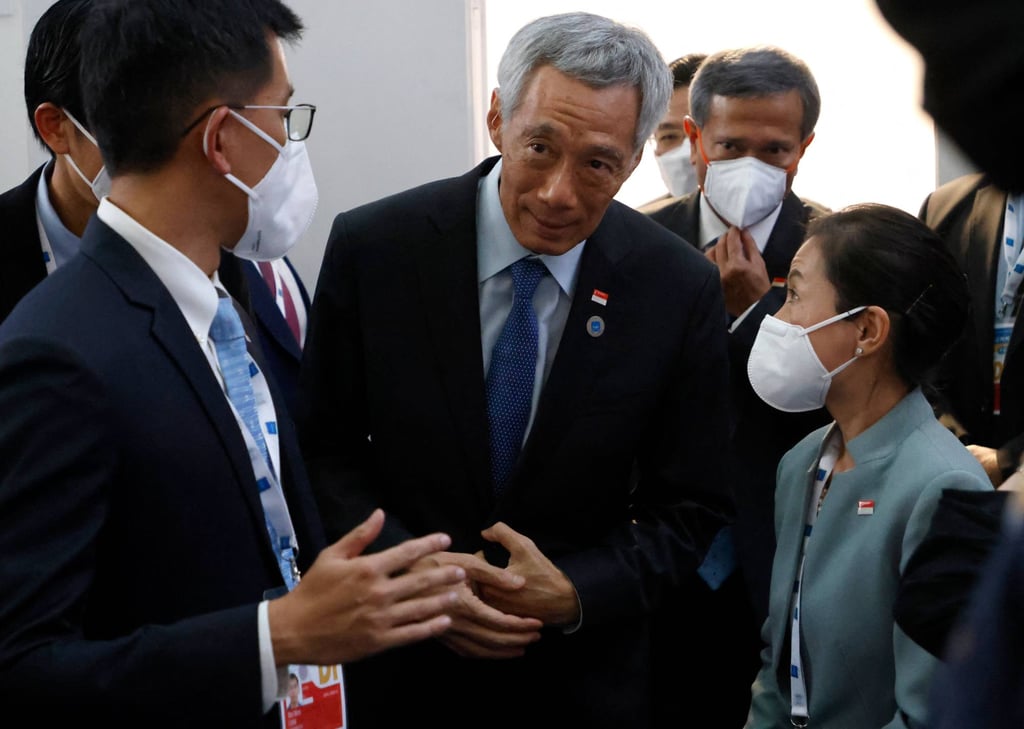

“I foresee there will be tougher competition for us. But we will take it in our stride,” he said.

Singapore has a corporate tax rate of 17 per cent but its Economic Development Board has long offered priority investors grants and other schemes that reduce the effective rate to as little as 4 per cent in some cases. Its political stability and strong legal system are also factors that have incentivised billionaires including Facebook co-founder Eduardo Saverin and hotpot chain Haidilao boss Zhang Yong to sink their roots in Singapore, snapping up flashy properties in the process.

Singapore has consistently been the top destination for foreign capital inflows in Southeast Asia. According to a United Nations investment report, the city state accounted for 67 per cent of total investments in the region last year, with US$91 billion worth of capital inflow.