Topic

Latest news, analysis and commentary about the provision by financial institutions of credits, loans and equity financing towards the construction of environmentally sustainable projects and business activities.

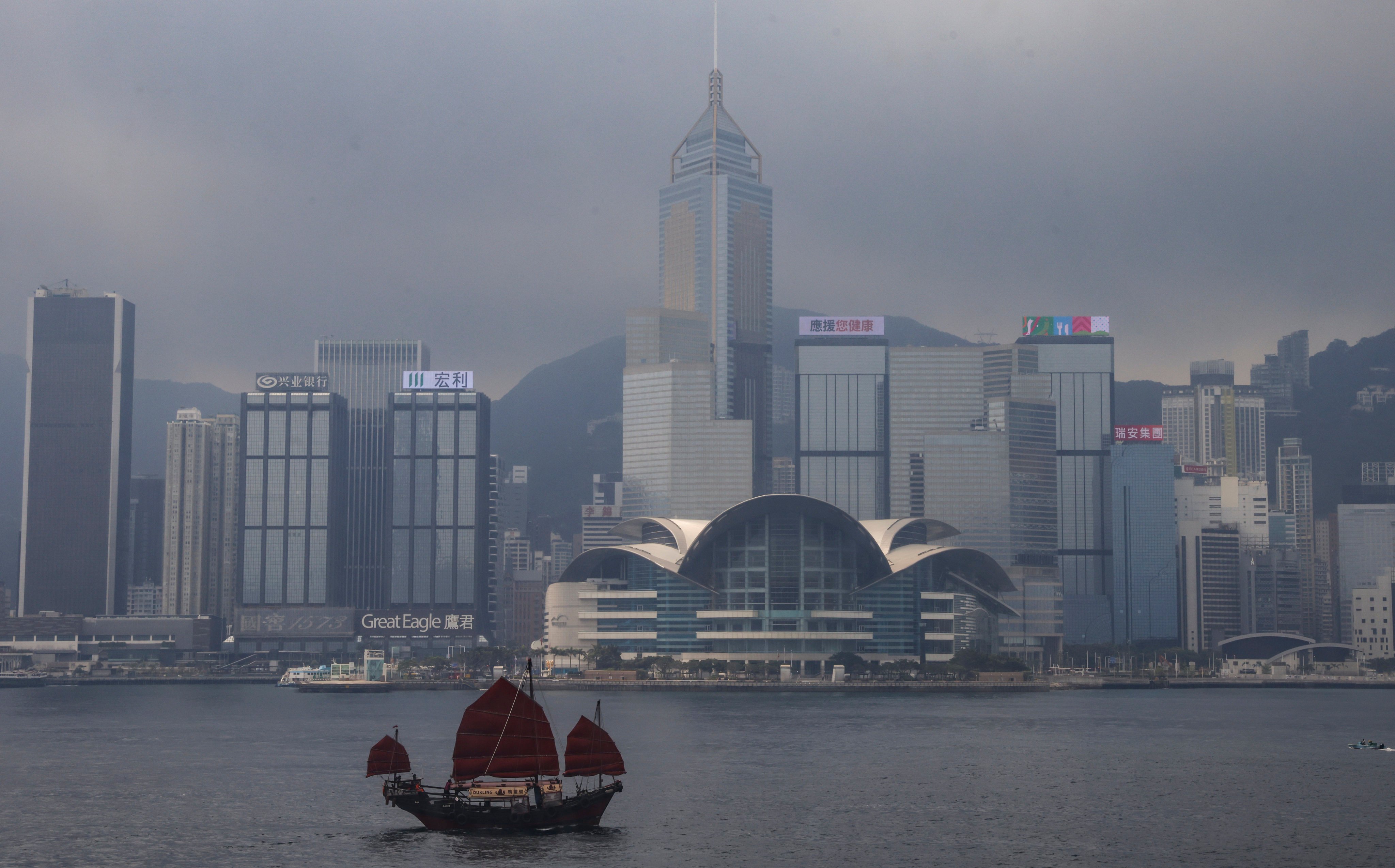

- The Hong Kong Taxonomy for Sustainable Finance is a milestone in the city’s green finance landscape, HKMA CEO Eddie Yue says

- The taxonomy covers 12 economic activities under four industry sectors, namely energy, transport, construction, and water and waste management

Finance chief says property and stock markets still under pressure amid geopolitical tensions, urges investment in green development and digital economy to drive growth.

All financial institutions licensed by the SFC should be required to submit ESG reports for the development of a comprehensive ecosystem of sustainability disclosures, City University of Hong Kong says.

The city needs to set financing volume targets, restrict fossil fuel financing and enact a specialised anti-greenwashing law, environmental group says.

With the world facing a US$4 trillion green investment gap a year, transition finance will grow in importance because of regulatory support in Asia, experts say.

More than 200 greentech companies currently operate in the city, of which some are equipped with ‘globally competitive’ technologies and are making inroads into the mainland Chinese and overseas markets.

Start-up H2 Solution is planning to set up its operations at Hong Kong’s science and technology park in Pak Shek Kok as a launchpad into overseas markets.

‘It’s not just about addressing a global issue that might affect everybody, it’s also about protecting our people in our own land,’ Eddie Yue says.

One key budget initiative is launch of HK$10 billion New Industrialisation Acceleration Scheme.

Such guidance will make it ‘a lot easier for banks to figure out what to do and what not to do’, expert says at Climate Business Forum, although profusion of guidance may cause confusion in the short term.

Companies should focus on increasing their integration with multiple sectors to enhance their ability to serve the real economy, industry experts said at a summit.

Banks need to adopt more forward-looking and long-term metrics on risk-return assessments to meet growing climate financing needs, according to top bankers at the Climate Business Forum.

The Hong Kong Monetary Authority is expanding its role as a banking supervisor by addressing the pain points faced by the industry when managing climate risk, including setting up an online risk assessment platform and training the workforce.

To develop greentech and pursue the city’s sustainability goals in transport, buildings and construction, Hong Kong needs an ecosystem that brings together partners across the supply chain, experts said at the summit on Monday.

GGSN, which is partly owned by New World Group, is in talks to set up research, product development and marketing facilities in Hong Kong, where it hopes to demonstrate its autonomous charging devices in the car parks of offices and malls.

‘Hong Kong has three strengths that are indispensable for fostering climate financing: technical, legal and financial knowledge,’ says Riccardo Puliti, IFC regional vice-president.

Investment products where security selection is based on companies’ ESG scores outperform in the long term, data has shown.

Numerous sectors are creating more green jobs, with candidates who can prove their ability to effectively implement green initiatives especially prized, a recruiter says.

Exporters of certain carbon-intensive products have six more months to set up systems to collect, calculate and report emissions data, and their exports are likely to face import duties starting in 2026.

China lacks both an adequate supply and a pipeline of finance professionals with expertise in environmental, social and governance issues, organisation says.

Hong Kong will play host to a green and sustainable finance training event in June for several hundred policymakers, regulators and finance professionals in dozens of developing nations.

Located near Madagascar, Mauritius could capitalise on its position as a gateway for China to enter the African market, and the tiny island hopes Chinese take an interest in its sugar-based rum.

Proof-of-concept subsidy scheme to launch in first half of year to provide early-stage funding for pre-commercial companies focusing on the collection and analysis of sustainability data.

While sources such as wind and hydropower are gaining traction, the solar sector could be the springboard to help India become a green energy giant.