SK Group backs US$140 million fund to bring South Korean chip firms to China

- The fund, supported by the government of Wuxi, is designed to help leading South Korean chip companies set up local operations

SL Capital, a private equity firm formed by SK and Beijing-based Legend Capital, signed an agreement with authorities in the eastern Chinese city of Wuxi on Tuesday to jointly set up a 1 billion yuan (US$140 million) fund, according to a statement from the local government.

SL Capital is financing the investment via a joint venture with Wuxi Industry Development Group, which is backed by the local government. The move is designed to help leading companies in South Korea’s chip supply chain set up operations in the municipality, the statement said.

The new fund also includes money from Wuxi National Hi-Tech District. The parties involved in the fund have worked together to bring South Korea’s chip equipment suppliers Nextin and Gigalane to Wuxi, according to the statement.

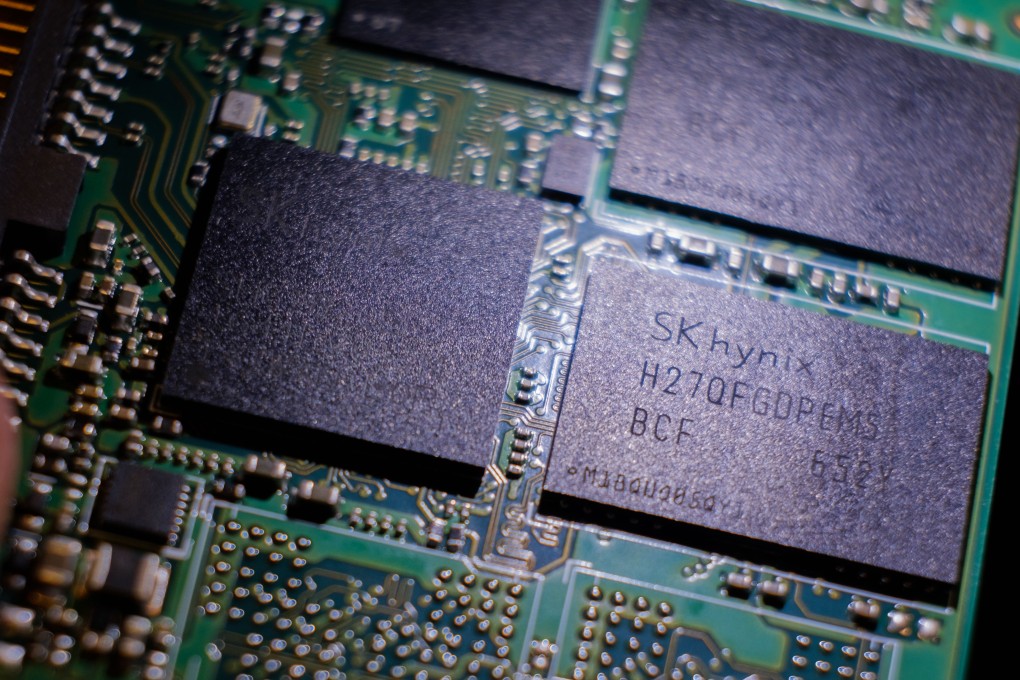

“SL Capital is a fund established by SK Group together with Legend Capital, but it is managed by SL Capital and SK Group is not directly involved in the fund management,” SK said in a statement to Bloomberg News, adding SL Capital has nothing to do with SK Hynix’s investment in semiconductors.