Tech war: Huawei wields growing influence in China’s server industry with AI chip success

- Huawei has taken on an increasingly important role under Beijing’s tech self-sufficiency drive, with soaring domestic demand for servers equipped with its AI chips

Huawei Technologies, which was forced to divest its traditional server subsidiary three years ago under pressure from US sanctions, has regained its influence in that sector on the mainland, thanks to the popularity of its artificial intelligence (AI) chips, according to industry analysts.

Shares of Digital China Group, one of the major players in China’s server market, fell by their daily limit of 10 per cent on the Shenzhen Stock Exchange on Monday and continued their weak performance through Wednesday, following a report that said Huawei may adjust its business model and return to assembling servers instead of just providing key components.

The China Business News quoted an unidentified Huawei official as saying that the Shenzhen-based firm was considering such a move but has not decided yet.

The potential move by Huawei could affect companies such as Digital China, which has been working with the telecommunications giant to jointly deliver server solutions to end users. If Huawei decides to go solo, these companies would become mere “distributors”.

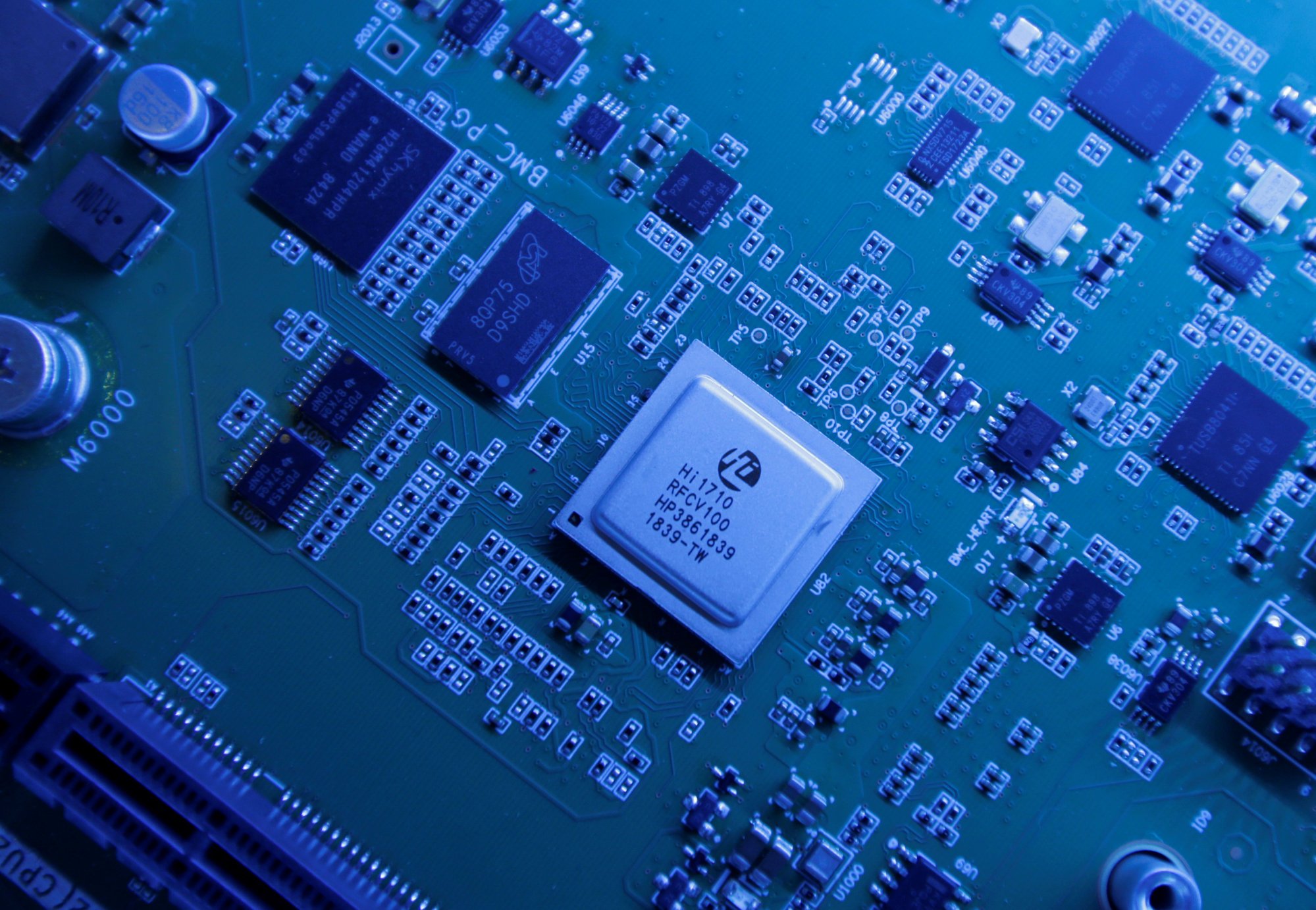

Huawei’s computing business has two product lines; Kunpeng for general servers and Ascend for AI computing. A number of Chinese computer developers, including iSoftStone Information, Talkweb, Huakun and xFusion, are also partnering with Huawei.

Huawei declined to comment on Wednesday.

Digital China said in an exchange filing that it was business “as usual”, adding that its current exposure to Huawei was small. It said Kunpeng and Ascend products only accounted for 3 per cent of its total revenue.

At present, Huawei has taken on an increasingly important role in China’s AI infrastructure ecosystem under Beijing’s self-sufficiency drive, with soaring domestic demand for servers equipped with Huawei chips.

Digital China launched its “Greater Huawei” strategy in 2018, becoming one of Huawei’s global distributors. Digital China’s own server product, Kuntai, is based on Huawei’s Kunpeng and Ascend chip technologies.

Huawei’s influence in the server industry marks a sharp contrast to a few years ago. In 2019, the company was put on Washington’s Entity List over national security concerns, and it was forced to sell its wholly-owned subsidiary xFusion because the company was unable to buy Intel x86 chips. xFusion, mainly engaged in the manufacture and sales of server products, was sold to third-party buyers in November 2021.

Since then, Huawei has adjusted its AI strategy to build an ecosystem based around its Kunpeng and Ascend servers, powered by self-developed chips, to serve domestic clients who have lost access to equivalent technology overseas.

The Ascend ecosystem, which includes AI computing architecture and related software platforms, now has 40 hardware partners, 1,600 software partners and 2,900 AI application solutions, according to Zhang Dixuan, head of Huawei’s Ascend computing business.

The company has also introduced its all-in-one machines, incorporating AI chips, industry-specific algorithms and pre-trained large language AI models, to Chinese tech giants like Tencent Holdings and Baidu, as well as start-ups like iFlyTek, according to Wang.