Chinese storage specialist Longsys, a major client of US chip maker Micron, completes US$132 million takeover of Suzhou plant from Taiwan’s Powertech

- Longsys has acquired a 70 per cent equity stake in Powertech Technology (Suzhou), which provides chip packaging and testing services

- The deal, which Longsys announced in June, involves an initial payment of US$65.8 million, with the balance to be paid on a later date

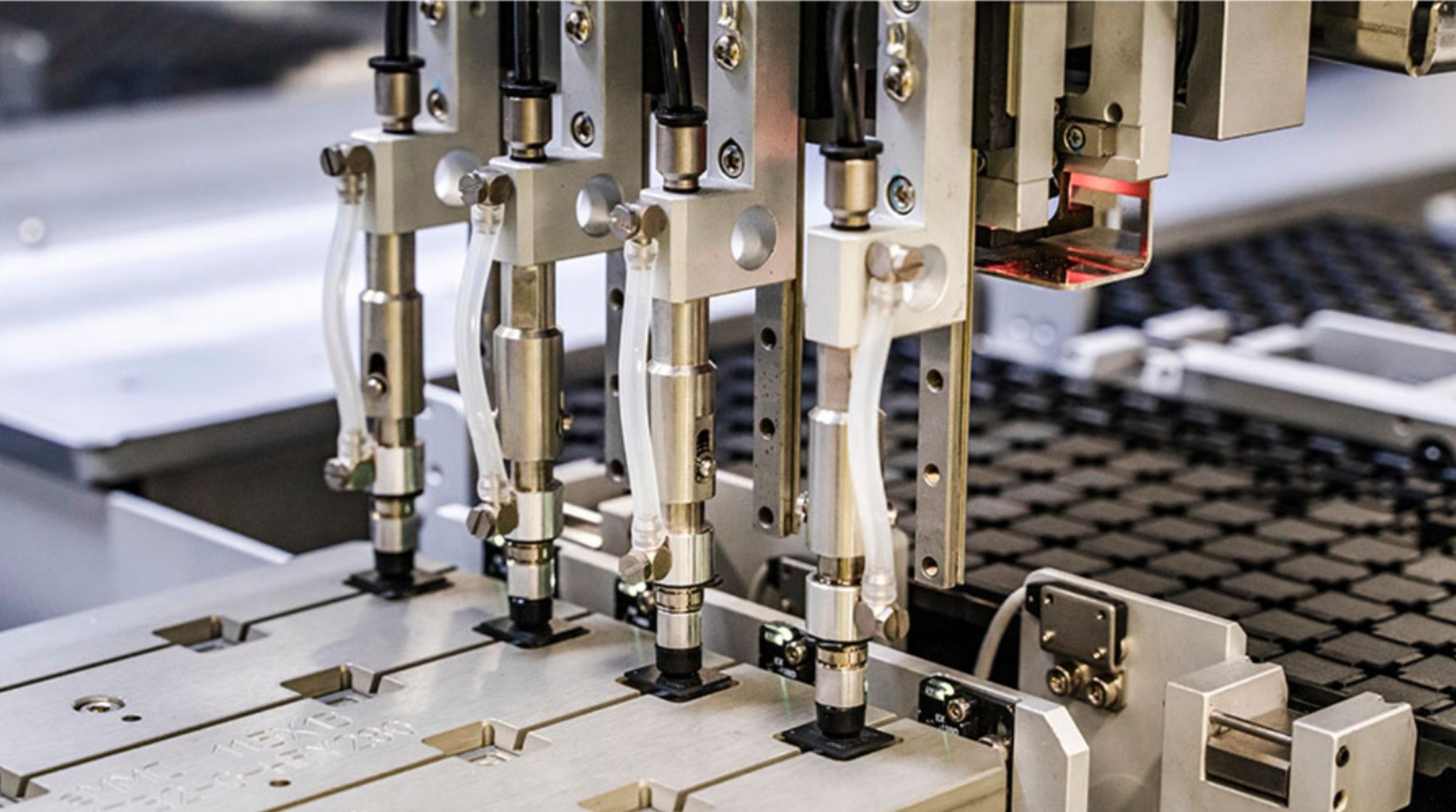

Longsys, which makes digital storage products that include memory modules and solid-state drives, said in a filing to the Shenzhen Stock Exchange on Wednesday that it has finalised the acquisition of a 70 per cent equity stake in Powertech Technology (Suzhou), which provides chip packaging, testing and surface-mount technology services in the most populous city of eastern Jiangsu province.

That acquisition, which Longsys announced in June, involved an initial payment of US$65.8 million, with the balance to be paid on a later date, according to the company.

The latest corporate acquisition by Longsys reflects the continued initiatives by mainland Chinese tech firms to further develop the country’s position in the global semiconductor manufacturing supply chain.

China’s share in OSAT work globally is projected to grow to 22.4 per cent by 2027, up from 22.1 per cent last year.

Micron had been the top supplier for Longsys between 2018 and mid-2021, with purchases exceeding 33 per cent of total procurement contracts of the Boise, Idaho-based company during that period.

Taiwan’s share in global chip manufacturing supply chain to decline: report

In 2017, Longsys acquired the “Lexar” brand name from Micron to help expand its removable storage business, including memory cards and USB flash drives.

Micron’s path from China business partner to alleged cybersecurity threat