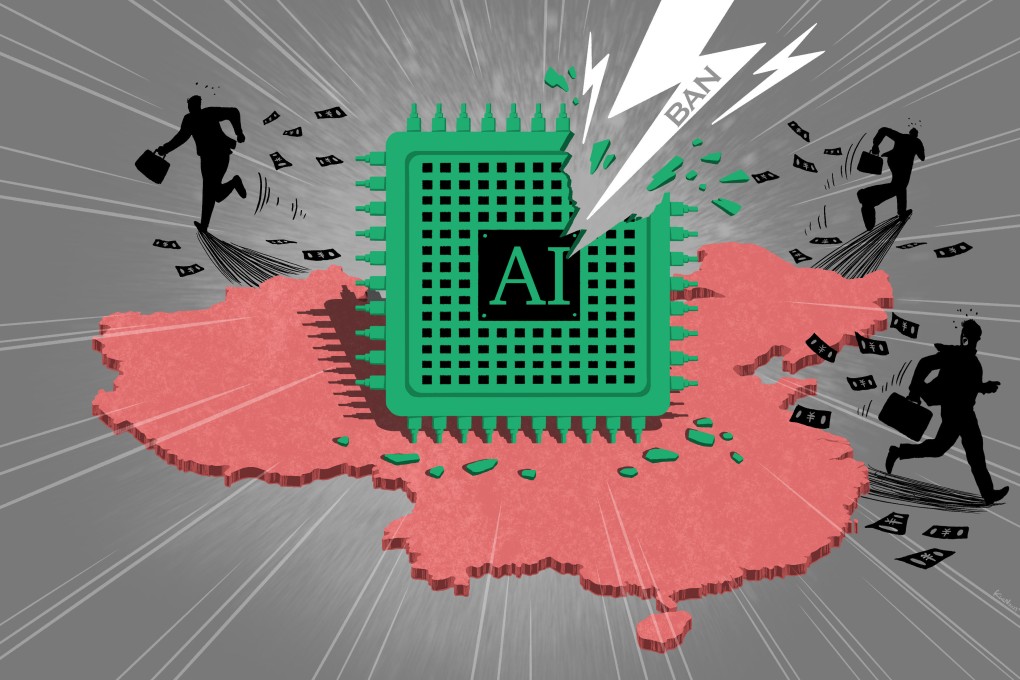

Tech war: Biden’s decree zaps lucrative investments in China’s chip and AI sectors

- Experts say US investment restrictions are final nail in the coffin for foreign investment into sectors such as chips and AI in China

- Some say local yuan funds cannot make up for loss of US dollar funds, which typically have long investment horizons and high-risk tolerance

It is most likely that China’s largest chip foundry, a key piece of the puzzle in Beijing’s efforts to achieve greater self-sufficiency in semiconductors, would not have been able to set up its first plant in Shanghai’s suburbs in the early 2000s without funding from American investors such as Walden International and Goldman Sachs.

Semiconductor Manufacturing International Corp (SMIC) is just one of many Chinese firms that received US venture capital funding from investors seeking extraordinary returns from China’s economic take-off, a bold example of the marriage of domestic technological ambition with adventurous American funds.

However, amid rising geopolitical tensions between the world’s two biggest economies and the implementation of tough US investment curbs, prospects for such collaboration in future have dimmed, dealing a direct blow to China’s ambitions to become a global power in artificial intelligence (AI). Industry insiders and analysts say the withdrawal of financial support and technical expertise is a game-changer.

“The damage is done in the sense that a lot of people will be scared away from the China market”, said Ben Harburg, managing partner at MSA Capital, a Beijing-based venture capital fund. “We will avoid sectors that we think are at risk or may fall foul of current or future US sanctions,” said Harburg in a recent interview with the Post.

MSA Capital manages US dollar funds with capital from sovereign wealth funds, international asset managers and pension funds, as well as Chinese entrepreneurs.

With more investors like MSA Capital trying to dodge the sanctions bullet, the backers of these funds will also have to rethink their China strategies given rising geopolitical acrimony.

Elton Jiang, founding partner at Shanghai-based Genilink Capital which backs chip start-up Black Sesame Technologies among others, said American investors will not only stop putting money into certain sectors but may also divest from companies in existing portfolios to comply with new restrictions.