The brothers behind Cambricon, the chip start-up powering China’s AI ambitions

- Cambricon Technologies is worth US$2.5 billion, making it one of China’s most valuable AI chip start-ups

- Founded by brothers Chen Yunji and Chen Tianshi, its chips have been used to power nearly 100 million smartphones and servers

What few know is that to achieve the decisive victory, the AlphaGo programme had to be powered by nearly 2,000 central processing units (CPUs) and 300 graphics processing units (GPUs). The electricity bills were as high as US$3,000 a game at the time, Massachusetts Institute of Technology (MIT) professor Han Song said in a recent speech at Tsinghua University.

The same month as AlphaGo’s victory over South Korean master Lee, two Chinese brothers working in a research lab at the Chinese Academy of Sciences (CAS) started their own company in Beijing. Their mission: to develop computer chips tailored for AI applications, allowing smaller and more power-efficient machines, at a lower price.

Raised in East China’s Jiangxi province by an educator mother and electric engineer father, Chen Yunji, 36, and Chen Tianshi, 34, have similar backgrounds. Both entered college at an early age, when they were 14 and 16 years old respectively, and obtained their doctorate degrees in computer science by the time they were 24 before joining CAS’ computing technology institute as assistant researchers, according to a profile by elecfans.com, an electronic industry portal.

Cambricon declined an interview for this story.

China sees a chance to close US core tech gap with AI chips in 5G era

While most consumers may not have heard of their company, the 3-year-old Cambricon Technologies’ AI chips are everywhere now – according to CAS they have been used to power nearly 100 million smartphones and servers so far including those by Huawei Technologies and Alibaba Group, which is the parent company of the South China Morning Post.

Cambricon was valued at US$2.5 billion in June 2018, according to a company statement, making it one of China’s most valuable AI start-ups after it raised hundreds of millions of dollars in a Series B funding round.

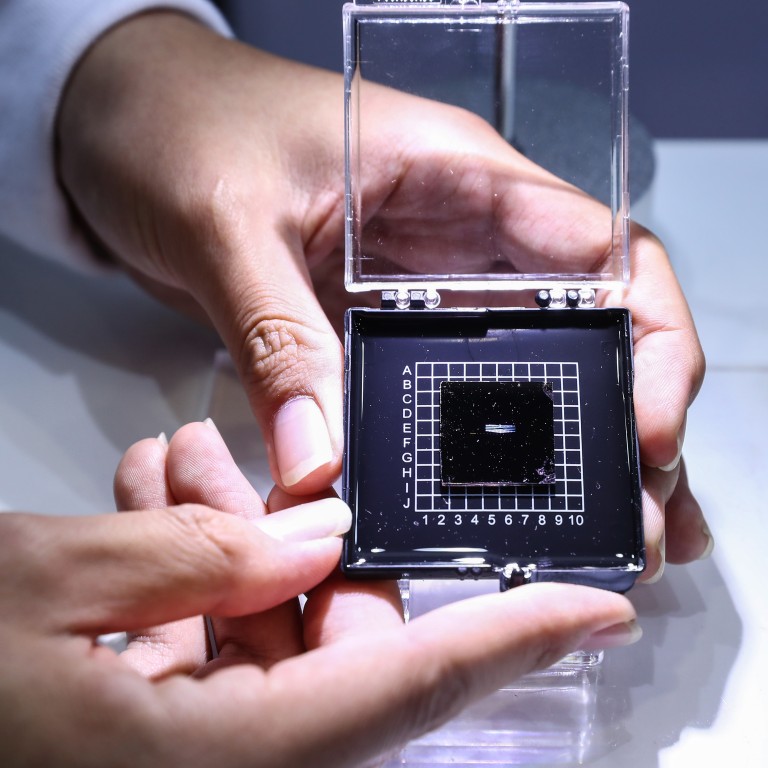

CAS, the cradle of China’s leading scientists, nominated Cambricon’s researchers for its Outstanding Science and Technology Achievement Awards 2019 last Friday for the company’s Cambricon A1 processor, which the academy said was the world’s first commercial deep learning processor.

Chinese AI chip maker Horizon Robotics raises US$600m in funding

The processor significantly outperforms traditional CPU and GPUs, according to a document posted on CAS’ official website.

Chen Yunji has compared traditional general-purpose processors to Swiss Army knives and deep-learning processors to kitchen knives.

“The Swiss Army knife has many applications, but when cooking a kitchen knife is still more handy,” he said in a 2017 interview with AI Xingqiu, an industry news portal. “Cambricon is like a good kitchen knife.”

Suppliers scramble for Plan B as US-China tech war starts to bite

But when Chen Tianshi, Cambricon’s chief executive, started to focus his research on AI chips about 10 years ago as an assistant researcher at the computing technology institute of the CAS, it was a choice that was “out of the mainstream,” the low profile Chen told China Science Daily in January in one of the very few interviews he has given.

“AI itself was not a buzzword at the time, let alone producing chips that are dedicated for AI use,” he was quoted as saying in the story.

On the increasingly competitive AI chip landscape, Chen Tianshi told tech blog Jazzyear in 2018 that professional chip companies such as Cambricon have an edge over tech conglomerates because they tend to provide a more comprehensive suite of products that can power a range of applications.

What Cambricon really wants to achieve is to become the “stepping stone” for ubiquitous AI applications in the future, he said in the January interview with China Science Daily.

“People don’t need to know our name, as long as we can support downstream [AI] applications, that is our contribution,” he said.

For more insights into China tech, sign up for our tech newsletters, subscribe to our award-winning Inside China Tech podcast, and download the comprehensive 2019 China Internet Report. Also roam China Tech City, an award-winning interactive digital map at our sister site Abacus.