US-China tech war: Beijing’s main policy lender pledges US$62 billion to fund tech innovation

- China Development Bank has earmarked financing to support strategic emerging industries and advanced manufacturing

- The funding support for hi-tech innovation forms part of a state-orchestrated strategy to reduce China’s reliance on imported technologies

“We’re selecting 100 leading companies in the field of technological innovation, and 1,000 firms along the upstream and downstream industrial chains and [will] offer them special financial services support,” said CDB chairman Zhao Huan at a press conference on Tuesday. “This year, we plan to arrange loans of more than 400 billion yuan for strategic emerging industries and advanced manufacturing.”

‘Two sessions’ 2021: can China create an ecosystem for tech talent to innovate?

“China lags behind the US in many areas, especially in semiconductors,” said Xu Hongcai, deputy chief economist at think tank China Centre for International Economic Exchange. “The top authorities have the duty to lead the country in making some breakthroughs in basic science research.”

“In the US, when the research comes to basic science, it is the same – the authorities also provide top-down support,” he said.

How China is still paying the price for squandering its chance to build a home-grown semiconductor industry

While state support in the form of fiscal subsidies of cheap loans from state banks were previously criticised for inefficiency, the vast resources now being used by China to catch up with the US in hi-tech development have not gone unnoticed in Washington.

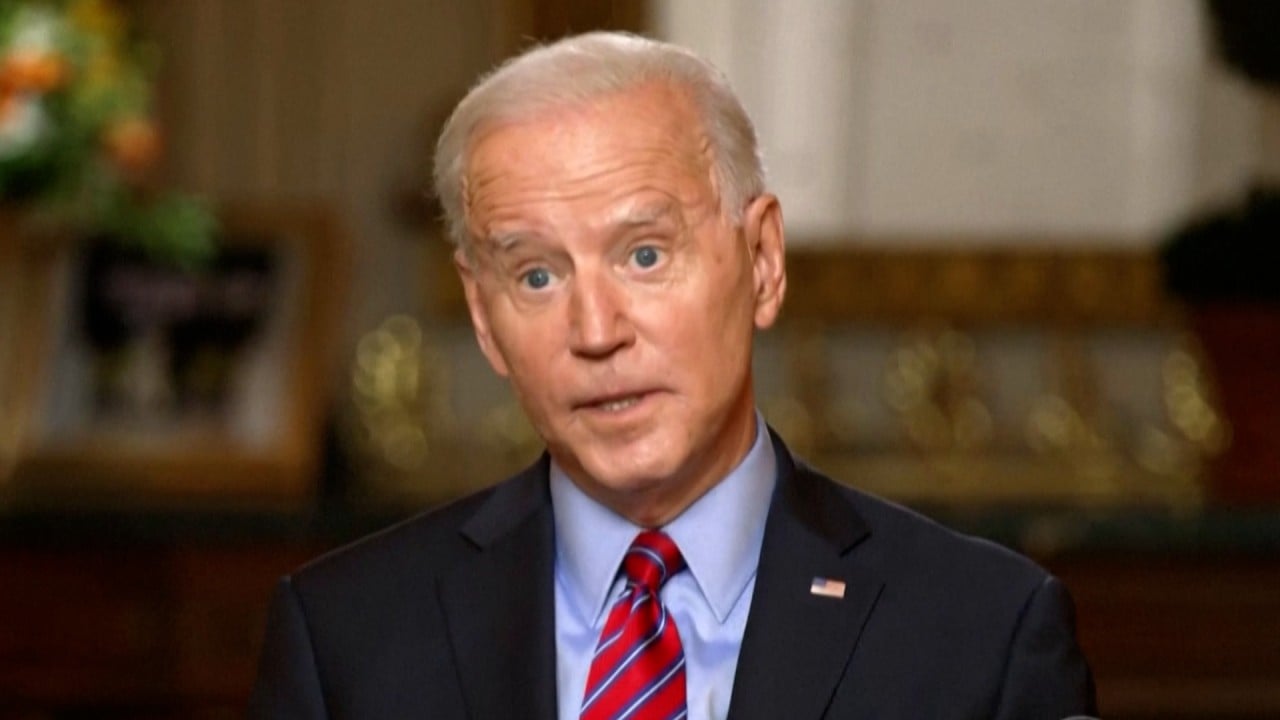

01:08

US President Joe Biden foresees ‘extreme competition’ with China

In China, economist Xu said “some problems in the technology industry, especially in semiconductors, cannot be solved only by money”. He said the country “needs to be patient to get more experience with attracting more talent” in the industry.