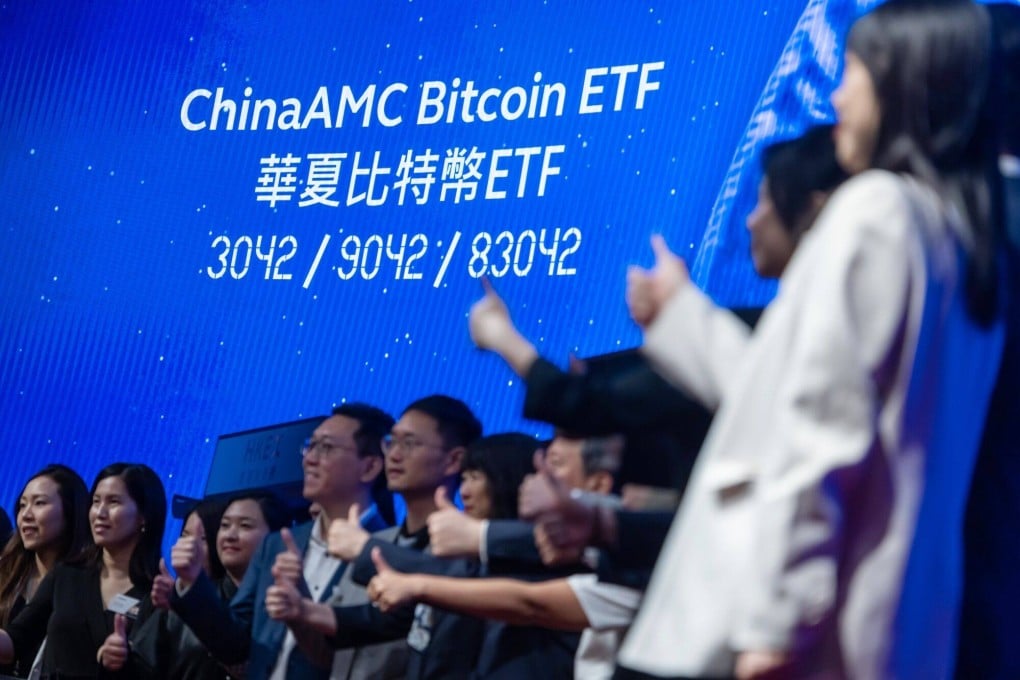

Hong Kong’s crypto ETFs off to bumpy start amid slumping bitcoin price, low trading volumes

- The city’s three ETFs that invest directly into bitcoin saw US$5.5 million change hands on Friday, down from US$8.6 million in their Tuesday debut

- Some see room for optimism, as the volumes are big relative to the small size of Hong Kong’s ETF market compared with the US, which has also seen outflows

Hong Kong’s newly launched cryptocurrency exchange-traded funds (ETFs), hailed as a milestone in the city’s efforts to become a virtual asset hub, have so far failed to generate much interest amid a slumping bitcoin price, as turnover remained small in the first four days of trading.

The city’s three ETFs that invest directly into bitcoin saw HK$43 million (US$5.5 million) change hands on Friday, while the three spot ether ETFs recorded HK$5.5 million in trading volume on the same day.

The volume was significantly smaller than on the first day of trading on the Hong Kong exchange on Tuesday, when nearly HK$67 million was traded for the bitcoin ETFs.

Cryptocurrency ETFs are seen as a major way for the volatile virtual assets to attract mainstream investors, possibly helping to boost prices.