Advertisement

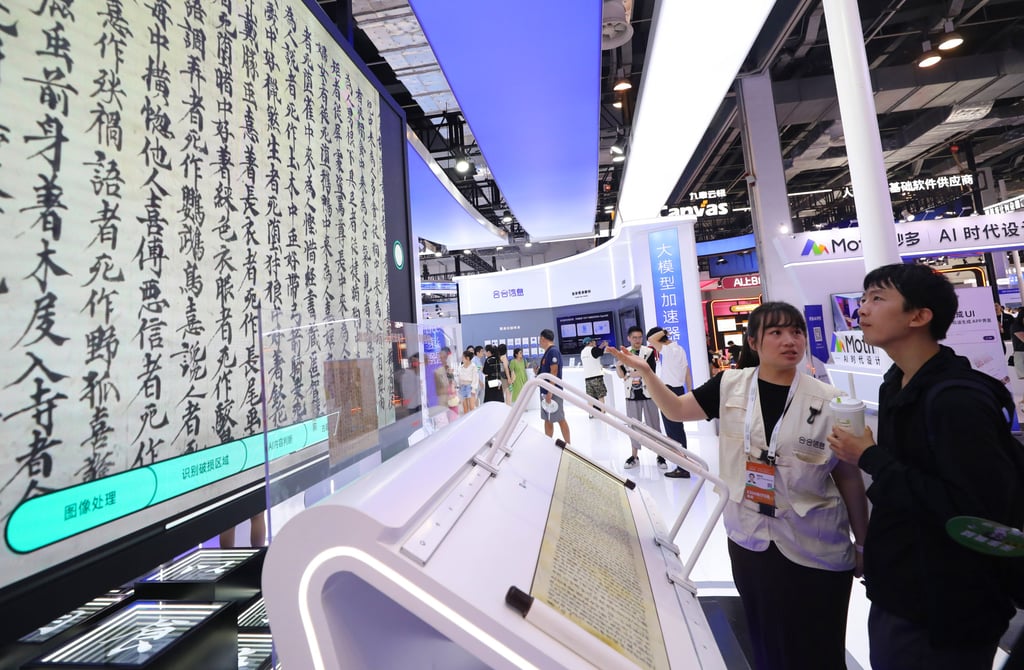

ByteDance, Alibaba, SenseTime lead generative AI infrastructure services market in China

- The three companies combined had a more than 50 per cent share of the market in the second half of 2023, according to an IDC report

Reading Time:2 minutes

Why you can trust SCMP

0

Coco Fengin Beijing

TikTok owner ByteDance, e-commerce giant Alibaba Group Holding and artificial intelligence (AI) specialist SenseTime are the top generative AI (GenAI) infrastructure services providers in China, according to market research firm IDC.

The three companies combined had a more than 50 per cent share of the market in the second half of 2023, according to a report on Tuesday by IDC, without offering each firm’s exact share. Alibaba owns the South China Morning Post.

They lease software, computing power, storage and networking resources for enterprises to build applications using large language models (LLMs), the technology underpinning GenAI services like ChatGPT.

GenAI refers to algorithms that can be used to create new content – including audio, code, images, text, simulations and videos – in response to short prompts.

The IDC data reflects how mainland China has swiftly become a world leader in GenAI adoption since OpenAI released ChatGPT in November 2022, which sparked an investment frenzy and soul searching on the mainland’s technology industry.

According to a survey of 1,600 decision-makers in industries worldwide by American AI and analytics software company SAS and Coleman Parkes Research, 83 per cent of Chinese respondents said they used GenAI.

Advertisement