China’s second-largest chip maker after SMIC gets green light for US$2.5 billion Shanghai IPO

- Hua Hong, already listed in Hong Kong, is aiming to raise 18 billion yuan on the Shanghai exchange’s Star Market

- Washington export restrictions cloud the future of the chip maker, whose most advanced technology is the 55-nm process node

Hong Kong-listed Hua Hong Semiconductor, China’s second-largest chip maker, has received regulatory approval for a US$2.5 billion initial public offering (IPO) in Shanghai, as the company forges ahead amid Beijing’s self-sufficiency drive despite new headaches from US restrictions.

Hua Hong has received a letter of acceptance from the Shanghai Stock Exchange to issue yuan-denominated shares and list them on its Science and Technology Innovation Board (Star Market), the company revealed in a filing to the Hong Kong stock exchange on Friday.

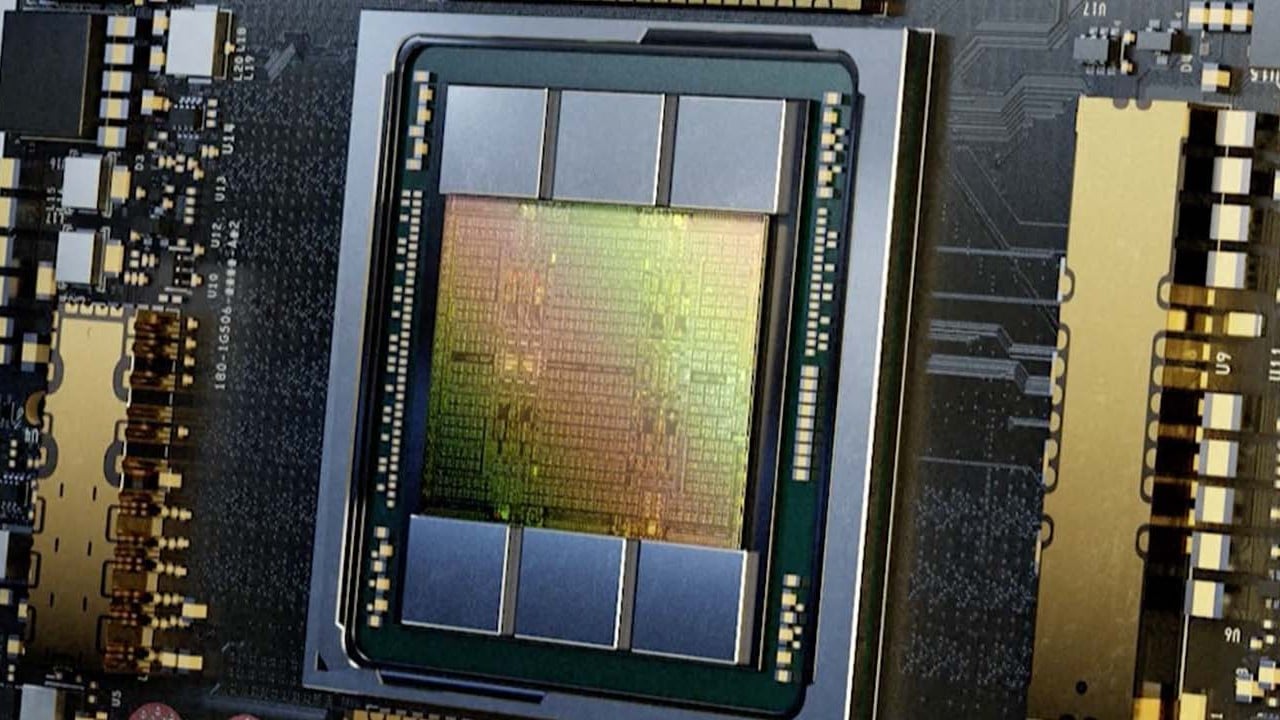

Hua Hong, whose most advanced technology is the 55-nanometre process node, has a capacity to produce 324,000 8-inch wafers a month, making it the second-largest chip maker in China after SMIC, according to its prospectus.

The company’s top revenue-generating processes are 350-nm and 90-nm, which together accounted for 60 per cent of its first-quarter revenue of 3.7 billion yuan.

The regulator’s green light for the IPO comes as Beijing has vowed more support for domestic tech companies amid escalating trade restrictions from the US in an effort to curb progress in China’s chip industry.