Ant Group moves key step forward in restructuring, as consumer finance unit wins approval to expand capital base

- The local branch of the CBIRC in Chongqing said it has approved the capital expansion plan of Chongqing Ant Consumer Finance

- Ant had been undergoing a restructuring and review of its myriad businesses ever since its US$39.7 billion IPO was pulled in 2020

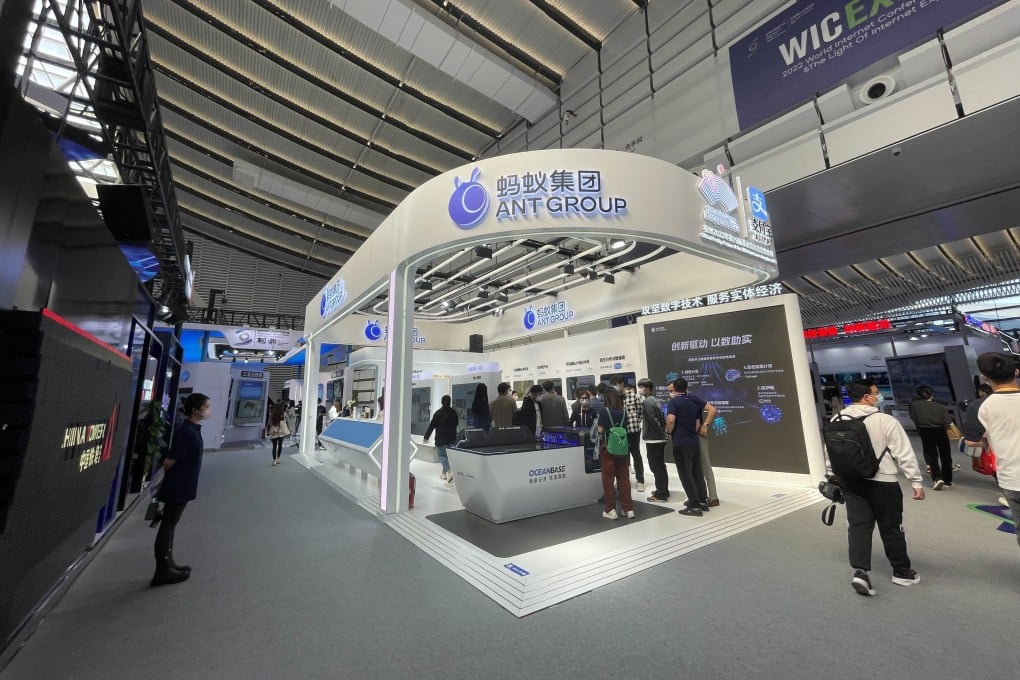

Ant Group, which is undergoing a restructuring to comply with new regulations after its planned mega IPO in Hong Kong and Shanghai was called off two years ago, has won regulatory approval to expand the capital base at its consumer credit unit, in a key step forward.

The local branch of the China Banking and Insurance Regulatory Commission (CBIRC) in Chongqing said on Friday it has approved the capital expansion plan of Chongqing Ant Consumer Finance, the consumer credit unit of Ant, to 18.5 billion yuan (US$2.63 billion) from a current 8 billion yuan.

The approval was granted a month and half after the unit’s investors made the plan public and weeks after Beijing renewed its pledge to support the country’s platform economies to play their role in economic growth and job creation.

An earlier capital expansion plan by the unit was halted in January 2022 after one potential investor, China Cinda Asset Management Corp, decided to pull out, just weeks after it announced its intention to become a new shareholder.

Under the current plan, state-owned company Hangzhou Jintou Digital Technology Group, optical part manufacturer Sunny Optical Technology and logistics tech firm Transfar Zhilian Co were added to the list of shareholders of Chongqing Ant, a new subsidiary set up by Ant Group in June 2021 to bring the firm’s sprawling and lucrative consumer finance business within regulatory limits.