Enjoy tax deduction under Voluntary Health Insurance Scheme

Tax deduction for individual health insurance is only available for Certified Plans under Voluntary Health Insurance Scheme (VHIS) which has been implemented by the Government as from April 1, 2019. You can enjoy tax deduction for the current year of assessment 2019/20 by purchasing VHIS before March 31, 2020.

[Sponsored Article]

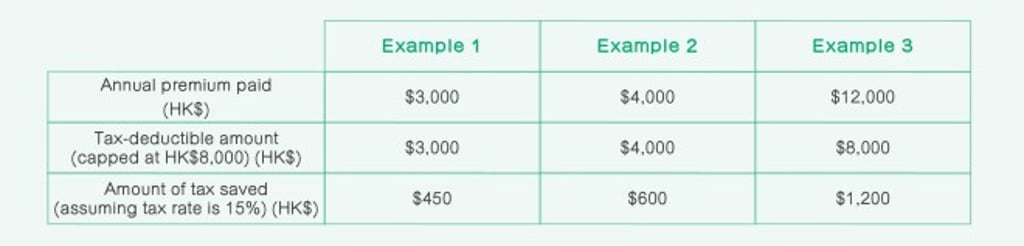

The maximum tax deductible amount of qualifying premium is HK$8,000 per insured person per annum without limit on the number of policies and insured persons

From the year of assessment 2019/20 onwards, taxpayers who purchase Certified Plans under VHIS for themselves or their specified relatives defined under the Inland Revenue Ordinance are eligible to apply for tax deduction. The tax deductible amount of qualifying premium is up to a maximum of HK$8,000 per insured person per year of assessment, and there is no limit on the number of policies and insured persons to claim tax deduction. However, the amount of premium qualifying for tax deduction (or tax-deductible amount) does not equal the amount of tax savings. The formula for calculating tax savings is as follows:

Amount of tax saved for each insured person= Tax deductible amount of qualifying premium (max. HK$8,000) x Tax rate (max. 17%)