Neobanks vs. Traditional banks: What’s the difference?

[Sponsored article]

As banks worldwide continue their slow pace of innovation, numerous startups and FinTechs have come around to modernise banking.

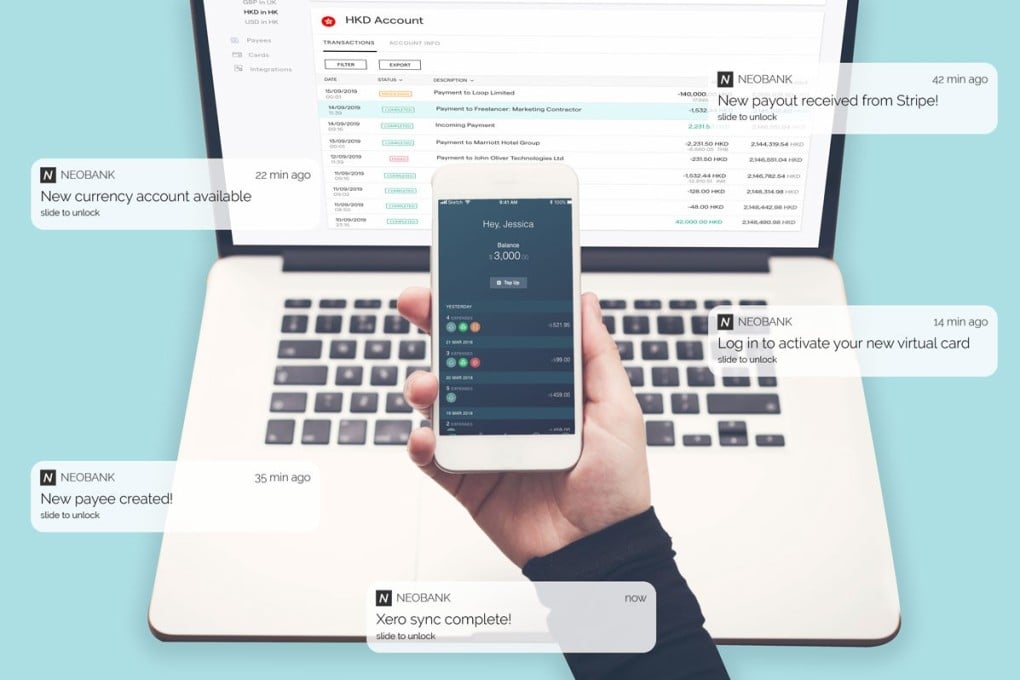

The so-called “neobanks” are digital-only challengers that provide technology-driven alternatives to services traditionally offered by banks like current accounts, loans, credit cards or trade finance.

They’re not necessarily fully licenced banks themselves, but may hold alternative licences or work with licenced partners to offer their services. Take for example Monese from the UK, Simple from the United States, or Neat from Hong Kong.

With this global phenomenon in full swing (not to mention Hong Kong’s looming 8 virtual banks), what can these new players offer that traditional banks cannot?

Fully-digital onboarding and account opening