The First BSc in Sustainable & Green Finance in Hong Kong

This new programme bridges the talent gap in this emerging field and is perfectly positioned to bring exceptional talent for a sustainable future.

[Sponsored Article]

As climate change continues to take center stage, profit alone can no longer underpin business activities. In fact, there is already an expectation that businesses will be geared towards sustainability and will join the fight against climate change. With this in mind, sustainable and green finance is now a fast-emerging field, and there is a corresponding and strong demand for professionals who have an understanding of green development.

HKUST has launched the first Bachelor of Science in Sustainable and Green Finance (SGFN) Program in Hong Kong. The aim of the Program is to foster talent to support green and sustainable development, and to support the Hong Kong Government’s objectives to turn the city into a leading green and sustainable finance center.

Green finance plays a huge role in protecting the environment, and the transition from brown-to-green requires the mobilization of large amounts of funding from the public and private sectors.

“We can see that many countries have started to undertake climate-resilient development pathways and aim to achieve carbon neutrality, something which requires a considerable investment,” explains Professor Jimmy FUNG Chi-hung, SGFN Program Co-Director, and an accomplished scholar in meteorology and air pollution. “Green finance activities will definitely help to mobilize resources across different sectors and support environmental protection.”

Investing to Meet Asia’s SDGs

Professor Veronique J. A. LAFON-VINAIS, SGFN Program Co-Director, and a seasoned financial market professional, says that Asia is significantly exposed to the impact of climate change. According to the Asian Development Bank, mitigation and adaptation efforts will require at least US$26 trillion dollars of investment. The United Nations estimated that Asia may have to invest US$3 to 5 trillion annually to meet its sustainable development goals. “This is a massive financing requirement which can only come from a combination of public and private investments,” she says.

The silver lining is that governments are already doing a lot through regulation. Professor Lafon-Vinais says that China is leading the way in Asia, and the country’s financial regulators are spearheading the development of green finance and working with their European Union counterparts to adopt common standards.

As sustainable and green finance continues to emerge, and development priorities are set at national and global levels, the need for people with the relevant knowledge, skill sets, and experience will increase. This is where the SGFN program will fill the gap.

Effective Leadership Skills

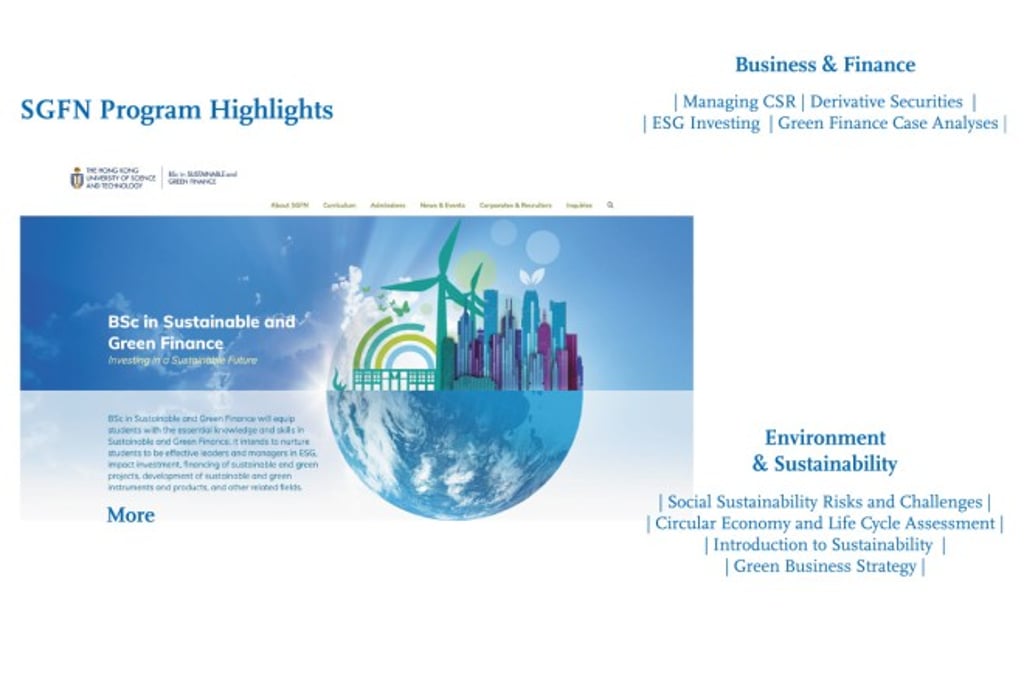

“The Program will teach students how to be effective leaders and managers in Environmental, Social and Governance (ESG), impact investment, the financing of sustainable and green projects, the development of sustainable and green instruments and products, and other related fields,” Professor Fung says.

Working in sustainability and green finance will require crossover skills, and that is why the program is organized by both the Business School and the Division of Environment and Sustainability. Its interdisciplinary nature will provide students with a broad-based learning experience that includes environment, science and technology. This will enable students to develop a global outlook which will enhance the development of sustainable and green finance. After graduating, SGFN students will be equipped to tackle issues that extend far beyond a single discipline.

“It is more than a finance degree, and it is more than an environmental management degree,” says Professor Lafon-Vinais. “The new Program gathers an interdisciplinary team of academic specialists in the area of finance and investment, environmental science and technology, to equip students with professional knowledge and a global outlook.”

The Program is taught by expert faculty members, and maintains strong connections with industry, as well as HKUST alumni. Such connections ensure there are plenty of practical and enriching co-curricular activities.

An Interdisciplinary Approach

The first intake for the inaugural program will be during the Fall of 2022, when 30 students will be admitted to the Program. Eighteen admissions will be program-based admissions, and 12 will be school-based. A program-based admission means that students will be directly admitted from secondary schools, if they fulfil the minimum requirements of admission by the Business School. School-based admissions will be for students already enrolled in the Business School, who can then apply for a BSc in SGFN as a major.

As part of the Program, students will study a wide range of topics across disciplines. These include ESG investing, sustainable supply chain management, green business strategy, the use of engineering technology to solve environmental problems, and more.

According to Professor Fung, the four-year programme is particularly suited to students who have a strong interest in green development and green projects. They will be able to apply a knowledge of finance to enhance the financial sustainability of projects.

“Sustainability will be at the heart of the economy in the 21st century and beyond. The new program is set to equip students with the essential knowledge and skills to fill the talent gap for green and sustainable finance.”

New Funding for Green Finance Research

In addition to nurturing green finance talent, HKUST has taken active steps in expanding its understanding of green finance. In our ongoing effort to support this realm, we are pleased to receive major funding from the Theme-based Research Scheme of the Research Grants Council for our research project entitled “Developing Hong Kong as a Global Green Finance Centre”.

Our funded proposal will gather an interdisciplinary team of academic specialists in the areas of finance, environmental science, public policy, and technology, as well as former policymakers and experienced practitioners, to address fundamental research questions of green finance through a series of cohesive studies.

Professor Chu ZHANG, Head of the Finance Department and Project Coordinator says, “Our research team represents six main research areas and will contribute towards helping various stakeholders achieve the ‘brown to green’ transition. Adopting a ‘think and do’ approach, we will gather academic insights, work with industry partners and government units, and guide them in implementation and execution phases of a broad range of green finance tasks.”

Professor TAM Kar Yan, Dean of HKUST Business School, says, “The cross-disciplinary nature of this project emphasizes the importance of collaboration across various industries and disciplines to ensure the success of building and financing better solutions for our planet.”