The rise of impact investing

[Sponsored Article]

The awareness that we as individuals and as investors have a responsibility and accountability over our decisions has sharpened over the last few years. Within the toolkit we have to influence positive change, investing serves as a means of transforming our best intentions into tangible action.

Rosa Sangiorgio, Head of ESG, Pictet Wealth Management

From intention to action: When it comes to having a positive impact, the intention has often been there for private and institutional investors, but the action has not necessarily followed. That is now changing. The impact investing market is estimated between roughly 700bn and 2.3Trillion, with estimates varying depending on the definition used (measured and/or intended impact). [1] [2]. In 2020, around one in four family offices globally engaged in impact investing, with over two-thirds of them planning to increase their allocations to between 10–100% of their portfolios over the next five years[2]. Intentions are finally being transformed into action. There are a number of factors behind this key transformation.

First is rising awareness. Both public and private sector initiatives, from the EU’s Sustainable Finance Disclosure Regulation to the Principles for Responsible Investment and Banking, have increased clarity and information, catalysing the momentum. The financial industry has responded and more solutions and options are becoming available, making impact investing increasingly accessible.

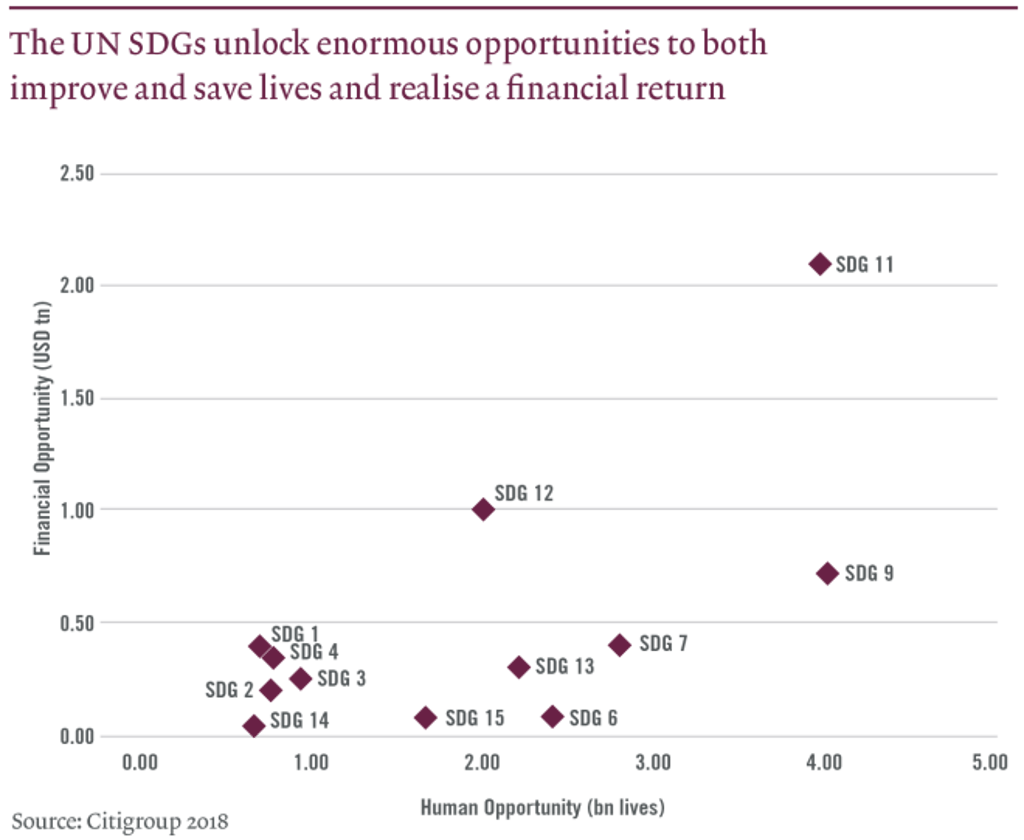

Second, we are slowly shedding the misconception of concessionary returns – the idea that investing responsibly requires sacrificing financial returns. As the number of responsible investing options (including impact investing) has grown, so too have their track records become established. Many of these products fared better than their counterparts during the crisis, and a growing number of studies confirm that not only is responsible investing not detrimental to performance, but that it often delivers superior financial returns in the long term [3].