Insurtech helps insurers build resilience and tap new markets

[Sponsored Article]

The Greater Bay Area (GBA) and the Belt and Road Initiative (BRI) will provide insurers opportunities to expand their business regionally and globally. Meanwhile, more tech-savvy customers will continue to demand a higher level of product innovation and improved customer engagement that the insurance industry has not seen previously.

These are some of the observations shared by leading industry players, regulators and virtual insurers at the Asian Insurance Forum (AIF), themed as "Spearheading Change for a Sustainable and Resilient Future", hosted by the Insurance Authority (IA) on December 8 as a hybrid event connecting with about 1,000 local and overseas online participants.

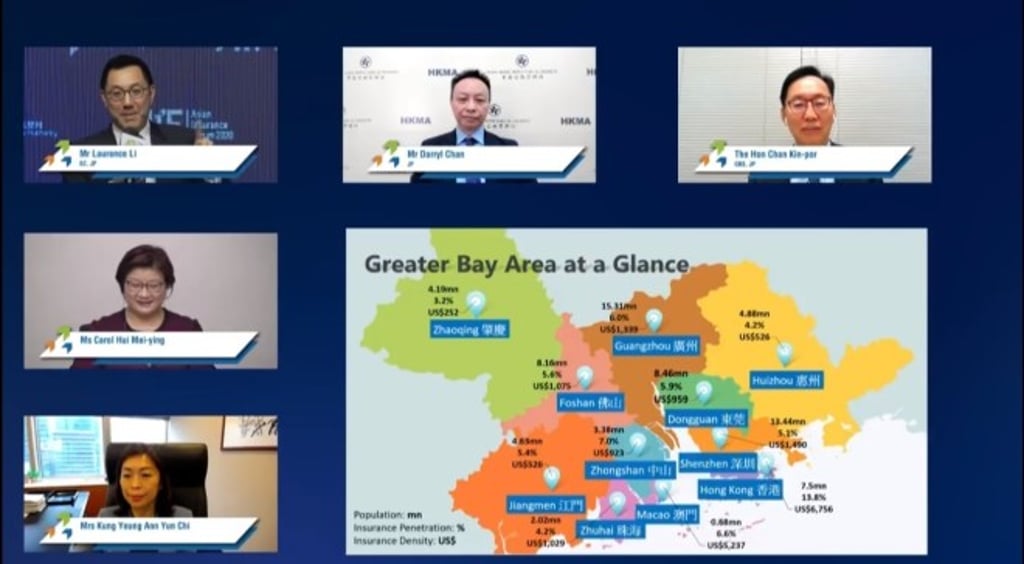

The event featured a total of three panel discussions — the first one on GBA moderated by Laurence Li, Chairman of the Financial Services Development Council; the second one on BRI moderated by Christopher Hui, Secretary for Financial Services and the Treasury; and the final one on Insurtech moderated by Dr George Lam, Chairman of Hong Kong Cyberport Management Company Limited.

Just as Carrie Lam, Chief Executive of the HKSAR Government, mentioned in her opening address, the GBA and the BRI will create abiding promise for the insurance industry as the IA continues to transform Hong Kong into a regional insurance hub and global risk-management centre. She revealed that the HKSAR Government is in an advanced stage of discussion with the Mainland authorities on the proposed establishment of after-sale service centres.