Advertisement

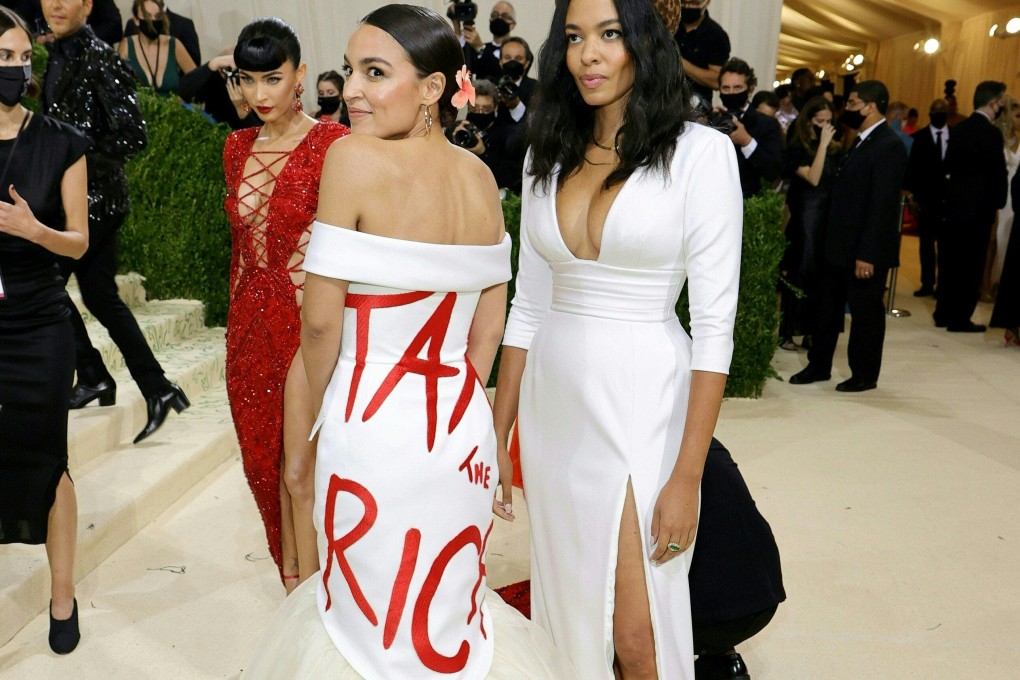

Outside In | Why global tax on super rich is least bad option to tackle crises

Amid the current wave of adversity, the wealthiest among us must acknowledge they are obliged to dig deeper into their pockets

Reading Time:4 minutes

Why you can trust SCMP

2

This year’s proliferation of democratic elections, combined with the largely unfunded costs of the global polycrisis, has led to an upwelling of calls from countries worldwide to raise taxes on the rich.

Advertisement

The mood is the same, whether among US Democrats ahead of November’s presidential elections, in the office of the UK’s newly appointed Chancellor of the Exchequer Rachel Reeves as she prepares her autumn budget or with French President Emmanuel Macron, who has recently joined Brazilian President Luiz Inacio Lula da Silva in calling for a global tax rate for the world’s wealthiest.

Wherever you look, political leaders are facing similar pressures. Spending needs have risen through the roof, government coffers are severely depleted, debt service costs have soared, and the inflation-poisoned political mood of working families pre-empts the option of higher consumption or mainstream income taxes. Social inequality seems to be its highest in decades.

Even here in Hong Kong, where our leaders have carefully nurtured budget surpluses across decades, the deep Covid-19 recession has plunged our government into deep deficits. They hit HK$101.6 billion (US$13 billion) last year and are forecast to reach HK$48.1 billion in the current financial year, with no early return to surplus yet in view.

Awareness of the extreme gap between Hong Kong’s cage-home-dwelling poorest and 143,400 millionaires has triggered increasingly animated calls for tax reforms that have the affluent classes directly in their sights: capital gains taxes on properties and investments and estate or inheritance taxes.

Advertisement

It has been bad enough for families struggling on stagnating take-home incomes to see the asset wealth of the community’s wealthy grow strongly on the back of soaring house prices. Even worse has been a rising sense that the rich do not pay their fair share of taxes and that this needs to be corrected.

Advertisement