Advertisement

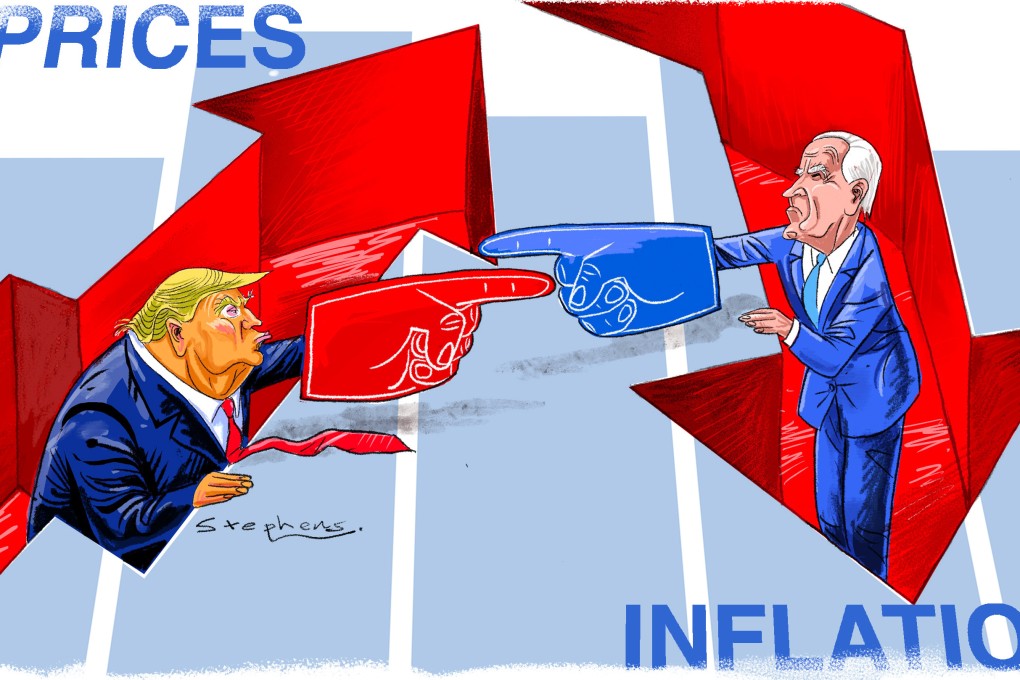

Opinion | The defining economic issue of 2024 US election is cost of living

- High prices weigh more on US voters’ minds than falling inflation, but don’t expect either major candidate to offer more than finger-pointing

Reading Time:3 minutes

Why you can trust SCMP

3

Economists are struggling to reconcile their upbeat views on the US economy with the angst of average Americans. The key measures of economic performance – growth, unemployment and inflation – are almost perfect, putting the United States in an enviably strong position. But ahead of November’s presidential election, voters continue to cite the economy as a top issue. The main problem: inflation.

Advertisement

How can this be? To the exasperation of most economists, all this hand-wringing seems terribly misplaced. The Covid-19 shock to US prices from the spring of 2021 has subsided dramatically. Yes, we are still waiting for an all-clear sign that inflation is settling back down to the 2 per cent target that the US Federal Reserve judges to be consistent with price stability, but there can be no mistaking a significant reduction in inflation risks.

Of course, there is an important catch. Even if inflation was to return to the promised land of price stability – although not as quickly as the optimists of the “transitory” camp initially expected – there is still a serious political problem with that result. Namely, prices are too high and are likely to remain elevated for many years to come.

By using the word “prices” instead of inflation, I am not splitting hairs. Inflation depicts changes in aggregate prices, which is very different from the level of the price index. That distinction bears critically on the political debate ahead of the election. US President Joe Biden’s team is focused on the inflation rate while the American public is more concerned about the price level.

There is little debate over the progress on inflation. After surging to a post-pandemic high of 9.1 per cent in June 2022, the overall inflation rate as measured by the consumer price index (CPI) has since receded to a 3.3 per cent average during the past 11 months – an extraordinary reduction over such a short period.

Nevertheless, inflation remains more than double the 1.5 per cent average rate during the seven years prior to Covid-19. It is also significantly above the Fed’s 2 per cent target, as seen through the lens of a slightly different metric, the GDP-based personal consumption expenditures price index.

Advertisement

Advertisement