Editorial | Decoupling may offer silver lining for IPOs in Hong Kong

Hong Kong stands to benefit if Chinese companies are delisted from American exchanges and have to look for a new home

As their trade war heats up, experts and industry insiders are fretting how China and the United States may escalate beyond tit-for-tat tariffs. A full-blown decoupling may be extreme, but is not beyond the realm of possibility.

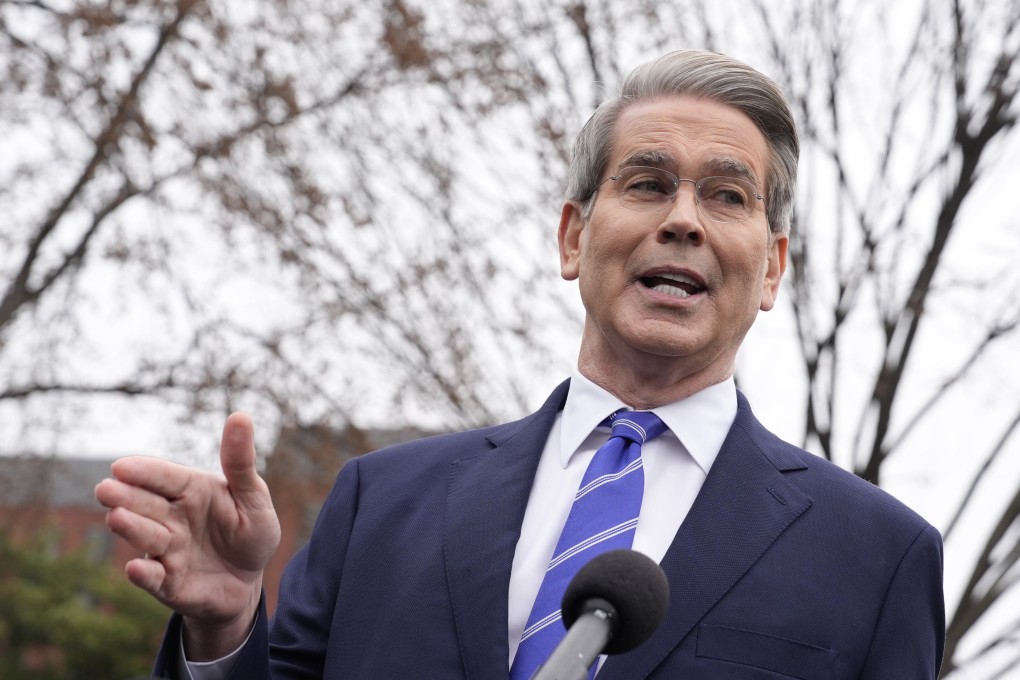

One worsening sign is that US Treasury Secretary Scott Bessent has warned that the option of delisting US-traded Chinese companies is now back on the table.

Should that happen, it would indeed become a major disassociation between the equities markets of the world’s two biggest economies.

Ironically, Hong Kong’s capital market may benefit in such an outcome.

Financial Secretary Paul Chan Mo-po has already instructed the Securities and Futures Commission and the local stock exchange to prepare the best conditions for such a “homecoming”.

An estimated US$1.1 trillion in the market capitalisation of nearly 300 Chinese companies, listed on the New York Stock Exchange, Nasdaq and NYSE American, would all be exposed, according to the congressional US-China Economic and Security Review Commission. Things can get worse from here.