Politico | Federal Reserve signals plan to pull back US economic support even as coronavirus looms

- The US central bank says it’s making progress toward its goals of averaging 2 per cent inflation over time and reaching maximum employment

- Officials forecast the US economy would grow 5.9 per cent in 2021, significantly slower than their June estimate of 7 per cent

This story is published in a content partnership with POLITICO. It was originally reported by Victoria Guida on politico.com on September 22, 2021.

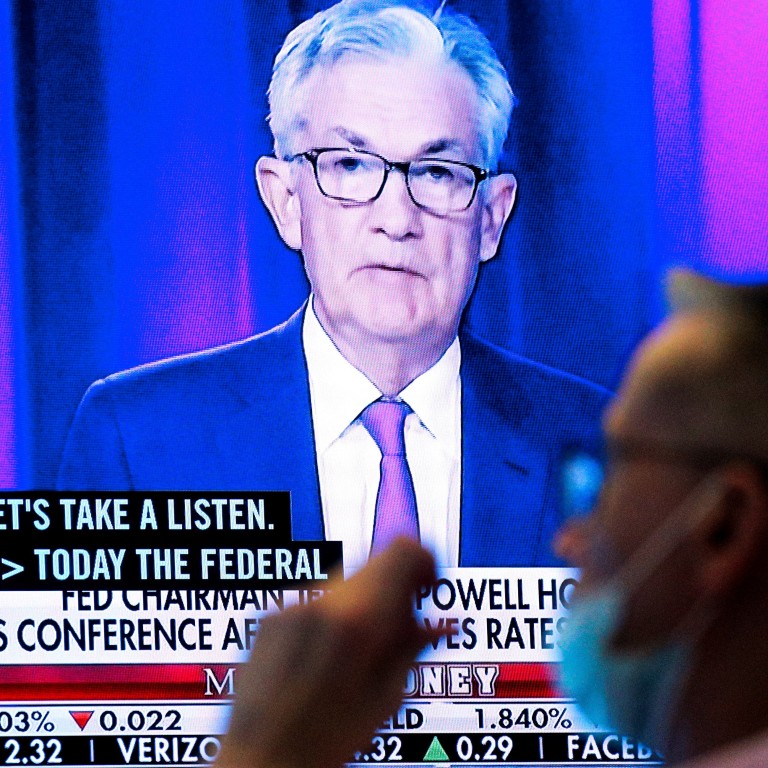

The Federal Reserve on Wednesday signalled it is on track to begin withdrawing some of its extraordinary support for the US economy later this year, even though officials are more pessimistic about the outlook for growth and job creation as the resurgent coronavirus weighs on the country.

Fully half of the Fed's 18 policymakers even pencilled in the possibility of an interest rate hike next year, indicating their belief that the economy might be strong enough by then for the central bank to start ending its massive support more aggressively. They left interest rates unchanged at their two-day meeting this week.

In its post-meeting statement, the Fed’s policymaking committee said the rise in Covid-19 cases has slowed the recovery, and officials forecast that the economy would grow 5.9 per cent in 2021. While that is still an impressive number, it is significantly slower than their June estimate of 7 per cent.

The central bank said it is making progress toward its goals of averaging 2 per cent inflation over time and reaching maximum employment. That means the policymakers could start to slow their monthly purchases of US government debt and mortgage-backed securities in November or December.

Those bond purchases – totalling a staggering US$120 billion a month – are intended to supercharge the central bank’s efforts to keep borrowing costs low while the economy recovers.

“The economy has made progress toward these goals,” the Fed statement said. “If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

The Fed’s meeting came amid jitters in the stock market over the past couple of weeks as investors nervously eye legislative drama in Washington, where the government will run out of funding by the end of the month and the debt ceiling needs to be raised over the next few weeks to avoid defaulting on bills the US has already racked up.

China Evergrande ‘resolves’ interest on bond as it battles to dodge default

Chinese real estate giant Evergrande’s debt woes have also boosted market fears as investors try to sort out how powerful a ripple effect there might be in the US.

Fed officials expect unemployment to be slightly higher than they had previously expected, forecasting it will drop to 4.8 per cent by the end of the year, rather than their June projection of 4.5 per cent.

They also acknowledged that inflation has been stronger than expected this summer, predicting that price levels will rise 3.7 per cent this year, excluding volatile food and energy prices, compared to the June projection of 3 per cent.

Still, they expect inflation to drop back to 2 per cent over the next couple of years, consistent with their messaging that the factors driving rapid price growth are only temporary.

Read Politico’s story.