Many airlines will avoid Hong Kong as long as uncertainty around Covid travel curbs remains, head of global airline association warns

- ‘Committing capacity in an environment where capacity is still constrained would be difficult decision for many airlines,’ says head of association

- At least 45 foreign carriers no longer fly to Hong Kong, including British Airways, Air France and Etihad, according to aviation analytics firm

Airlines that are no longer flying to Hong Kong will continue to avoid the city as long as uncertainty around its Covid-19 rules remains, the head of a global airline association has warned.

The director general of the International Air Transport Association (IATA), Willie Walsh, on Wednesday said it was “disappointing” to see how the city’s pandemic-related travel curbs had continued to restrict flights into Hong Kong.

“I can’t see many airlines returning while the uncertainty continues, and committing capacity in an environment where capacity is still constrained would be a difficult decision for many airlines,” he said during a media briefing.

Looking ahead, he added that while carriers would keep an eye on Hong Kong, they would be “reluctant to commit anything to the market until they see clear evidence that the restrictions were being removed”.

According to aviation analytics firm Cirium, at least 45 foreign carriers no longer fly to Hong Kong – including British Airways, Air France and Etihad – compared with about 85 which operated routes to the city before the pandemic.

Virgin Atlantic extended a suspension of its London to Hong Kong flights to March next year instead of resuming service in September as planned because of “ongoing operational complexities”.

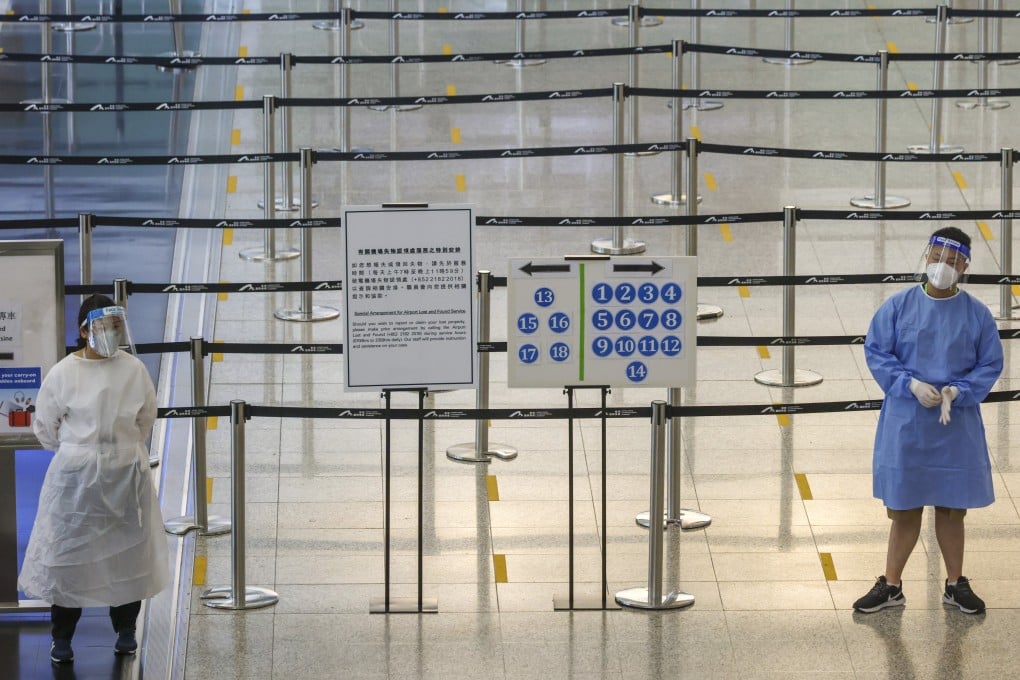

As countries began lifting their Covid-19 travel restrictions from April, mainland China and Hong Kong have remained outliers, sticking to a policy that requires travellers to take tests for the virus and undergo quarantine in hotels upon arrival.

Hong Kong eased its strict entry regime from August 12 by implementing the “3+4” travel scheme – which comprises three days of hotel quarantine and another four under home medical surveillance with limited freedom of movement.