China underlines support for Sri Lanka’s debt restructuring, IMF push, as Prime Minister Gunawardena wraps up visit

- Pledge comes in joint statement issued as Lankan Prime Minister Dinesh Gunawardena wraps up five-day visit to China

- Beijing also willing to ‘play a positive role’ in the IMF ‘to assist Sri Lanka in financial relief’, statement says

Beijing was willing to “continue supporting its financial institutions to actively negotiate with Sri Lanka, maintain friendly communication with other creditors, and play a positive role in the International Monetary Fund to assist Sri Lanka in financial relief”, the statement said.

China is the largest bilateral creditor of Sri Lanka, which declared bankruptcy in 2022 and suspended repayments on some US$83 billion in local and foreign loans after it ran out of foreign reserves.

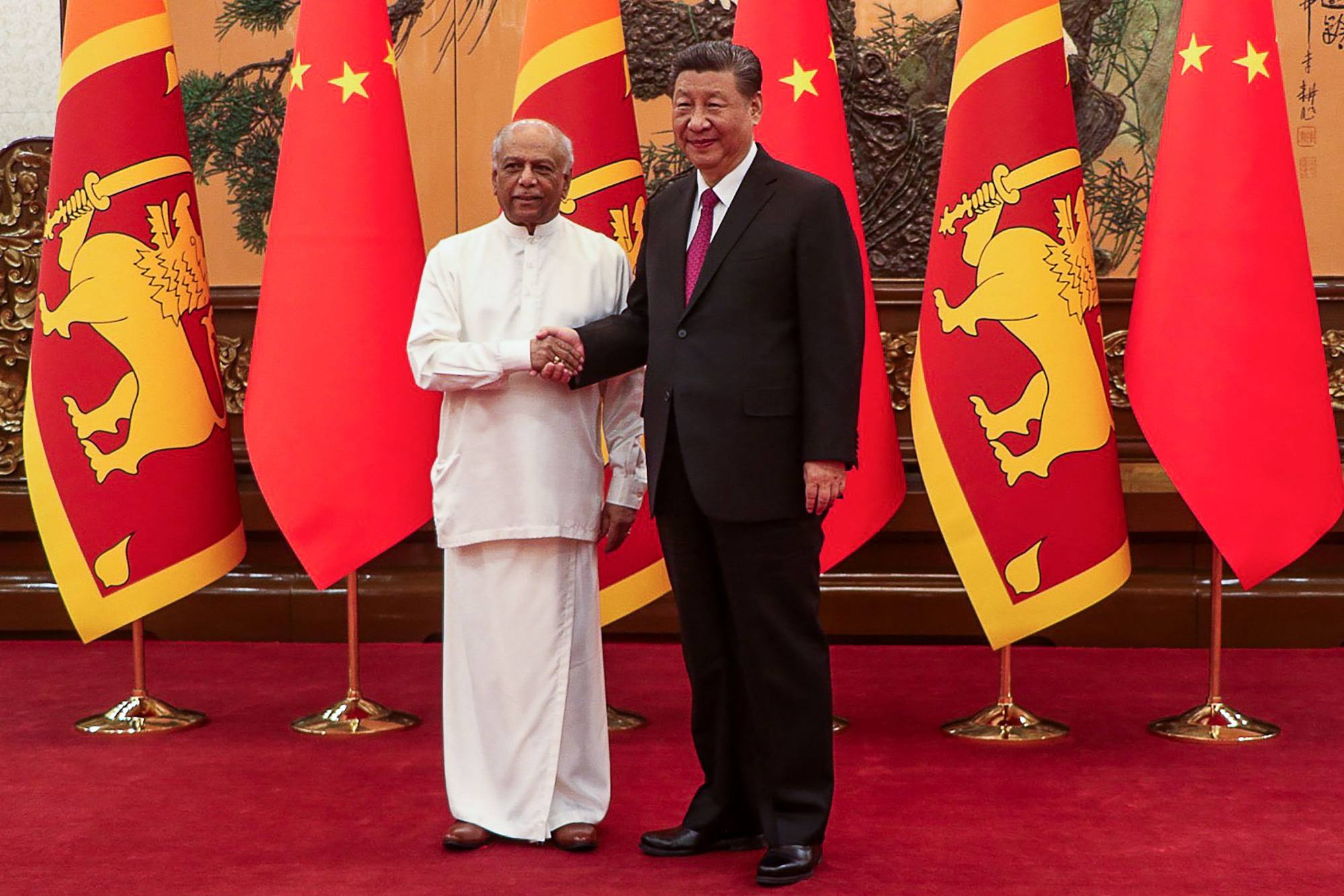

Debt restructuring was top of the agenda for Gunawardena’s visit to China, where he held talks with Chinese President Xi Jinping and Premier Li Qiang in Beijing before travelling south to Hainan province to address the Boao Forum.

Colombo is working to maintain an IMF bailout of US$2.9 billion, extended on the condition of debt restructuring with foreign creditors and measures taken to develop the country’s economy.

In October, Sri Lanka said it had reached an agreement with the Export-Import Bank of China to cover about US$4.2 billion of outstanding debt.

However, there was no news about talks with other major Chinese lenders, including the China Development Bank and some Chinese state enterprises.

By the end of 2022, China’s debt stock in Sri Lanka had reached nearly US$7.3 billion, constituting 19.6 per cent of the island country’s public external debt. The figure includes debts by both government-backed banks and state-owned companies, according to a paper by Chulanee Attanayake of the National University of Singapore, published in the peer-reviewed Journal of Contemporary East Asia Studies last May.

Friday’s joint statement also said China would continue to support Port City Colombo and the Hambantota Development Project, and envisioned turning them into “flagship projects of the Sino-Sri Lankan joint construction of the ‘Belt and Road [Initiative]’”.

Hambantota and debts owed to China have come under international scrutiny after Colombo handed over the strategically important port to a venture led by China Merchants Port Holdings Co in return for US$1.1 billion on a 99-year lease in 2017. The move also irked regional rival India, as the port at the southern tip of Sri Lanka is a potential key maritime hub in the Indian Ocean.

China has rejected accusations by Western media and officials that its infrastructure investment projects in Sri Lanka are debt traps.

Are China-backed mega projects causing Sri Lanka to face ‘Chinese debt trap’?

The joint statement also said China would encourage more companies to invest in Sri Lanka, while Sri Lanka said it was planning to announce more preferential treatment for Chinese companies to invest in the Colombo port city and Hambantota.

President Xi highlighted China’s support for the two projects during his meeting with Gunawardena on Wednesday.

China will also increase imports from Sri Lanka including tea, according to the statement.