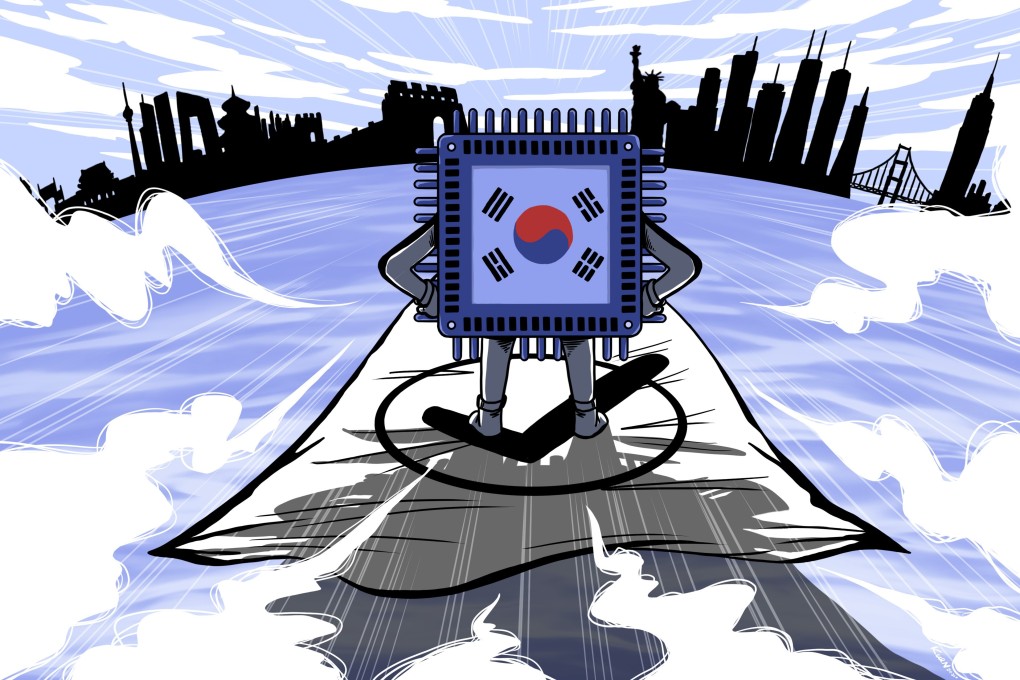

Will South Korea’s chip sector have to take sides in the China-US tech war?

- Under Moon Jae-in, Seoul has charted a middle course between its biggest semiconductor market and its traditional military ally

- But that could change if a conservative candidate wins the South Korean presidency, observers say

This is the first in a two-part series on the potential impacts of presidential elections in the region on relations with China and the United States. Here, Laura Zhou and Eduardo Baptista examine the challenges a swing in the electoral pendulum could pose for South Korea’s semiconductor industry.

Semiconductors are crucial to almost every industry in the modern economy, from mobile phones to cars and defence facilities, and in March alone, China, including Hong Kong, accounted for 60 per cent of South Korea’s exports of the products, according to Seoul’s Ministry of Trade, Industry and Energy.

On the other side is the United States, a traditional military ally and owner of many of the semiconductor technologies that have helped transform South Korea into a hi-tech powerhouse.

Samsung, for example, is a leading world player in mobile processor design, but the key technologies, from the core semiconductor intellectual property to design software and fabrication tools and materials, are dominated by US companies.