China raises rare earth quotas in ‘goodwill trade signal’ to US

- Chinese companies allowed to increase output by more than a quarter amid reports that Beijing could aim export restrictions at US

- Biden administration should take message seriously, analyst says

The Ministry of Industry and Information Technology and the Ministry of Natural Resources announced on Friday that first-half output for the minerals could increase by more than a quarter to 84,000 tonnes, up from 66,000 tonnes at the same time last year.

01:44

Amid US-China trade war, China aims to elevate its domestic rare earth industry

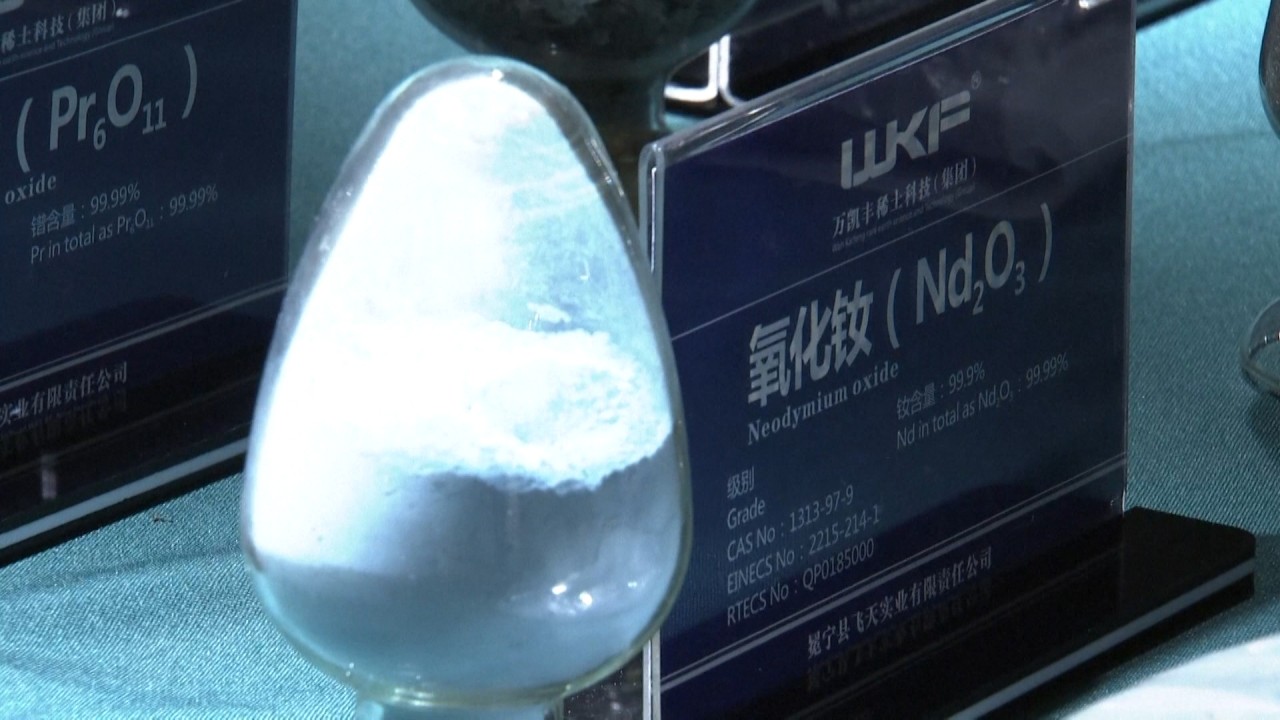

China is the top rare earth producer, accounting for over 60 per cent of the world’s output.

It strictly controls mining and refining, with the two ministries setting quotas twice a year for the six main state-owned producers. Production without a quota is banned.

The substantial increase in the quota is a gesture of Beijing’s willingness to work with the West, particularly the US, on trade, according to Wang Yong, director of Peking University’s Centre for International Political Economy.

“The Biden administration should take the message seriously, that China hopes to maintain a stable and mutually beneficial trade relationship and repair ties,” Wang said.

“But if the US side continues its economic sanctions and blocks on technology, rare earth supply will still be in the toolbox.”

US-China rivalry: Pentagon invests US$12.7 million in rare earth producers to reduce reliance on China

In January, the industry ministry prompted concerns about a potential export ban by releasing draft provisional regulations for rare earths that would further tighten controls on production – including tracking, reserve management and penalties for infractions.

The Financial Times reported on Tuesday that China was exploring whether it could harm US defence contractors by limiting supplies of the minerals. Bloomberg also reported that China might ban exports of rare earth refining technology to countries or companies it deemed as a threat to state security.

These metals have national security implications because some are essential elements in the alloys used in stealth fighter jet engines, nuclear reactors on aircraft carriers and submarines, and magnets for precision-guided munitions and missiles.

The US imported about 80 per cent of its rare earths from China from between 2015 and 2018 and various commenters suggested that Beijing could “weaponise” supplies in response to US tariffs on Chinese imports under former president Donald Trump.

Beijing briefly used rare earths as a geopolitical weapon against Tokyo in 2010, in a territorial dispute over the Diaoyu Islands, also known as the Senkakus, in the East China Sea. But the strategy misfired with the Japanese responding by building a rare earth supply chain outside China. The Chinese share of rare earth production dropped from more than 95 per cent of the global total in 2010 to around 70 per cent in 2018.

To reduce their heavy reliance on the “strategic rival”, the US started in 2017 to invest in domestic rare earth development. The Pentagon has sponsored the Mountain Pass mine in California, which has now become the biggest operation of its kind outside China. Malaysia-based rare earth company Lynas is also building production facilities in Hondo, Texas.

Macau-based military specialist Antony Wong Tong said Australia, Vietnam, Mongolia and the US mainland all had major reserves that could be exploited.

“In fact It might also be a bit too late for China to play this card now,” Wong said.

Nevertheless, with just 36.7 per cent of global rare earth reserves, China has over 90 per cent of the refining capacity, partially due to high starting cost of facilities and environmental impact.

That dominance means future players would take a long time to catch up with China, especially in processing, according to Wang.

“China’s expansion of supply and increase in quotas will result in more rare earth supplies to the market at better prices, which in turn will lead to more shortfalls in the US-invested production. The law of economics would prevail,” he said.