Securities investments between US and China reach US$3.3 trillion in 2020, says report

- Recent policy headwinds can hinder future growth, says New York-based consultancy

- Washington has enacted policies in recent years to restrict US investments in Chinese companies on national security concerns

American and Chinese investment in each other’s corporate securities reached US$3.3 trillion in 2020, despite political headwinds on both sides, according to Rhodium Group.

Given the size of the two countries’ economies, “there would be room for trillions of dollars in additional US-China financial investment” to triple to more than US$9 trillion, said the report released on Tuesday by the New York-based consultancy and the National Committee on US-China Relations.

But policy challenges can hinder future growth.

“Measures have proliferated on both sides which, if current trends persist, could greatly diminish growth prospects,” said the authors, led by Adam Lysenko in the report.

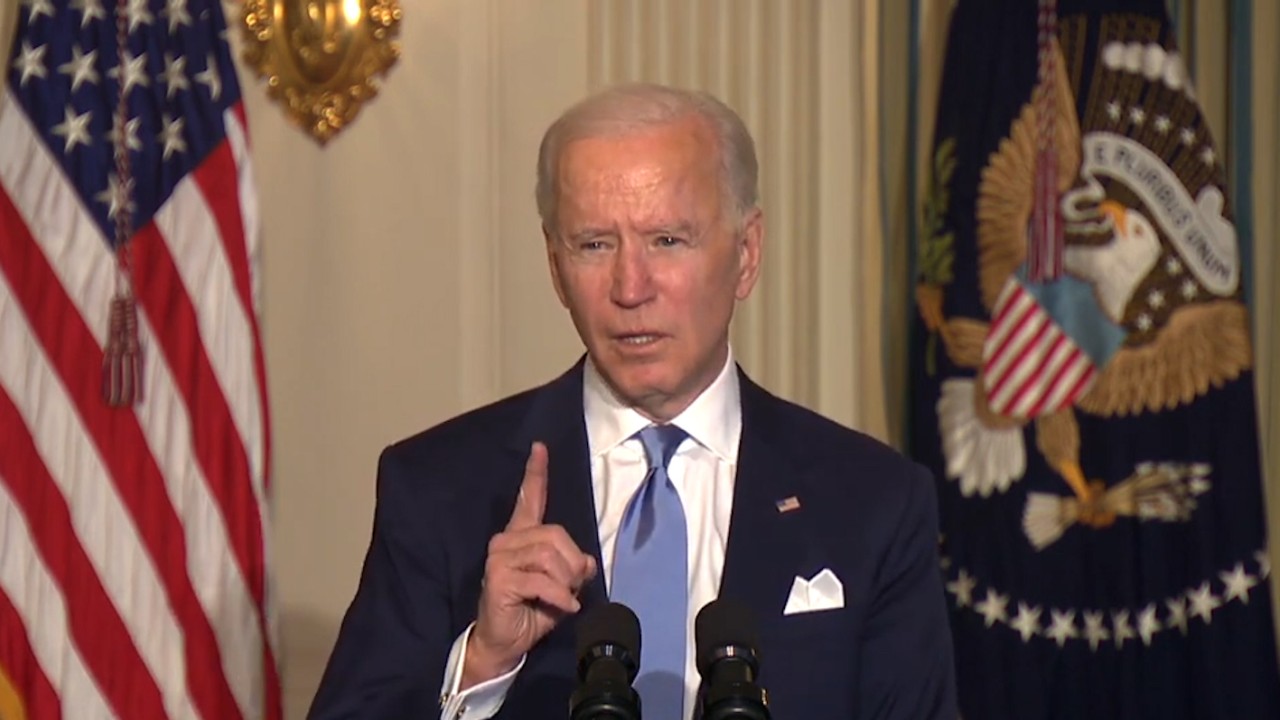

00:52

US President Biden recounts chat with President Xi before swearing in appointees and staffers

Chinese investors held approximately US$2.1 trillion, with about US$700 billion in equity and US$1.4 trillion in debt issued by US entities, said the report titled “US-China Financial Investment: Taking Stock”.