Global impact | With a price war at home spreading overseas, and a tariff war in the US and EU, China’s EV industry is bracing itself despite new tech roll-out

- Global Impact is a weekly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world

- In this week’s issue, we look at the latest developments with China’s electric vehicle industry

The Qin L and the Seal 06, which can go as far as 2,100km (1,305 miles) with a fully charged battery and a full tank of petrol, both start from 99,800 yuan (US$13,767). The batteries, developed and produced by BYD, offer a driving range of up to 80km on a single charge.

BYD, the world’s largest EV builder, said that the new cars will become benchmarks for mid-size models, ratcheting up pressure on its petrol-powered rivals.

And Morgan Stanley warned that legacy carmaking giants such as Volkswagen and Toyota were likely to cut the prices of their bestselling models, such as the Passat and Camry, in response to BYD’s marketing push.

Deliveries of Qin L and Seal 06, which are more than 40 per cent cheaper than the Passat and Camry, are set to begin soon after the launch.

Backed by Warren Buffett’s Berkshire Hathaway, Shenzhen-based BYD is viewed as a game changer in the global automobile sector, since its pure electric and plug-in hybrid cars have become increasingly affordable to consumers and benefit from a production advantage.

Morgan Stanley said the DM-i technology would effectively reinforce BYD’s ambitions of selling between 500,000 and 1 million units abroad between 2024 and 2025. In 2023, the company recorded sales of 3.02 million cars, most of which were delivered to buyers in mainland China.

To make matters worse, a price war has already spread to overseas markets, including Southeast Asia, due to overcapacity woes that Chinese carmakers face at home.

In Thailand, BYD slashed the prices of the updated versions of its flagship Atto3 sport-utility vehicle (SUV) by 18 per cent to 899,900 baht (US$24,455).

Subsequently, Shanghai-based Hozon New Energy Automobile’s Neta V pure-electric car saw its price cut by about 20 per cent to 549,000 baht, 30 per cent cheaper than BYD’s Dolphin electric sedan, while Chongqing-headquartered Changan Automobile also reduced the price of its Lumin EV by 20 per cent to 480,000 baht.

David Zhang, general secretary of the International Intelligent Vehicle Engineering Association, said last week that price competition among Chinese carmakers outside the mainland would be inevitable as they battle for a bigger share of the overseas markets.

“It is advisable for Chinese carmakers to form an alliance so they can avert severe losses with constant price competition,” he said.

In China, leading EV players, from BYD to Nio, have already prolonged the cycles to settle payments with their suppliers amid a bruising discount war, data compiled by Bloomberg showed.

Last year, BYD took 275 days to pay supply-chain vendors, compared with 219 days in 2022, and 198 days in 2021.

Shanghai-headquartered Nio needed 295 days to pay suppliers in 2023, up from 247 days in 2022 and 197 days in 2021. Unprofitable Nio is expected to publish its first-quarter earnings report on Thursday.

Guangzhou-based Xpeng took 221 days to honour its obligations to suppliers last year, up from 208 days in 2022 and 179 days in 2021.

The time taken by carmakers to pay their suppliers is an indicator of their financial health.

While Chinese EV manufacturers are in the media spotlight as new model launches and a global push are believed to be redrawing the global automotive market landscape, Elon Musk’s Tesla is strengthening its presence in China, where EV sales account for 60 per cent of the world’s total.

Tesla is also believed to be considering licensing the software to other carmakers in China.

60-Second Catch-up

Deep dives

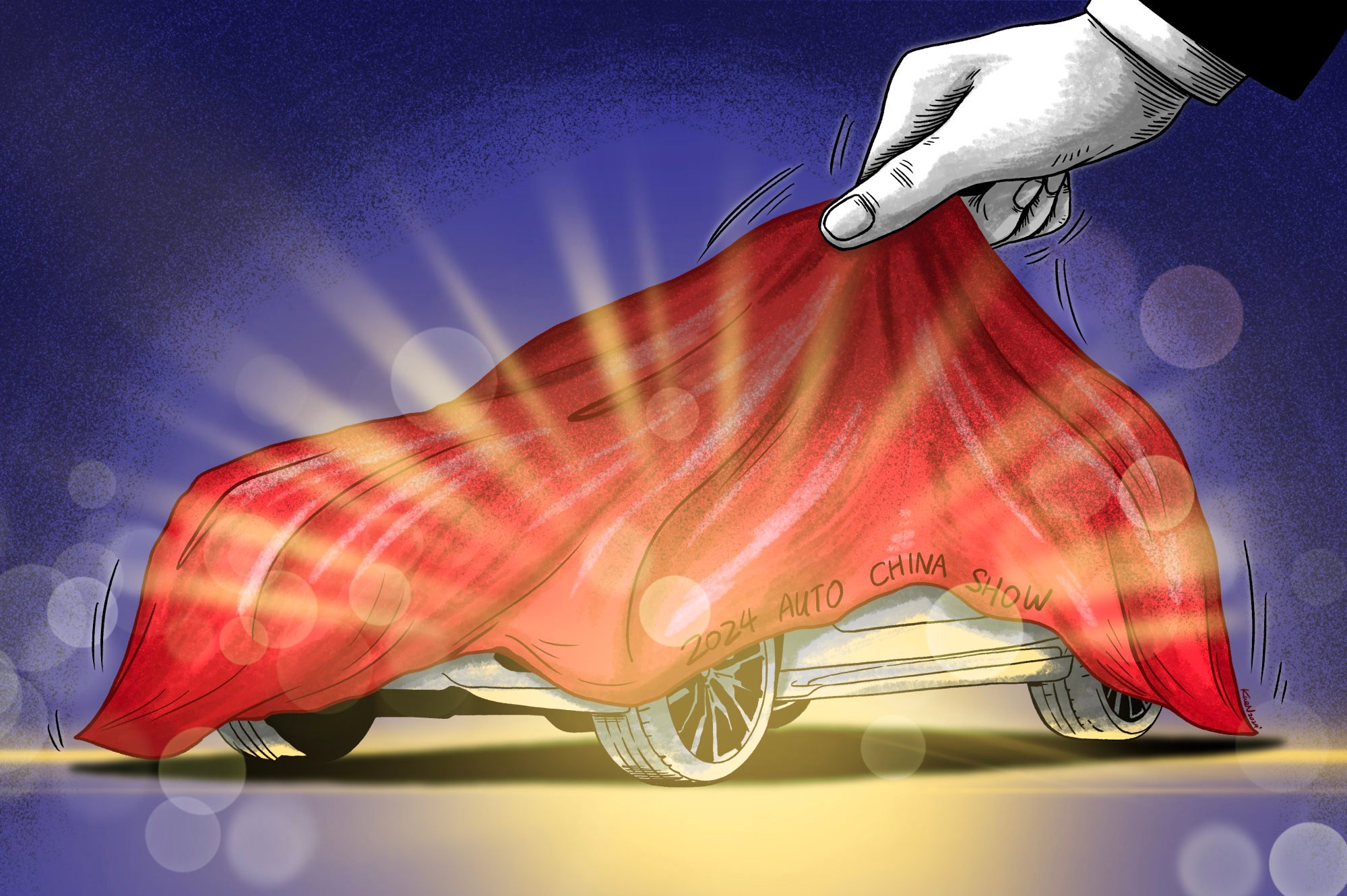

A peek at EVs’ future at Beijing show as oil-guzzlers stay on sidelines

-

Petrol-guzzlers played second fiddle to EVs, as some 280 fully electric and petrol-electric hybrid cars, trucks and vans were on display

-

Tesla was conspicuous by its absence for a second year in a row, even as CEO Elon Musk was in Beijing as the show opened to the public

When the curtains came down last weekend at the 2024 Auto China show in China’s capital, it was a watershed moment for the tentpole event in the world’s largest vehicle market.

China’s EV overcapacity may set it on a political collision course with the US

-

Fresh US tariffs targeting China’s new-energy sector are imminent, threatening to thwart export efforts aimed at alleviating a market oversupply

-

Analysts break down what this means across green and new-energy industries, and why the overcapacity scenario is not like those in China’s past

Fresh sparks are flying as risks associated with an overcapacity overflow in China’s electric vehicle (EV) industry have turned up the heat between Beijing and the West, intensifying frictions and hearkening back to ghosts of trade past.

With demand unleashed amid Beijing’s policy blessings to rev up the green transition over the past several years, the EV and other green industries saw a steady build-up of capacity – widely viewed as the tip of China’s hi-tech-manufacturing iceberg.

From BYD to Xpeng, Chinese EV makers delaying payments to vendors

-

Extended payment cycle shows that some EV makers are facing liquidity issues, automotive analyst says

-

EV sales slumped by 31 per cent quarter on quarter in the three months to March despite massive discounts to shift inventory, CPCA data shows

Shenzhen-based BYD, the world’s largest EV maker, took 275 days to pay supply-chain vendors in 2023, compared with 219 days in 2022, and 198 days in 2021, data compiled by Bloomberg shows.

EU members split sharply over measures to de-risk China economic ties

-

France leads states eager to protect industries from any unfair competition by Beijing while Germany and other free-traders say the market can handle it

-

A focus remains EU inquiry into Beijing’s subsidies for electric vehicle manufacturers, with decision likely delayed until after European Parliament elections

Battle lines are being drawn in Brussels on trade, with the EU’s plans to securitise its economic ties with China thrilling some of its members and enraging others.

On one side of the divide: a group of countries led by France, which champion hardcore industrial policy and robust tools to protect their industries from unfair competition, and equip them with the tools and money to compete.

Global Impact is a weekly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world.