Boeing being edged out by Airbus in China’s aviation market, but is there a way back amid US tensions?

- China’s narrowbody and widebody passenger jet fleet size rose by 18 per cent and 26 per cent, respectively, as of July compared to July 2018

- But the increase mainly came from Airbus’ A320neo, A321neo and A350-900, with US-China tensions limiting Boeing’s access to the critical aviation market

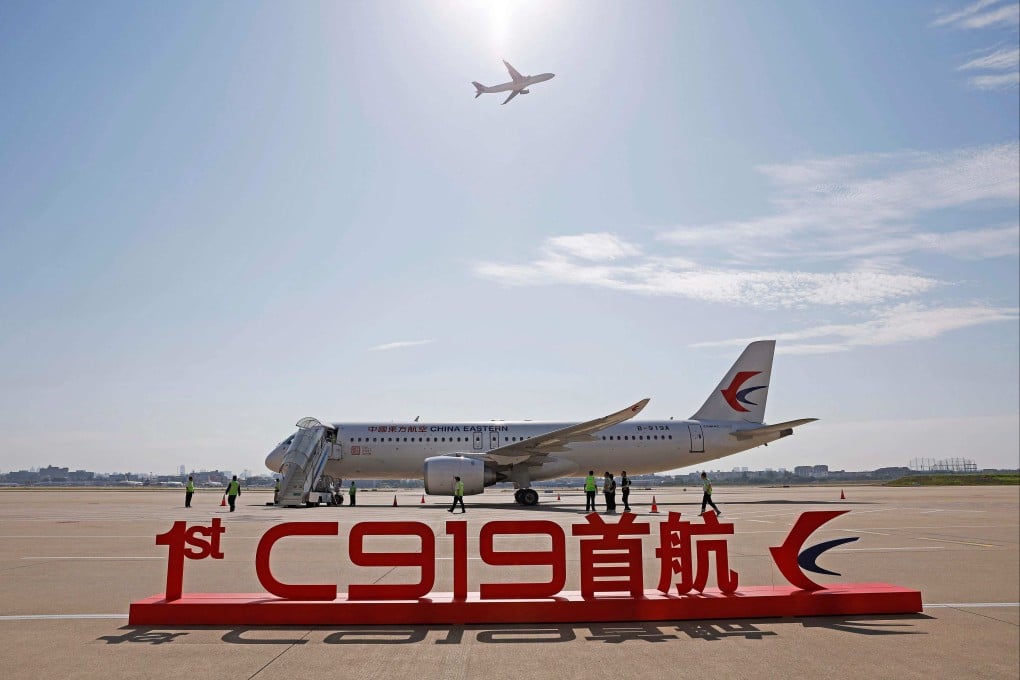

Chinese airlines’ need to renew their fleets of aircraft could offer an opportunity for Boeing, but ongoing US tensions and the launch of China’s first domestically built narrowbody passenger jet may undermine its efforts to compete with European rival Airbus and pick up new orders in the critical aviation market.

Although domestic travel in China declined and its borders were largely closed for international flights during the coronavirus pandemic, Chinese airlines expanded their fleets, mainly by purchasing from Airbus, according to Cirium Ascend fleet data.

The narrowbody passenger jet fleet size in China grew by 18 per cent as of July compared to July 2018, while the number of widebody passenger jets rose by 26 per cent, the data showed.

The increase mainly came from Airbus’ A320neo, A321neo and A350-900, while the contribution to China’s fleet from Boeing’s 737 MAX 8 and 787-9 were relatively marginal over the same period.

Despite the lack of Boeing orders from China’s airlines, growth has still been possible

“Hence, despite the lack of Boeing orders from China’s airlines, growth has still been possible albeit clearly not at the same trajectory as seen in the mid-part of the last decade,” said Rob Morris, head of consultancy at Ascend by Cirium.