Explainer | Airbus, Boeing are vying for China’s aviation market, but does the European aerospace firm have the edge?

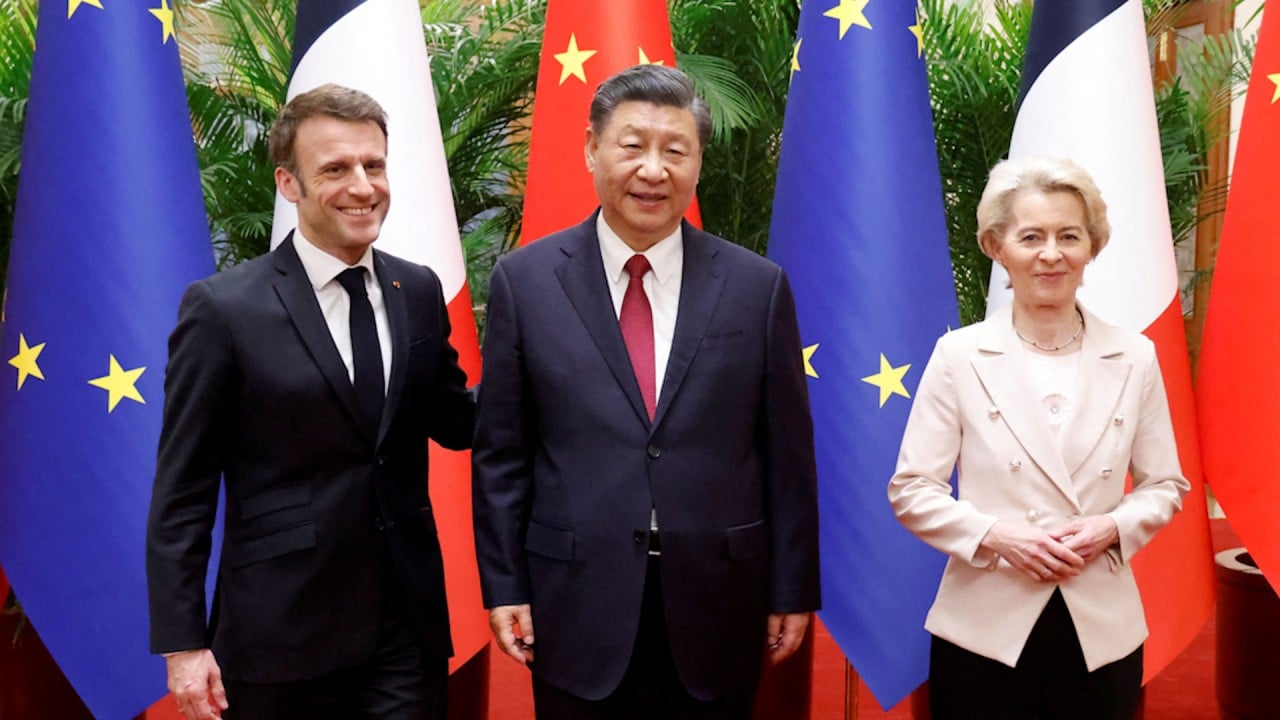

- Airbus is set to double the capacity at its A320 family assembly plant in Tianjin following a state visit to China by French President Emmanuel Macron in April

- US rival Boeing also counts China as a key market, but worsening trade relations between Beijing and Washington have limited its growth prospects

Airbus doubled down on its investment in China during a state visit by French President Emmanuel Macron, as the European aerospace firm seeks to widen its lead over rival Boeing in the critical aviation market.

Airbus has three other A320 family final assembly sites worldwide: Hamburg, Germany; Toulouse, France; and Mobile, US.

China also agreed to buy 150 A320 and 10 A350-900 widebody commercial aircraft from Airbus.

The announcements came amid worsening trade relations between China and the US that have essentially locked American aerospace manufacturer Boeing out of the world’s second-largest economy.

How important is China for Airbus?

Airbus expects huge growth in the Chinese aviation market in the next 20 years. The European aerospace firm predicts that China’s air traffic will grow by 5.3 per cent annually, significantly faster than the world average of 3.6 per cent.

This will lead to a demand for 8,420 passenger and freighter aircraft by 2041, representing more than 20 per cent of the world’s total demand for around 39,500 new aircraft in the next 20 years.