China warns ‘side effects’ of US economic stimulus risk causing sharp market correction

- Guo Shuqing, head of the China Banking and Insurance Regulatory Commission, says Chinese officials are ‘very worried’ that foreign asset bubbles will burst

- Guo says high valuation of US stock market, the world’s largest, means it is the most at risk of a ‘serious run in the opposite direction’

The “side effects” of aggressive economic stimulus policies in the United States and other developed countries have started to surface in the US stock market, China’s top financial regulator warned on Tuesday, saying officials in Beijing were “very worried” that foreign asset bubbles could burst soon.

Guo Shuqing, Communist Party secretary of the People’s Bank of China (PBOC), identified the US market – the world’s largest – as the greatest bubble risk in the global economy when asked on Tuesday.

His comments are the latest in a string of warnings made by policymakers in Beijing about mounting external financial threats and their potential impact on the Chinese economy.

If [the financial market] diverges too much from the real economy, there will be problems

Guo, who is also chairman of the China Banking and Insurance Regulatory Commission, said the extra liquidity in US and European financial markets from stimulus measures had pushed asset valuations above levels justified by economic fundamentals, risking a “serious run in the opposite direction”.

The stock market capitalisation to gross domestic product ratio, which famous US investor Warren Buffett described as “the best single measure of where valuations stand at any given moment”, reached an all-time high of 228 per cent in the US on February 11. That was higher than the level at the start of the dot-com crash in March 2000, according to an analysis by the blog Current Market Valuation.

The reading was also well above its long-term trend and suggested US stock market valuations were “strongly overvalued”, the blog said.

“If [the financial market] diverges too much from the real economy, there will be problems. [The market] would be forced to adjust sooner or later,” Guo said at the press conference.

Policymakers in developed countries should pay more attention to the impact proactive fiscal policies and extremely loose monetary policies were having on the rest of the world, he said.

“There will be some side effects, which are now gradually appearing,” Guo said.

In addition, the PBOC has started to gradually reduce its monetary stimulus in recent weeks by restraining liquidity in China’s interbank market, according to some analysts.

Guo’s comments follow similar statements from a number of high-profile Chinese officials in recent months.

03:42

SCMP Explains: The ‘two sessions’ – China’s most important political meetings of the year

Former Chinese finance minister Lou Jiwei said in February that Washington was transferring its debt burden to the rest of the world through its economic aid programme. It was one of the major reasons China’s fiscal situation was “extremely severe” and full of “challenges”.

Chen Yulu, deputy director of China’s central bank, said the month before that the country must be alert to the impact of Biden’s latest stimulus to “prevent and control external financial risks”.

The US House of Representatives voted early on Saturday to approve the Biden relief plan, paving the way for it to be sent to the Senate.

Some analysts have expressed concerns that the American package will plough money into a global economy already awash in liquidity, with the extra funds ending up in China, resulting in imported inflation.

China’s economy is still undergoing a recovery in growth, our asset prices are very attractive compared with other countries

Guo said on Tuesday that foreign capital inflows into China were likely to increase significantly since its economy had become “highly globalised”.

“China’s economy is still undergoing a recovery in growth, our asset prices are very attractive compared with other countries, the interest rate margin is still large, so the inflow of foreign capital is inevitable,” he said.

“But so far, the scale and speed [of inflows] are still within our control.”

Chinese policymakers are studying how to avoid major turbulence in domestic financial markets as the country opens up to additional capital inflows, Guo said.

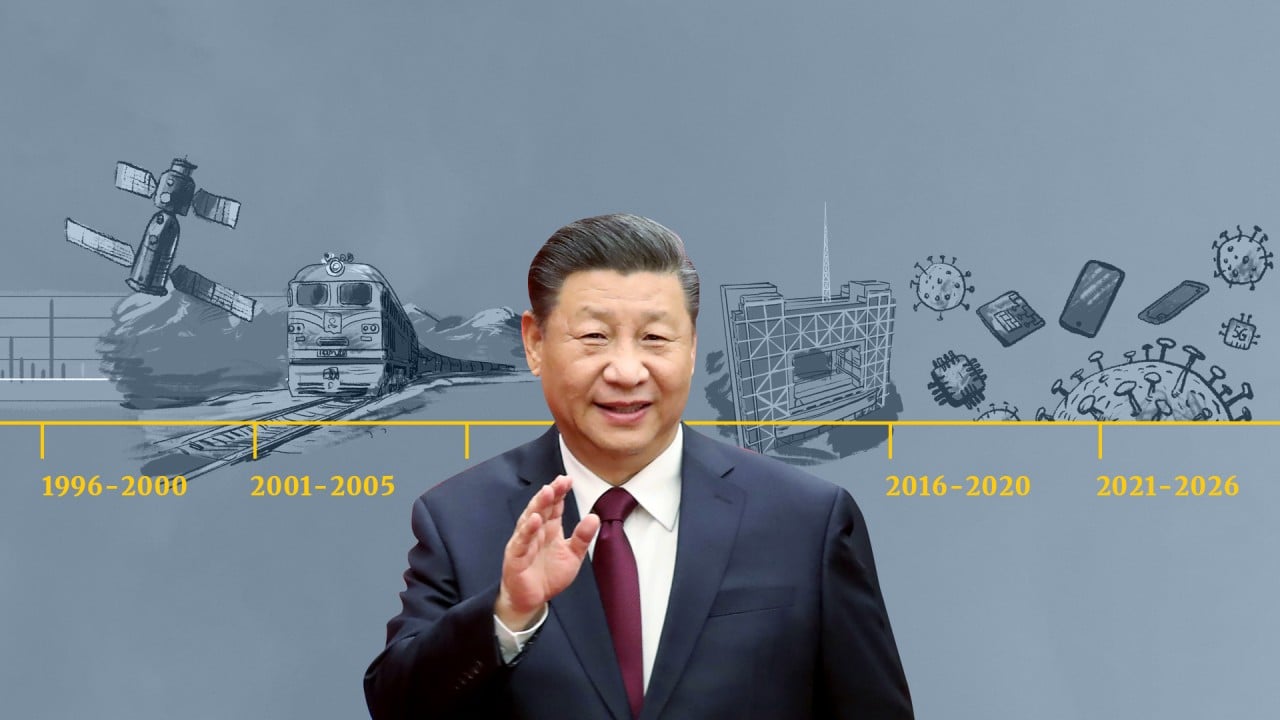

05:57

SCMP Explains: China’s five-year plans that map out the government priorities for development

Guo’s comments come only a few days before the start of the “two sessions”, the most important annual meetings of China‘s top officials and advisers.

The gatherings are expected to scale back some stimulus policies enacted last year, with the focus returning to the government’s “deleveraging” campaign to reduce debt and financial risks.

Guo said cutting the leverage level in the financial sector was the priority for defusing the financial risks.

“Due to the rise in overall market interest rates, loan interest rates may rebound this year,” he said.