China scouts Hungary to power EV battery production and sell to wider, warier EU

- Chinese producers are seeing Hungary as a useful staging ground for the production of lithium batteries, and a sales platform for the rest of the EU

- With EU trade investigations looming, eastern European country would bypass dumping and overcapacity concerns, simplify shipping

Chinese battery manufacturer Contemporary Amperex Technology is already building a €7.3 billion (US$7.9 billion) plant in the central European nation with plans to launch production next year, according to a paper by the think tank Centre for European Policy Analysis.

Xinwanda Electronics, also of China, is investing about 1.9 billion yuan (US$262.9 million) in Hungary for an EV battery factory.

Hungary does offer advantages as an EU member … but with potentially lower associated costs

Hungary has access to lithium mines and warm political ties with China, and its location makes shipping to the entire European continent a simple matter.

“We believe Chinese battery manufacturers are actively seeking opportunities to go overseas, and the EU is a huge market where leading auto manufacturers are located,” said Charlene Wang, associate director for Asia-Pacific companies with Fitch Ratings.

“Hungary does offer advantages as an EU member, allowing free trade with other member countries, but with potentially lower associated costs than western Europe.”

A €500 million Chinese-owned electric vehicle factory – with investment from flagship EV maker BYD – is due to open in Hungary next year, the think tank said.

And last month, a battery industry association from Shenzhen, China’s southern hi-tech hub, led more than 20 local energy storage and “new energy industry chain” companies on a fact-finding trip to Hungary, city news outlet Sznews.com reported.

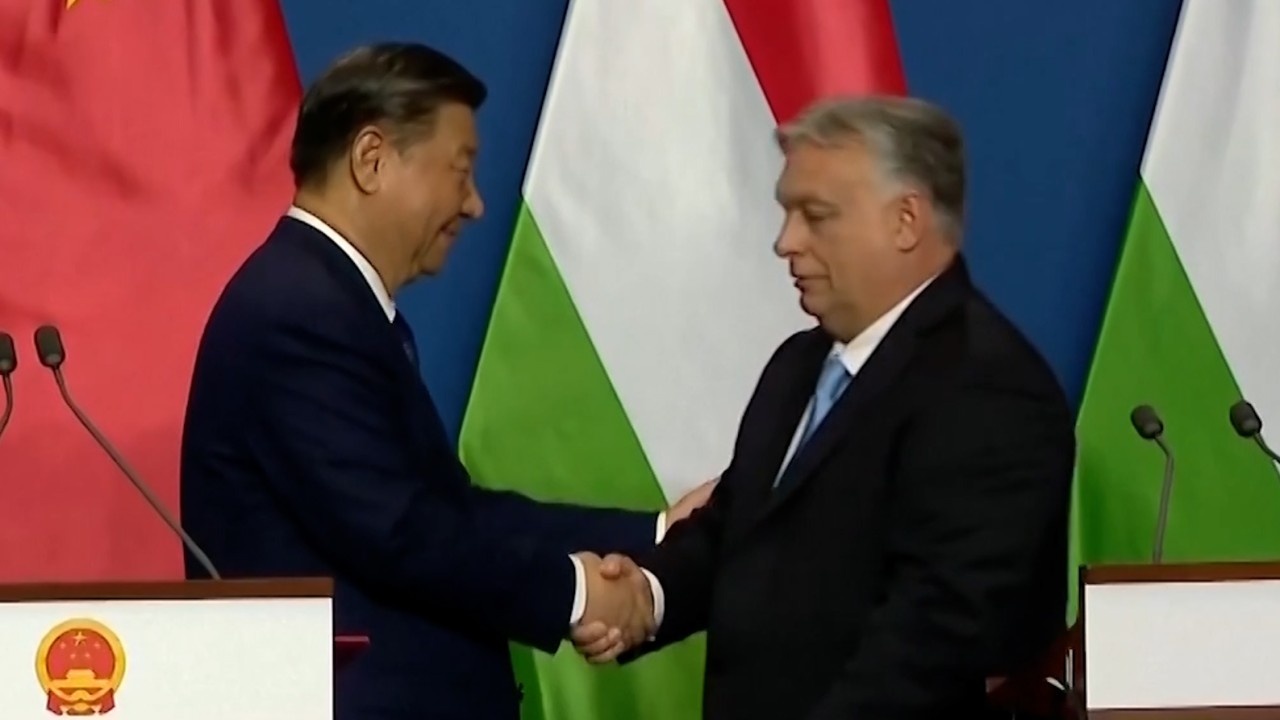

China and Hungary agreed during Xi’s visit to improve transport links, which would help ship batteries smoothly from Hungary to nearby markets.

“As a critical node in the European automotive industry and supply chain, Hungary with its unique geographical location … becomes an ideal place for Chinese companies to establish roots,” said Alberto Vettoretti, a managing partner at business management consultancy firm Dezan Shira & Associates.

Lithium batteries are one of three new commodities, along with solar panels and finished EVs, that Beijing is promoting as economic staples. All three saw exports increase last year.

Goods made in Hungary, even with the involvement of Chinese investment, would be considered Hungarian if produced with local labour, materials and capital, said Jayant Menon, a senior fellow at the ISEAS-Yusof Ishak Institute in Singapore.

Beijing released two draft orders this week to protect its role as a world leader in EV battery production. One document suggests specs for batteries themselves, including recommended values for properties like lifespans and coating thickness. The other will “guide their industry to upgrade”, the ministry said.

China wants to affirm a set of standards for lithium batteries before another country decides how the prized Chinese goods should be made, said James Chin, a professor of Asian studies at the University of Tasmania.

“They are trying to set the default standard around this industry,” Chin said.

China turns out roughly 70 per cent of the world’s electric vehicle batteries, according to the China EV100 think tank, an organisation that aims to boost development of the EV industry.