China’s excess clean energy production is ‘likely only temporary’, former central bank chief says

- Overcapacity will be absorbed as long as global demand for green transitions stays strong, says former People’s Bank of China governor Zhou Xiaochuan

- Experts at Boao Forum reject Western claims that subsidised products flooding markets give Chinese manufacturers competitive edge

China’s overcapacity in the clean energy sector will be temporary as long as global demand for green transitions holds up, according to two prominent Chinese former economic officials, who said that more market opportunities should be explored through the Belt and Road Initiative.

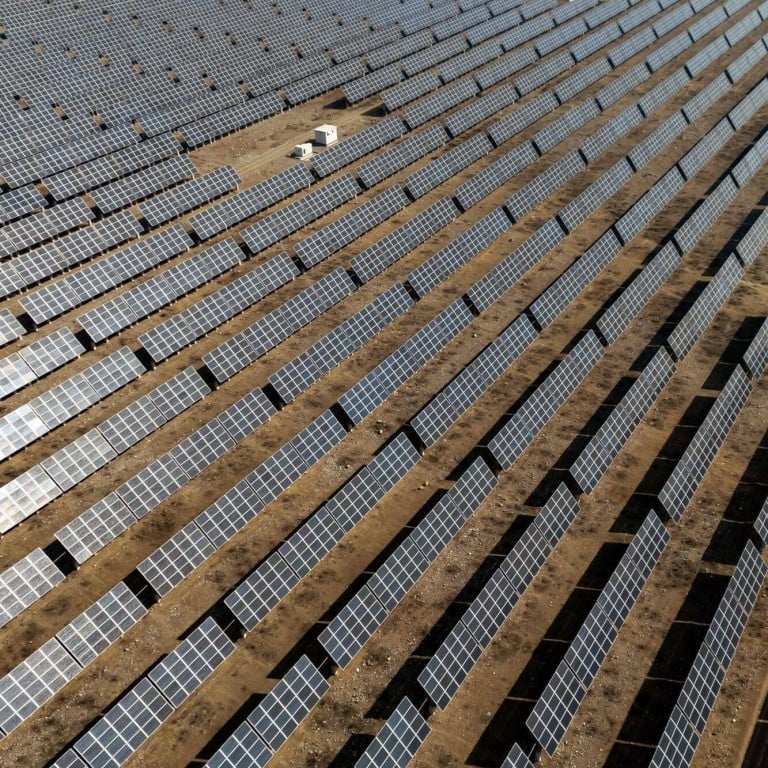

Last year China saw robust growth in installed capacity and exports of solar panels and wind turbines, as well as blockbuster shipments of electric vehicles and lithium-ion batteries. But Beijing has been facing trade restrictions from both sides of the Atlantic over accusations that cheap Chinese exports are flooding international markets.

Senior Chinese officials voice concerns on US tariffs, investment curbs

Zhou said one of the factors contributing to excess capacity was slow progress in upgrading power grids and installing energy storage facilities.

“Overcapacity is likely only temporary since the world will need to further boost the development of clean energy in the future,” he said.

Zhou also rebutted Western claims that unfair trade practices and state-backed subsidies had been distorting markets for clean energy products.

While various levels of governments had stepped in with help in the early stages of industrial development, such as in research and development, he said government support has been withdrawn in recent years.

“Chinese solar firms now have hard-won expertise and global dominance through their own technological advancements and unbeatable cost controls,” Zhou said.

Chinese-made solar panels may see stronger demand in belt and road countries as Beijing ramps up exports of its tech-intensive and green products, as the United States and Europe close their doors, he added.

Zhou’s comments were echoed by Long Yongtu, a former Chinese deputy trade minister and chief negotiator who brokered the country’s accession to the World Trade Organization in 2001.

Faced with overcapacity, domestic market saturation and intensifying competition, more Chinese firms should look abroad to tap potential markets, he said.

“In the first 20 years [since joining the WTO] the China growth story was about Chinese exports going global, and now Chinese companies need to go global … the heyday of double-digit export growth is long gone,” Long said during a separate panel discussion.

At a key economic conference in December, Beijing admitted that “overcapacity in some sectors” and a lack of demand had compounded difficulties on the road to economic recovery.

In fact, China’s total automobile sector production capacity utilisation rate has hovered below 50 per cent since 2019, with just 20 of the country’s 77 carmakers reaching rates higher than 60 per cent, a level deemed to be a normal operation rate, according to the document.

US tariffs on Chinese imports might increase in 2024, analysts say

Denis Depoux, global managing director at German consultancy Roland Berger, told the Post in Boao that moves by the EU to restrict Chinese imports would slow the bloc’s green transition and efforts to reduce emissions.

An additional seven terawatts of renewable energy capacity is needed in the next five years to stay in sync with Paris Agreement commitments to fight global warming, he said.

“So China’s excess capacity will be absorbed. If it’s not, the market will consolidate over time in a very dynamic environment with sustained demand. This is very different from commodities markets and situations that might have occurred in the past,” he said.