Could establishment of an Asian monetary fund help China’s yuan dethrone US dollar?

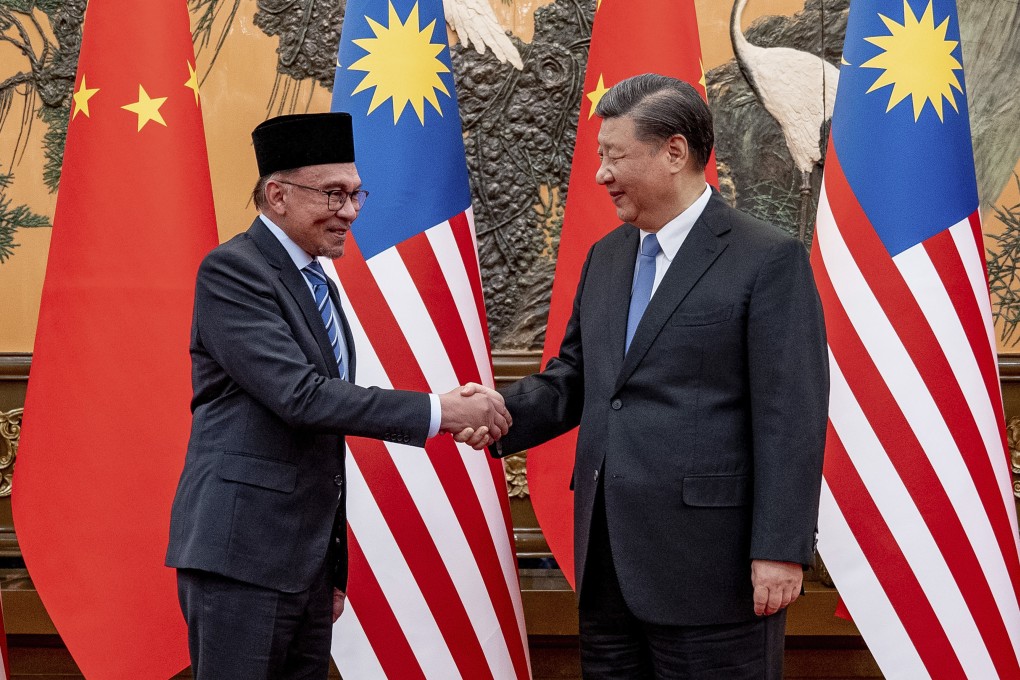

- Malaysian Prime Minister Anwar Ibrahim revived a decades-old proposal for the establishment of an Asian monetary fund last month during a visit to China

- The idea of creating an Asian monetary fund had been mentioned in the wake of the Asian financial crisis in 1997

When Malaysian Prime Minister Anwar Ibrahim revived a decades-old proposal for the establishment of an Asian monetary fund during a recent visit to China, he framed it as a way for participating nations to reduce their reliance on the US dollar – possibly giving a boost to the regional role played by the yuan.

But other regional powers responded cautiously, with Indonesian Coordinating Minister for Economic Affairs Airlangga Hartarto telling The Jakarta Post that while it was “a good idea”, realising it “would require commitments from countries that may be hard to come by”.

Michael Ignatius Ho, the Hong Kong-based Asia director at OurCrowd, Israel’s largest venture capital platform, said central banks around the world were increasingly diversifying their foreign exchange holdings, but any rebalancing of monetary policy power would prove “tough” because very few countries were able or willing to pay the cost of maintaining their own currency as the world’s reserve currency.

It’s a long way to go for the yuan

Edwin Lai, a professor of economics at the Hong Kong University of Science and Technology, said the internationalisation of the yuan as a replacement for the US dollar would “be a long term plan rather than something that will come about very soon – say in 10 to 20 years’ time”, because there was a “very high degree of persistence” in the status of a dominant currency in the international monetary system.