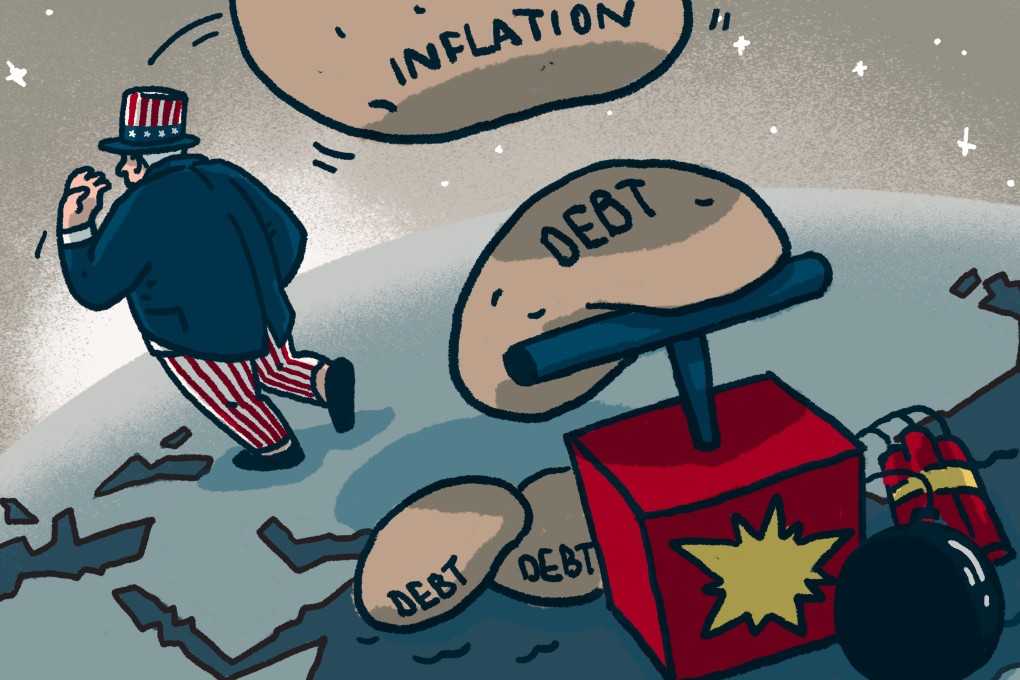

Chinese warn US debt, dollar hegemony may lead to another ‘Nixon shock’ with global implications

- ‘Nixon shock’ occurred a half-century ago when economic policy shifts by US President Richard Nixon upended the international monetary system

- US ‘doomed to bring a second shock to the world’, globalisation expert says, pointing to record inflation levels and mounting debt

The current state of US economic policy, with its decades-high inflation levels and a mountain of federal debt, is a worrying reminder for China of the conditions that prompted US President Richard Nixon to end the gold-to-US dollar convertibility and eventually switch to a floating exchange-rate regime a half-century ago.

Fresh concerns over another “Nixon shock” causing turbulence in the international monetary system have also prompted Beijing’s policy advisers to say that the two largest economies must work together on policy coordination to manage short-term risks, while the US dollar’s hegemony should be weakened in the interest of long-term financial security.

“The 2008 global financial crisis and the unprecedented pandemic have built up the debt level, and the Fed’s balance sheet is snowballing … There’s a potential crisis that the US dollar’s hegemony will go bust,” Liu Junhong, who heads globalisation research at the China Institute of Contemporary International Relations, said last month.

His comments came during a closed-door symposium reflecting on the 50th anniversary of the “Nixon shock”, which occurred in August 1971. Other government think tanks in attendance included the China Association of Policy Science and the Chinese Academy of Macroeconomic Research affiliated with China’s economic planner, the National Development and Reform Commission.

The US shows no intention of cooperating with other countries … to deal with a crisis that it is unable to handle alone