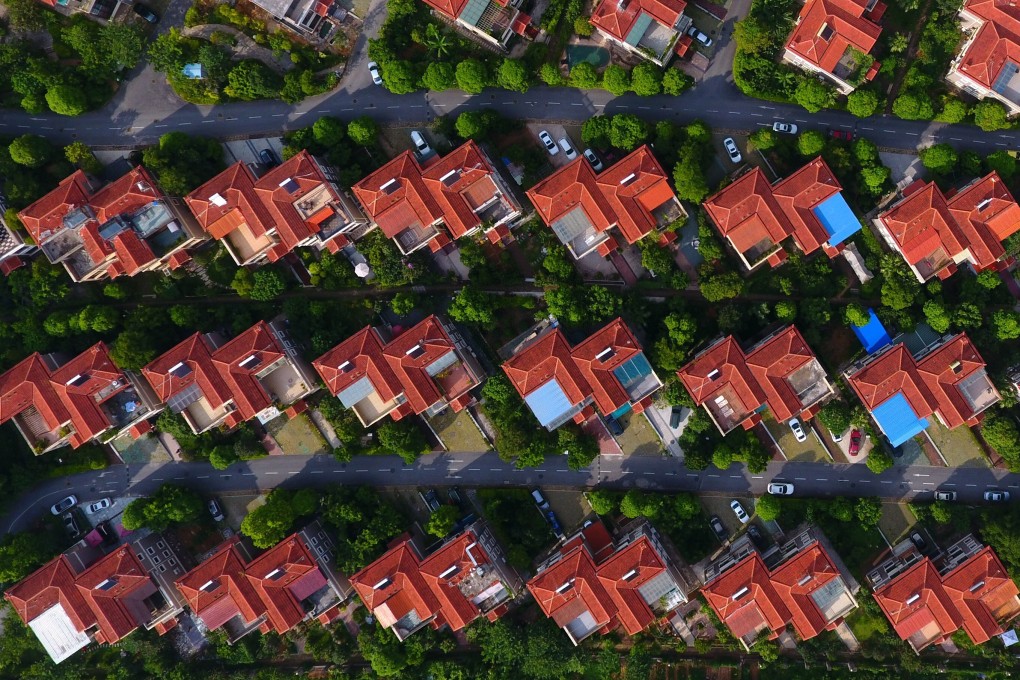

Is China ripe for a subprime crisis? Regulator sees bank property loans as ‘biggest grey rhino risk’ for financial system

- Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission, says property is now the biggest risk facing China’s financial system

- Property loans in China currently account for about 39 per cent of total outstanding bank lending, and Guo says steps must be taken to avoid ‘bubbles’

Chinese banks’ excessive exposure to property is now the “biggest grey rhino risk” facing the stability of the financial system, a top financial regulator has warned.

Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission and Communist Party chief of the People’s Bank of China (PBOC), wrote recently steps must be taken to avoid “bubbles” in the real estate sector because “among the 130 financial crises since the start of 20th century, more than 100 of them are related to property markets”.

His article is included in a newly released book from the central government explaining the country’s economic priorities and development plan for 2035.

Guo said property-related loans made up 39 per cent of all bank lending in China, although according to the PBOC property loans, including mortgages and lending to developers, accounted for 28.8 per cent of the total at the end of September.

The property market is now the biggest grey rhino financial risk in China

Using Guo’s figures, property-related loans are equal to about two thirds of China’s gross domestic product (GDP), but nearly half of GDP if using the central bank data, according to South China Morning Post calculations.