China’s central bank issues draft rules on financial holding companies in move to rein in risk

- Firms with two types of financial business must apply for licence within six months of regulation taking effect and have US$726 million registered capital

- People’s Bank of China says ‘regulatory vacuum has led to risk accumulation and exposure’

China’s central bank on Friday released a draft regulation on financial holding companies, as it seeks to contain the potential spread of risk from their business to other sectors.

“There is a regulatory vacuum around some financial holding companies, especially those starting from non-financial businesses, which has led to risk accumulation and exposure,” the People’s Bank of China (PBOC) said in an online statement.

The draft rules, which will be finalised after feedback is received by late August, confirm the central bank’s regulatory responsibility and set entry thresholds for financial holding firms’ capital requirements, management qualification and risk parameters.

According to the draft, companies with two types of financial business – such as securities brokerage, banking, insurance, trusts, asset management and financial leasing – will have to apply for a financial holding company licence within six months of the new regulation taking effect, and they must have more than 5 billion yuan (US$726.7 million) in registered capital.

In addition, a financial holding company cannot also run a non-financial business, a move aimed at stopping the spread of risk to the real economy.

However, they can be set up by non-financial groups – for example tech companies wanting to move into financial service – if their non-financial assets are kept to no more than 15 per cent of the total.

Financial holding companies are a mixed business model that – like unlicensed online financing products such as peer-to-peer lending and crowdfunding – have grown rapidly in China and challenged the country’s fragmented regulatory system. They offer non-banking financial services such as selling insurance products and investment in securities.

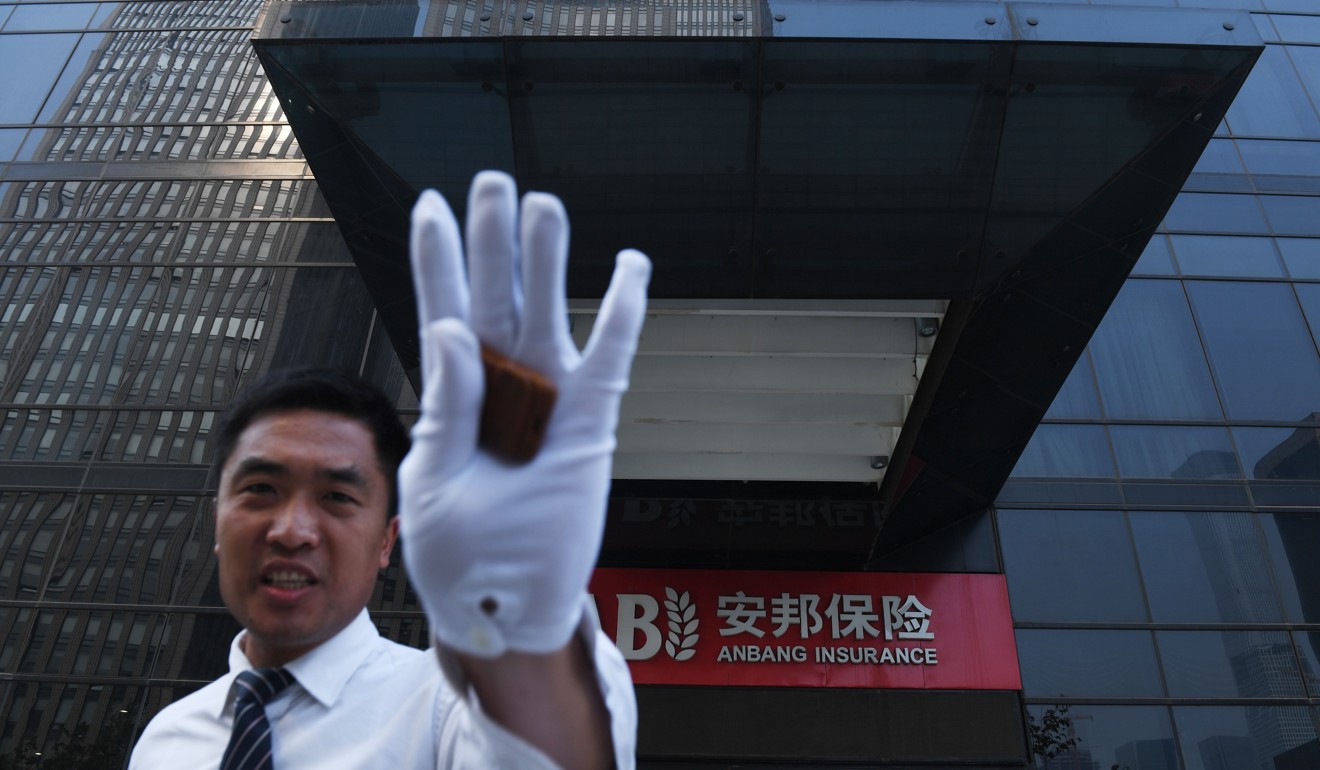

But the de-risking is set to continue, with regulators on alert for more cases like Tomorrow Group and Anbang Insurance Group, both of which are being dismantled.

Anbang – known for its overseas shopping sprees including high-profile acquisitions like the Waldorf Astoria hotel – has been under state control for over a year after the government determined that the company was a risk to China’s financial stability.

Wang Jun, chief economist of Zhongyuan Bank, said financial holding firms had been in the cross hairs for a few years.

“Privately run financial holding companies have obviously lost the trust of regulators because of their terrible performance in the past several years,” Wang said.

Privately run financial holding companies have obviously lost the trust of regulators because of their terrible performance in the past several years

“The existing ones could face a harsher regulatory environment – they need to either transform their businesses into categories encouraged by the government or just die a natural death.”

As Beijing gradually opens up its tightly controlled finance sector, financial holding company licences have been keenly sought after, but newcomers such as technology and industrial giants have also come under greater scrutiny from regulators.

The central bank last year targeted five financial holding companies – China Merchants Group, Shanghai International Group, Beijing Financial Holdings Group, Ant Financial and Suning Holdings Group – for non-compulsory internal supervision.