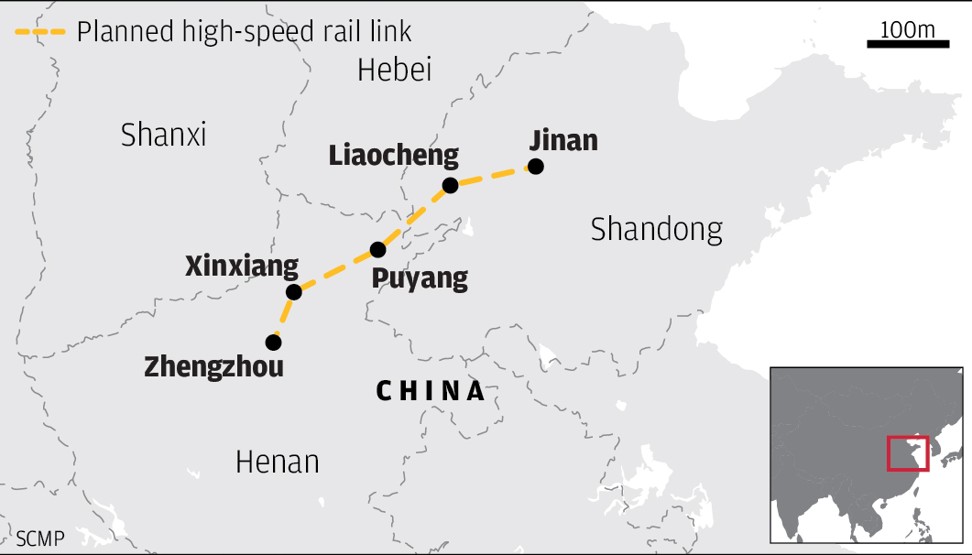

China struggling with slow progress on high-speed rail network expansion due to local financing problems

- Construction of new high-speed link between Zhengzhou in Henan province and Jinan in Shandong delayed due to funding issue

- Beijing’s policy moves to reduce debt and cut taxes are hampering local governments’ ability to fund new projects

Zong Zifa, a 67-year-old Chinese peasant who has worked the land his entire life, likes to stand at the eastern end of his village to check the progress of a new high-speed railway train station under construction. He and many of his fellow villagers hope that the station, on a plot of land where he used to tend to peach and walnut trees, will be the gateway for the otherwise sleepy village to connect with the country’s rapid development.

But “construction is slow … probably because of the funding shortage,” said Zong, while sitting under a tree playing with his grandson.

Zong’s village of Zongchanghu is on the eastern edge of city of Puyang in the province of Henan, around 500km south of Beijing. It is desperately in need of the economic development that could come with being connected to China’s high-speed railway network as its local economy is weakening having relied heavily upon an oil exploration and drilling industry that has almost run dry.

Last year, Puyang’s local economic growth slowed to 5.8 per cent, below the national average of 6.6 per cent, from 8.1 per cent in 2017 and 10.0 per cent as recently as 2014.

So, when the provincial governments of Henan and neighbouring Shandong, with Beijing’s blessing, in 2016 finally agreed to build the high-speed railway line running through Puyang, the city immediately jumped into action, setting up a task force comprising of the city’s top leaders to manage all the details of the construction project.

In the past, infrastructure projects that enjoyed full government support would mean that the work was conducted around the clock, backed by a steady flow of funding. The government would draw up a blueprint and then all necessary resources would be mobilised to make it happen. But in the case of Puyang, however, the local government’s enthusiasm has not translated into a construction frenzy on the ground.

On one afternoon, the construction site was relatively quiet, with more than a dozen trucks, bulldozers and other pieces of plant equipment lined up sitting idle in a corner. One construction worker from China Railway No 3 Engineering Group, the company in charge of building the station, said the ground work is expected to be completed by the end of 2019, and only then will the construction of the main buildings will begin.

According to Puyang’s municipal development and reform commission, 1.55 billion yuan (US$225 million) has been invested in the Puyang section of the railway line by mid-June, about one third of planned expenditure, with construction expected to be completed in 2021.

But construction activity on the rail line running the 39km north to the provincial border, as well as the 170km that extends through Shandong province, is quiet because budget constraints mean work on the Shandong section of the Zhengzhou-Jinan rail line has not yet started. According to a statement posted on the website of Henan’s provincial development and reform commission, the Zhengzhou-Jinan rail link will cost around 50.4 billion yuan (US$7.3 billion), including 30.5 billion yuan for the Henan section.

Local newspaper the Dahe Daily said that the project will be handled by a joint venture between the China Railway Corporation and the Henan provincial government with registered starting capital of 15 billion yuan, with the remainder to be financed by bank loans.

Shandong is believed to have delayed its portion of the project because the provincial government prioritised the development of its export-oriented coastal areas, while continuing its campaign to reduce debt and financially risky projects, leaving insufficient capital to build the new section of the railway line.

Since Liu Jiayi, the former head of the National Audit Office who led the nationwide investigation into local government debt in 2014, was named the provincial party chief two and a half years ago, Shandong has taken a tough stance against further increases in local debt.

It has been preoccupied with a series of high-profile corporate defaults, including the bankruptcy of Qixing Group and the restructuring of Hengfeng Bank, a Jinan-based national commercial bank heavily exposed to bad loans.

Shandong also prioritised the construction of fast rail links to the port cities of Qingdao and Yantai, while it has debated at length over the route, feasibility and economic benefit of a costly line connecting the inland city of Zhengzhou to the provincial capital of Jinan.

The province of Shandong, which has the third largest provincial economy in China, had outstanding debt of 1.1 trillion yuan (US$160 billion) at the end of 2018, equal to 15 per cent of its gross domestic product (GDP). After considering the off-budget debts of it financing vehicles, which are used to borrow from banks to finance projects, the ratio rises to 26 per cent of GDP, leaving it in middle when compared to mainland China’s 31 provincial jurisdictions.

However, as the trade war began to hit harder, the province released an ambitious railway construction plan at the end of last year, aiming to triple its high-speed railway network to 4,500km by 2022, with the Shandong section of the Zhengzhou-Jinan line put on the list of construction projects scheduled for this year.

The problems facing the Zhengzhou-Jinan rail line mirror the dilemmas faced by Beijing policymakers. On one hand, the central government believes that many less developed central and western regions of the country still need additional infrastructure, which justifies the need to finance the projects with extra fiscal stimulus amid the trade war with the United States.

But Beijing is also nervously watching rising local government debt and wants to prevent it from weighing down the world’s second largest economy. According to the Bank for International Settlements, the country’s total debt reached US$33.2 trillion by the end of 2018, the world’s second largest after the US, while the debt-to-GDP ratio rose to 254 per cent, one of the highest in the world.

In the past year, the administration of President Xi Jinping has tried to balance the need for more local government spending on infrastructure to stabilise economic growth, while preventing local debt from rising to the point that it endangers the nation’s financial system.

Infrastructure investment is one of the quickest government tools to drive up economy growth, as exports have been haunted by US tariffs and a boost from consumer spending could take a long time due constraints on income growth.

However, policy initiatives from the central government in the last several years have cut back the ability of local governments to finance infrastructure projects. First, the deleveraging campaign to reduce excess debt and risky lending sharply reduced “shadow banking,” which included the off-balance sheet borrowing that local governments had used in the past to fund projects. Infrastructure investment growth slowed to just 4.0 per cent in the first five months of 2019 from 19 per cent in 2017.

In addition, Beijing cut both individual and business tax rates over the last year as part of its fiscal stimulus programme. This exacerbated the funding gap that exists in a majority of Chinese provinces under the current tax revenue sharing scheme with the central government. Local government tax revenue grew by only 3.9 per cent to 4.65 trillion yuan (US$676 billion) in January-May, while their other revenues, mainly from land sales, dropped 4 per cent from a year earlier to 2.32 trillion yuan (US$337 billion).

Beijing did transfer 7.5 trillion yuan (US$1.1 billion) to local governments in the first five months of 2019, while local governments also raised another 859.8 billion yuan (US$125 billion) from special purpose bonds. But observers believe some local governments will be forced to resort to the old school method of borrowing through financing vehicles to fund daily operations and ongoing projects, boosting local government’s hidden debt, if Beijing decides to begin a larger stimulus effort.

The need to find financing for the Zhengzhou-Jinan railway project is a case in point. It is a branch line not included in the original national network, so local financing, which could account for as much as 70 per cent of the total investment, is important to begin construction as early as possible.

But behind the impressive infrastructure already in Puyang, that includes broad streets and big squares, is a mountain of local debt. According to a government document, Hualong, the downtown district that houses the current railway station and future high-speed railway terminal, had implicit off-budget liability – borrowing through local financing vehicles or from guaranteeing local development loans – of 2.6 billion yuan (US$378 million) at the end of June 2018, three times its on-budget debt.

Ivan Chung, an associate managing director who heads Moody’s Greater China credit research, said the government's latest policy fine-tuning allowing local government to use bond proceeds and bank borrowing on infrastructure projects can leverage their ability to finance projects and also shore up the confidence of investors.

But, he said that funding difficulties remain and differ by province. “Rich provinces have less infrastructure projects to invest in,” since they’ve already built extensively, “while poor regions often can’t get enough funding for their projects,” he said.

And Beijing’s clampdown on local government debt has reduced the ability of local governments to use financing vehicles to raise funds.

“The leverage of some local financing vehicles has been lowered amid tightening regulatory restrictions against their borrowing and debt swaps,” he added.