Advertisement

Macroscope | Why Magnificent Seven US tech stocks are the bubble that won’t burst

- The Magnificent Seven’s dominance of US stocks and its outsize impact on the performance of global equity markets has amplified fears of a new tech bubble

- These fears ignore that the grouping is built on sound fundamentals and is driving structural mega trends rather than being a threat to financial stability

Reading Time:4 minutes

Why you can trust SCMP

1

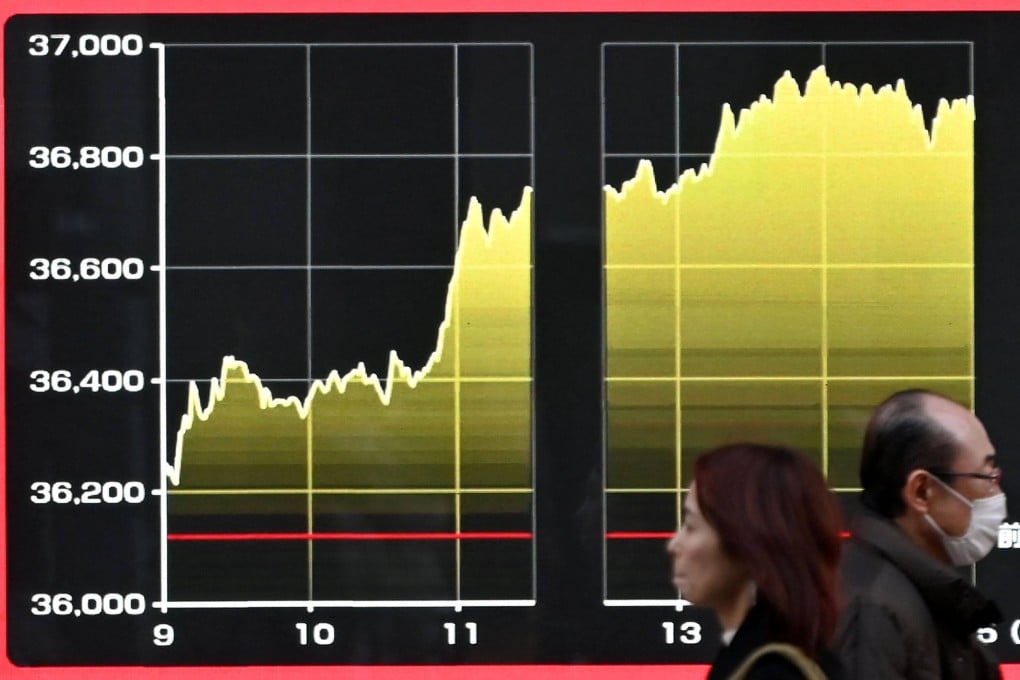

In stock markets, records are close to being surpassed around the world. The Nikkei 225 index, one of Japan’s main equity gauges, surged past the all-time high it set in December 1989 even though Asia’s second-largest economy unexpectedly slipped into recession last quarter.

Last week, the French and German stock markets reached a record high despite a bleak economic outlook for the euro zone. The MSCI World Index, a gauge of shares in advanced economies, also hit a new peak, having surged 20 per cent since the end of October. The rally was driven by the strong gains in stocks in the United States, which has a 70 per cent weighting in the index.

A clutch of giant technology companies – Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia and Tesla – has turbocharged the US equity market. So much so that if not for the “Magnificent Seven”, the benchmark S&P 500 index’s 26 per cent return last year would have been less than 10 per cent, according to data from S&P Global.

It is hard to overstate the importance of this septet. With the exception of Tesla, all the companies figure among the world’s top seven firms by market capitalisation. Moreover, the group’s combined weighting in the S&P 500 is 29 per cent while its share of expected earnings growth this year is 34 per cent, according to JPMorgan.

Indeed, the Magnificent Seven are “more like countries than companies in size and profitability”, with the group’s combined market value of US$13.1 trillion double that of Japan’s equity market and its profits during the last 12 months roughly half of those generated by Chinese stocks, according to data from Deutsche Bank.

The Magnificent Seven’s dominance of US stocks and its outsize impact on the performance of global equity markets has amplified concentration risks and fanned fears about a dangerous bubble in the making.

Advertisement