Advertisement

Macroscope | Risk of Trump’s return overshadows Asia’s 2024 election bonanza

- The 2024 electoral calendar is jam-packed as more than 4 billion people around the world will go to the polls, but one election has world-changing potential

- A second presidency for Trump would be a gift to the US’ adversaries while eviscerating its security commitments and crippling climate change efforts

Reading Time:4 minutes

Why you can trust SCMP

3

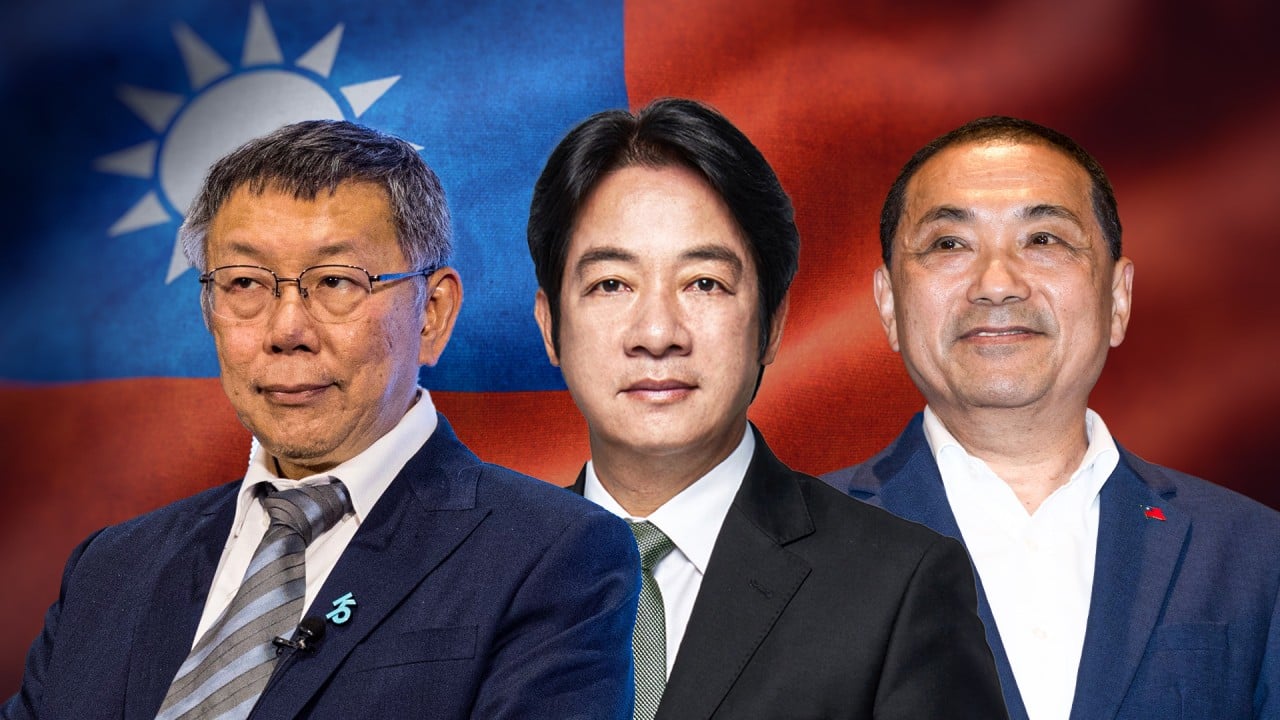

On Saturday, Taiwan will fire the starting gun on a succession of elections in the majority of the world’s most important economies and financial markets. To say the 2024 global electoral calendar is a busy one would be an understatement.

More than 4 billion people in around 70 countries will go to the polls. According to Bank of America, nations accounting for 60 per cent of global economic output, 80 per cent of global stock market capitalisation and 40 per cent of the world’s population are holding elections.

The geographic breadth of the exercise in democracy is remarkable. Elections for the European parliament across the European Union’s member states in June will determine whether the rise in support for eurosceptic and populist parties will stymie the enlargement of the bloc. Voters in many African nations, notably South Africa, will also cast their ballots, while important municipal elections will be held in Brazil and Turkey.

However, the immediate focus is on Asia. Indonesia will hold a crucial presidential and parliamentary election next month, while a general election in India will take place over several weeks in April and May. Both countries – whose combined population is nearly 1.7 billion people – are making high-stakes bets on brisk growth that hinge crucially on their ability to successfully exploit geopolitical realignments and renewable energy-related shifts in the global economy.

Three leading Asian economies – Taiwan, India and South Korea – are heading to the polls this year. Each of them plays a crucial role in the stock markets of developing nations at a time when sentiment towards China has deteriorated sharply.

The three economies have a combined weighting of 45 per cent in the MSCI Emerging Markets Index, compared with mainland China’s 26 per cent. It is therefore somewhat surprising that investors have barely reacted to the increase in political risk in Asia, especially in Taiwan, whose presidential and legislative elections are a potential flashpoint just when Beijing and Washington are trying to ease tensions.

Advertisement