Why London’s bruised office market is still luring Asian investors

- Asian buyers have spotted opportunities to acquire London assets at a critical moment – the price correction is entering its final stage and competition from other buyers will intensify when central banks start to loosen policy

The UK has been hit hard by the double whammy of the pandemic and rising rates. According to the findings of a survey by Morgan Stanley of office markets in the UK, US, Germany and France published last week, Britain experienced the sharpest rise in remote working since the pandemic began. Office workers are working from home an average of 2 days a week, compared with 1.7 in the US.

In London, one of the world’s biggest office markets, leasing volumes in the first three-quarters of this year were 21 per cent below the equivalent period in 2022 and 15 per cent below the average for the first three-quarters during the past 10 years, according to JLL data. The vacancy rate, moreover, has shot up from 4 per cent at the end of 2019 to 9.6 per cent.

A bifurcation, even trifurcation, of the city’s office market has taken hold as the divide between secondary, prime and “ultra-prime” assets widens. The premium placed on high-quality space – not just in terms of location but also building specification and energy efficiency – is a key driver of Asian investment in London.

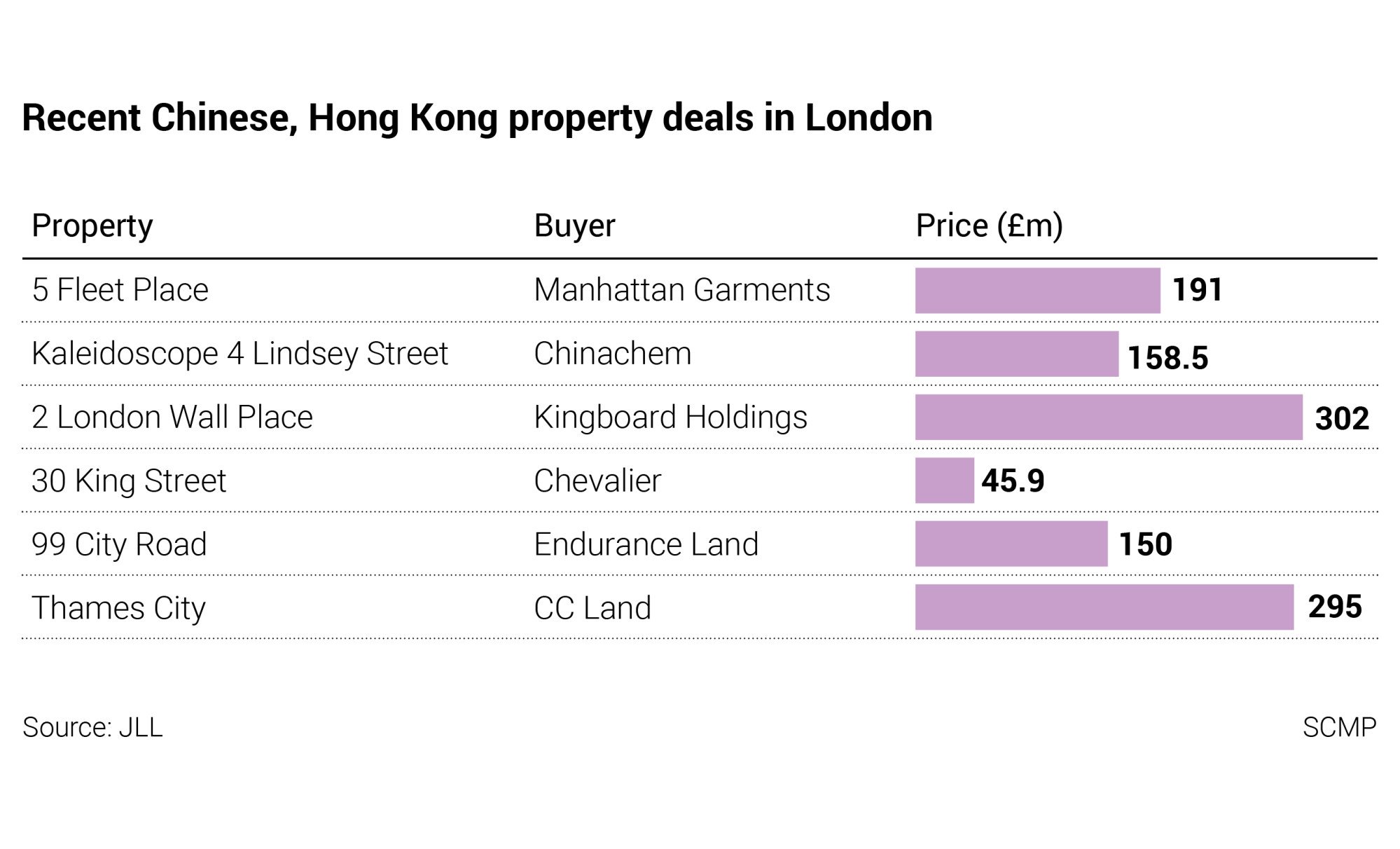

Four months later, Chinachem bought another prime office building in the City for £349.5 million to bolster its presence in London – the headquarters of Deloitte, which at the time of completion in 2016 was the world’s first office building to achieve top sustainability and health and wellness ratings.

Donald Choi, Chinachem’s executive director and chief executive, said the acquisitions were not so much “a contrarian bet” as an opportunity to invest in “future-proof” office buildings “at an opportune moment to capture the limited window of yield expansion”.

The maturity, liquidity and transparency of the UK commercial property market are crucial strengths that have helped the London market reprice more efficiently. “The clarity over pricing is like nowhere else in the world,” said Julian Sandbach, head of Central London office markets at JLL.

While the price correction in London is entering its final stage and competition from domestic and other foreign investors will intensify when central banks start to loosen policy, the enduring weight of Asian capital is a vote of confidence in the London office market. Although a dirty word for some, offices retain their appeal even in the most vulnerable markets.

Nicholas Spiro is a partner at Lauressa Advisory