Advertisement

Macroscope | US debt ceiling crisis is the result of reckless politics fuelled by dollar hegemony

- Any other economy would have been punished far more severely by markets for its politicians’ brazen willingness to play fast and loose with the nation’s financial system and creditworthiness

- However, US monetary hegemony gives its politicians too much leeway to endanger national and global stability

Reading Time:3 minutes

Why you can trust SCMP

In a tiny corner of the markets, the world’s largest economy – whose sovereign bonds are the bedrock of the global financial system – is considered to be a riskier bet than Greece, a country that was on the brink of bankruptcy a decade ago and whose credit rating is still in “junk” territory.

Advertisement

For most international investors, such an assessment is preposterous and should be ignored. Yet, this is not the only signal prices of credit default swaps (CDS) – financial instruments offering investors insurance against the default of a borrower – are sending about the creditworthiness of the United States.

According to Bloomberg data, the cost of insuring US sovereign debt via a one-year CDS contract is now several times more expensive than in Brazil and Mexico. Like Greece, these two emerging markets are serial defaulters and have credit ratings that are many notches below the top-tier rating of the US.

While the thinly traded CDS market is a poor gauge of credit risk, other, more reliable, indicators suggest the reckless political brinkmanship in Washington over raising the country’s debt ceiling is unnerving investors.

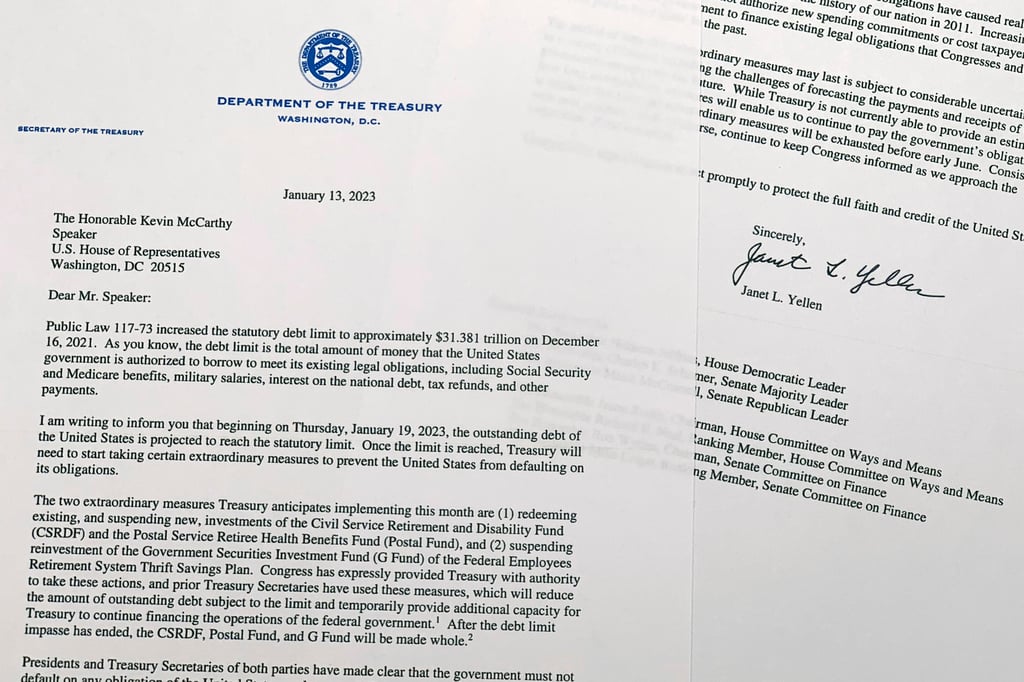

Treasury Secretary Janet Yellen’s warned on May 1 that the government risked running out of cash as soon as June 1, making it difficult to make bond payments and meet its spending obligations. Afterwards, the yield on one-month Treasury bills – which mature around the time the US is in danger of breaching its borrowing limit – rose sharply. It now stands at 5.3 per cent, close to its all-time high.

The consequences of an outright US default hardly bear thinking about. Last week, the Treasury Borrowing Advisory Committee, a group of banks and asset managers that advises the government on debt issuance, warned that “any delay in making an interest or principal payment would be an event of seismic proportions”, undermining “the full faith and credit of the US government”.

Advertisement